Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Portfolio overview

The Prime Minister and Cabinet portfolio is responsible for: providing advice and support to the Prime Minister, the Cabinet, Portfolio Ministers and Assistant Ministers on matters that are at the forefront of public policy and government administration; and providing stewardship of the Australian Public Service (APS). The Department of the Prime Minister and Cabinet (PM&C) is the lead entity in the portfolio. It is responsible for supporting the Prime Minister as the head of the Australian Government and the Cabinet and providing advice on major domestic policy and international and national security matters. Further information is available from the department’s website.

In addition to PM&C, there are 19 entities within the portfolio that are responsible for: Australian Government Aboriginal and Torres Strait Islander policy, programs and service delivery; improving results for Aboriginal and Torres Strait Islander people through enhanced Indigenous economic rights to support economic independence; improved access to education, employment, health, wellbeing and other services, as well as the maintenance of cultural identity; coordination and evaluation of Australia’s foreign intelligence activities; Australian Government employment workplace relations policy to position the APS workforce for the future by improving people management and manage capability and professional development across the APS; support to the Governor-General to perform her official duties; and promoting and improving workplace gender equality in Australian workplaces. While located in the PM&C portfolio, the Auditor-General is an independent officer of the Parliament. The Governor-General appoints an independent auditor of the ANAO to conduct financial statements audits and performance audits of the ANAO. The Auditor-General engages the Independent Auditor to audit the performance statements of the ANAO.

In the 2025–26 Portfolio Budget Statements (PBS) for the Prime Minister and Cabinet portfolio, the aggregated budgeted expenses for 2025–26 total $4.5 billion. The PBS contain budgets for those entities in the general government sector (GGS) that receive appropriations directly or indirectly through annual appropriation Acts.

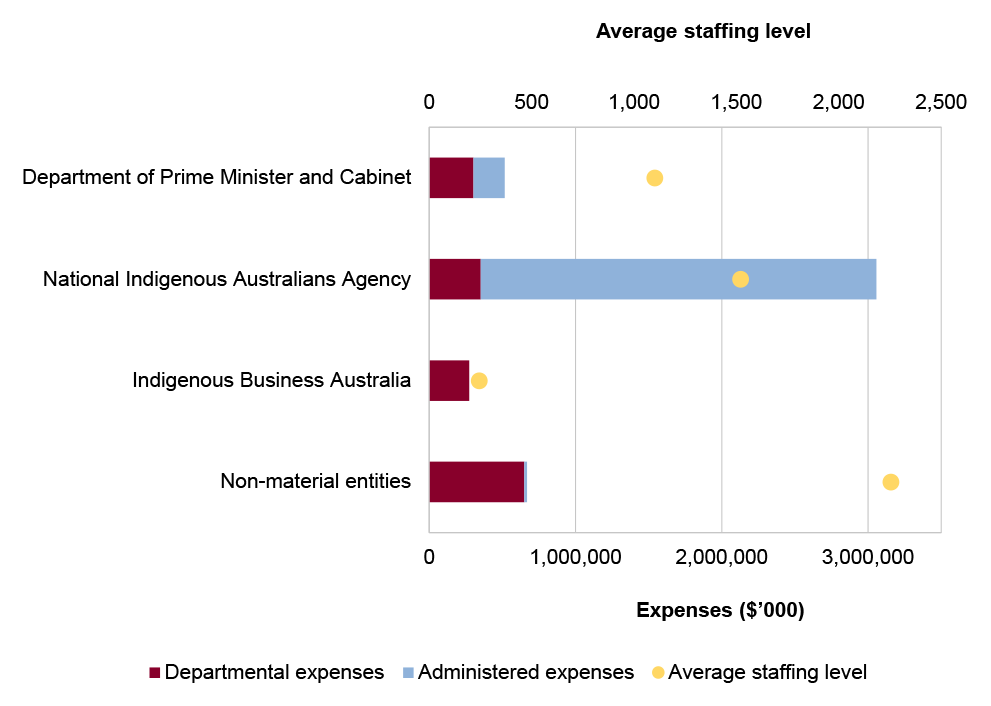

The level of budgeted departmental and administered expenses, and the average staffing level for entities in the GGS within this portfolio are shown in Figure 1. The National Indigenous Australians Agency represents the largest proportion of the portfolio’s expenses, and administered expenses of the portfolio are the most material component, representing 65 per cent of the entire portfolio’s expenses.

Figure 1: Prime Minister and Cabinet portfolio – total expenses and average staffing level by entity

Source: ANAO analysis of 2025–26 Portfolio Budget Statements and the 13 May 2025 AAO.

Audit focus

In determining the 2025–26 audit work program, the ANAO considers prior-year audit and other review findings and what these indicate about portfolio risks and areas for improvement. The ANAO also considers emerging risks from new investments or changes in the operating environment.

The ANAO had regard to the final report of the capability review of the Australian Public Service Commission (APSC) that was endorsed by the Department of the Prime Minister and Cabinet in June 2023.

The primary risk identified by the ANAO for PM&C and the APSC is providing effective stewardship of the APS. The primary risk for the National Indigenous Australians Agency (NIAA) relates to how it is demonstrating the effective achievement of its purpose and responsibilities.

Specific risks in the Prime Minister and Cabinet portfolio relate to governance, service delivery, grants administration and policy development.

Governance

The department and portfolio agencies have an important responsibility in explaining and modelling for the Australian Public Service (APS) the new APS value of stewardship. A key risk for the NIAA is its effective stewardship of the APS in achieving genuine partnership with First Nations groups and peoples.

The APSC has a lead role in developing the integrity, capacity and capability of the APS. The first priority of the APS reform agenda is developing an APS that embodies integrity in everything it does. Audits have shown Australian Government entities on occasion falling short of ethical requirements. A risk is APSC’s ability to provide assurance that APS reforms are being implemented effectively and efficiently in accordance with reform priorities; and to quantify the cost and benefits of the reforms.

PM&C describes itself as taking a ‘whole-of-government and whole-of-nation approach’, which requires effectively working with diverse stakeholders. There are risks associated with working with multiple stakeholders in a coordinated manner through governance structures where roles and responsibilities are clearly articulated and appropriate records are maintained.

Among PM&C’s roles is enabling a well-functioning Cabinet and providing advice to the Prime Minister, the Cabinet and ministers. As holders of sensitive Cabinet information PM&C needs to ensure it has appropriate arrangements for information management and security, including user access to information and systems.

The portfolio includes 13 entities that have been established to serve the interests of Aboriginal and Torres Strait Islander peoples. Audits have highlighted governance deficiencies in relation to managing risk; fraud control; and conflicts of interest. A risk for the NIAA is identifying its role in supporting the improvement of governance arrangements in Indigenous portfolio agencies.

Service delivery

The NIAA’s responsibilities include leading Commonwealth program design, program implementation and service delivery for Aboriginal and Torres Strait Islander peoples. The NIAA is directly responsible for delivering on recent government commitments, including in relation to remote employment, food security and women’s safety. The NIAA faces challenges in balancing ongoing service delivery with program design and redesign.

The NIAA states that it will continue to work across Australian Government agencies to lead and coordinate the National Agreement on Closing the Gap. The Productivity Commission’s Closing the Gap Dashboard shows that of 18 socio-economic outcome targets, three were on track and five were worsening or unchanged from the baseline. These results highlight risks for the NIAA in coordinating and assuring the achievement of Closing the Gap targets across government at a pace that meets community expectations.

The NIAA’s responsibilities include analysing and monitoring the effectiveness of programs and services for Aboriginal and Torres Strait Islander peoples. Responding to public and parliamentary interest in the effectiveness and efficiency of expenditure on First Nations programs is a key risk for the NIAA. Audits have shown that the NIAA’s measurement and accountability frameworks for program performance require improvement.

Grants administration

The NIAA is responsible for the timely assessment and administration of grants programs. ANAO audits since the NIAA was established in 2019 have raised issues relating to NIAA’s management of Indigenous Advancement Strategy grants including: assurance over provider data; the management of potential provider fraud and non-compliance; calculation and reporting of performance information; and demonstrating value for money and impact. In 2025–26, the NIAA faces the additional challenge of replacing the grant opportunity guidelines that have enabled the NIAA to issue grants, which expire in December 2025.

Policy development

PM&C’s focus is on supporting the Prime Minister, Cabinet and portfolio ministers to achieve their policy priorities. There are risks associated with ensuring that advice and major policy decisions are supported by sound evidence and analysis, and the views of a diverse range of stakeholders are considered.

The NIAA is responsible for leading and coordinating Commonwealth policy development and program design for Aboriginal and Torres Strait Islander people. Audits have highlighted risks related to the NIAA’s coordination, implementation and monitoring of government policy; and provision of timely, proactive and evidence-based policy advice.

Previous performance audit coverage

The ANAO’s performance audit activities involve the independent and objective assessment of all or part of an entity’s operations and administrative support systems. Performance audits may involve multiple entities and examine common aspects of administration or the joint administration of a program or service.

During the performance audit process, the ANAO gathers and analyses the evidence necessary to draw a conclusion on the audit objective. Audit conclusions can be grouped into four categories:

- unqualified;

- qualified (largely positive);

- qualified (partly positive); and

- adverse.

In the period between 2020–21 to 2024–25, entities within the Prime Minister and Cabinet portfolio were included in tabled ANAO performance audits 27 times. The conclusions directed toward entities within this portfolio were as follows:

- two were unqualified;

- 11 were qualified (largely positive);

- 14 were qualified (partly positive); and

- none were adverse.

Figure 2 shows the number of audit conclusions for entities within the Prime Minister and Cabinet portfolio that were included in ANAO performance audits between 2020–21 and 2024–25 compared with all audits tabled in this period.

Figure 2: Audit conclusions 2020–21 and 2024–25: entities within the Prime Minister and Cabinet portfolio compared with all audits tabled

Source: ANAO data.

The ANAO’s annual audit work program is intended to deliver a mix of performance audits across seven audit activities: governance; service delivery; grants administration; procurement; policy development; regulation and asset management and sustainment. These activities are intended to cover the scope of activities undertaken by the public sector. Each performance audit considers a primary audit activity. Figure 3 shows audit conclusions by primary audit activity for audits involving entities in the Prime Minister and Cabinet portfolio.

Figure 3: Audit conclusions by activity for audits involving entities within the Prime Minister and Cabinet portfolio, 2020–21 to 2024–25

Source: ANAO data.

Performance statements audits

There are two performance statements audits within the Prime Minister and Cabinet Portfolio. The audits of the 2024–25 Department of Prime Minister and Cabinet (PM&C) and the National Indigenous Australians Agency (NIAA) annual performance statements are being conducted following a request from the Minister for Finance on 2 July 2024, under section 40 of the Public Governance, Performance and Accountability Act 2013. The audits are conducted under section 15 of the Auditor-General Act 1997.The 2024–25 reporting period marks the first year in which both PM&C and the NIAA will be included in the annual performance statements audit program.

Department of the Prime Minister and Cabinet

The ANAO considers the risk associated with PM&C’s performance statements audit as moderate. Key risks for PM&C’s performance statements that the ANAO has highlighted include:

- the absence of a complete enterprise-wide performance framework through which PM&C plans, monitors and reports its performance;

- the completeness of PM&C’s key activities, performance measures and targets;

- the appropriateness of PM&C’s performance measures and targets against the requirements of the PGPA Rule; and

- performance statements preparation processes.

National Indigenous Australians Agency

The ANAO considers the risk associated with NIAA’s performance statements audit as moderate due complexity in the NIAA environment, including the extent of collaboration with other entities to coordinate and deliver against Closing the Gap and transition of key programs.

Key risks for NIAA’s performance statements that the ANAO has highlighted include:

- completeness of performance measures and targets and the extent to which the NIAA meaningfully reports against all key functions and priorities in the performance information;

- appropriateness of the performance measures and targets against the PGPA Rule; and

- suitability of the performance statement preparation processes.

Financial statements audits

Overview

Entities within the Prime Minister and Cabinet portfolio, and the risk profile of each entity, are shown in Table 1.

Table 1: Prime Minister and Cabinet portfolio entities and risk profile

|

|

Type of entity |

Engagement risk |

Number of higher risks |

Number of moderate risks |

|

Material entities |

||||

|

Department of the Prime Minister and Cabinet |

Non-corporate |

Low |

0 |

1 |

|

Indigenous Business Australia |

Corporate |

Moderate |

0 |

3 |

|

National Indigenous Australians Agency |

Non-corporate |

Moderate |

1 |

3 |

|

Non-material entities |

||||

|

Aboriginal Hostels Limited |

Company |

Moderate |

|

|

|

Anindilyakwa Land Council |

Corporate |

Moderate |

||

|

Australian Institute of Aboriginal and Torres Strait Islander Studies |

Corporate |

Low |

||

|

Australian Public Service Commission |

Non-corporate |

Low |

||

|

Central Land Council |

Corporate |

Moderate |

||

|

Indigenous Land and Sea Corporation |

Corporate |

Moderate |

||

|

National Australia Day Council Limited |

Company |

Low |

||

|

Northern Land Council |

Corporate |

Moderate |

||

|

Northern Territory Aboriginal Investment Corporation |

Corporate |

Low |

||

|

Office of the Official Secretary to the Governor-General |

Non-corporate |

Low |

||

|

Office of National Intelligence |

Non-corporate |

Low |

||

|

Outback Stores Pty Ltd |

Company |

Low |

||

|

Tiwi Land Council |

Corporate |

Moderate |

||

|

Torres Strait Regional Authority |

Corporate |

Low |

||

|

Workplace Gender Equality Agency |

Non-corporate |

Low |

||

|

Wreck Bay Aboriginal Community Council |

Corporate |

Moderate |

||

|

Other audit engagements (including Auditor-General Act 1997 section 20 engagements) |

||||

|

Aboriginal Benefits Account |

||||

Material entities

Department of the Prime Minister and Cabinet

The Department of the Prime Minister and Cabinet (PM&C) is responsible for providing advice to the Prime Minister, the Cabinet, portfolio ministers, and assistant ministers to improve the lives of all Australians. The role of PM&C is to support the policy agenda of the prime minister and Cabinet and the coordination of the implementation of key government programs, to provide leadership to the Australian Public Service, coordination of government activities, effective policy advice and development, and program delivery.

PM&C’s total budgeted assets for 2025–26 are $4.2 billion, with other investments representing 94 per cent, as shown in Figure 4.

Figure 4: Department of the Prime Minister and Cabinet’s total budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There is one key risk for PM&C’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage.

- Valuation of administered investments, as PM&C estimates the fair value of a number of corporate Commonwealth entities and companies in the Prime Minister and Cabinet portfolio including Indigenous Business Australia and the Indigenous Land and Sea Corporation.

Indigenous Business Australia

Under its enabling legislation, the Aboriginal and Torres Strait Islander Act 2005, Indigenous Business Australia’s (IBA’s) purposes are to assist and enhance Aboriginal and Torres Strait Islander self-management and economic self-sufficiency, and to advance the commercial and economic interests of Aboriginal and Torres Strait Islander peoples by accumulating and using a substantial capital base for their benefit. IBA has 14 actively trading subsidiaries which are audited by the ANAO.

IBA’s total budgeted assets for 2025–26 are $2.5 billion. Of this, 58 per cent is attributable to trade and other receivables, 25 per cent are attributable to other investments and eight per cent is attributable to investment property, as shown in Figure 5.

Figure 5: Indigenous Business Australia’s budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are three keys risk for IBA’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage.

- The valuation of the loan portfolio, including fair value assessment and amortised cost, which requires the use of judgement and estimates.

- The valuation of expected credit losses relating to the loan portfolio, which requires the use of judgement and estimates.

- The valuation of investment properties, land and buildings, and investments in associate entities, due to the judgements and assumptions involved in these valuations.

National Indigenous Australians Agency

The National Indigenous Australians Agency (NIAA) is responsible for policy oversight in relation to the Indigenous agencies in the Prime Minister and Cabinet portfolio.

The NIAA’s total budgeted expenses for 2024–25 are $3.1 billion, with 70 per cent of these expenses attributable to grants, as shown in Figure 6. Property, plant and equipment contributes to 14 per cent of total budgeted assets.

Figure 6: National Indigenous Australians Agency budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are four key risks for the NIAA’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage, including two risks that the ANAO considers to be a potential key audit matter (KAM).

- The NIAA manages approximately $1.7 billion in administered grants expenses each year across geographically dispersed locations, including remote areas, and payments are made through different IT systems operated across a number of government departments. Grants expense is forecast to be approximately $2.0 billion for 2024–25. (KAM – Occurrence of grants expenses)

- The effectiveness of controls, including the compliance framework, over the Community Development Program (CDP) and NIAA’s activities to ensure that payments made have been assessed appropriately in accordance with the underlying agreements. (KAM – accuracy and completeness of CDP payments)

- The NIAA has entered into shared services arrangements with several government departments for: financial transaction processing, including payroll and ICT infrastructure services. The NIAA remains responsible for oversight of the shared services and obtaining appropriate assurance from the service providers.

- The NIAA has substantial holdings of land, buildings, infrastructure and plant and equipment, which are dispersed around Australia and are required to be valued at fair value under the Financial Reporting Rule.