Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Portfolio overview

The Veterans’ Affairs Portfolio is responsible for developing government policy and implementing programs to fulfil Australia’s obligations to veterans, war widows or widowers, families, serving and former members of the Australian Defence Force, certain Australian Federal Police officers with overseas service and Australian participants in British nuclear tests in Australia and their families and dependents.

The Department of Veterans’ Affairs (DVA) is responsible for supporting the wellbeing of those who serve or have served in the defence of our nation and their families, through the development and implementation of programs that assist the veteran and ex-service communities. The programs and services can be broadly grouped into three main areas: care, compensation and commemoration. Further information is available from the department’s website.

The Australian War Memorial (AWM) is responsible for maintaining and developing the national memorial to Australians who have died in wars or warlike operations. It also develops, maintains and exhibits a national collection of historical material and conducts research into Australian military history.

DVA and the AWM are formally part of the Defence Portfolio.

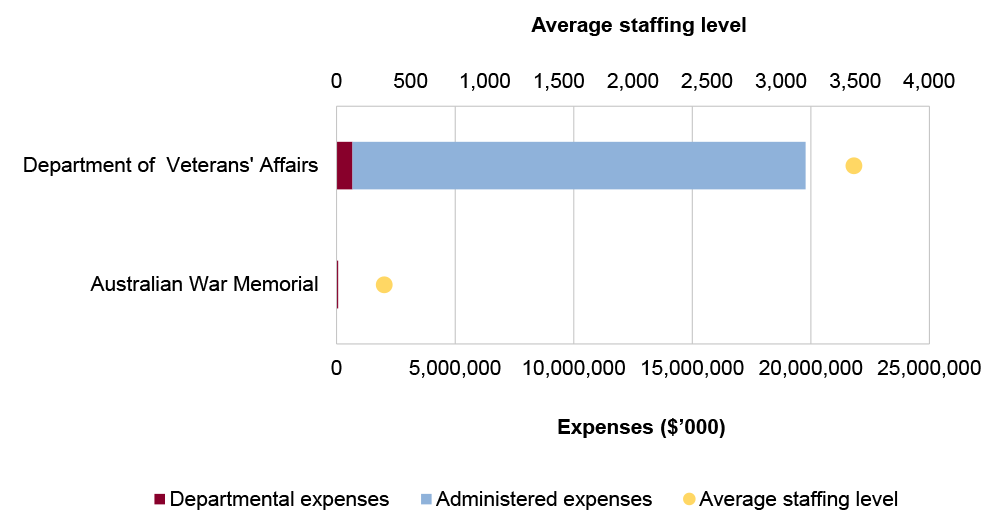

In the 2025–26 Portfolio Budget Statements (PBS) for the Veterans’ Affairs portfolio, the aggregated budgeted expenses for 2025–26 total $19.9 billion. The PBS contain budgets for those entities in the general government sector (GGS) that receive appropriations directly or indirectly through annual appropriation Acts.

The level of budgeted departmental and administered expenses, and the average staffing level for entities in the GGS within this portfolio are shown in Figure 1. DVA represents the largest proportion of the portfolio’s expenses, and of this, administered expenses are the most material component, representing 96 per cent of the entire portfolio’s expenses.

Figure 1: Veterans’ Affairs portfolio – total expenses and average staffing level by entity

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

Audit focus

In determining the 2025–26 audit work program, the ANAO considers prior-year audit and other review findings and what these indicate about portfolio risks and areas for improvement. The ANAO also considers emerging risks from new investments or changes in the operating environment.

The ANAO had regard to the final report of the capability review of the Department of Veterans’ Affairs (DVA) that was endorsed by the Australian Public Service Commissioner in October 2024.

The primary risks identified by the ANAO for the portfolio relate to DVA’s ability to maintain decision making quality as it processes the backlog of claims for compensation and implements legislative, policy and program changes and modernising its ICT systems.

Specific risks in the Veterans’ Affairs portfolio relate to governance, service delivery, asset management and sustainment, and financial management.

Governance

DVA is undertaking a modernisation program with the aim of significantly improving the effectiveness and efficiency of veterans’ services, in response to the recommendations from the Royal Commission into Defence and Veteran Suicide (Royal Commission). Successful delivery of change programs requires robust planning, stakeholder engagement, change management practices and evaluation activities.

The legislation to simplify and harmonise the existing tri-Act framework of legislation governing veterans’ entitlements, rehabilitation and compensation arrangements received Royal assent on 20 February 2025 and comes into effect from 1 July 2026. In the 2024–25 Federal Budget DVA received $213.9 million over four years to reform the veterans’ compensation and rehabilitation legislative framework.

Effective management of claims requires strong compliance controls and quality assurance processes, particularly with the large number of new claims received each week. As at 28 February 2025 DVA had 81,712 claims on hand, of which 7,784 were unallocated.

The final report from the Royal Commission included recommendations that will impact on the role and responsibilities of DVA. In particular, the government accepted the recommendation to establish a new statutory entity to oversee system reform across the whole ‘defence ecosystem’. The interim Head of the new Defence and Veterans’ Service Commission commenced in January 2025 and the Commission is expected to be established in September 2025. The government also accepted in principle the recommendation to establish a new agency to focus on veteran wellbeing. Such initiatives will require extensive engagement, consultation and management across entities.

Protective security measures, including systems controls, risk assessments and education and training, are essential to ensure that personal and sensitive information held by DVA is safeguarded from unauthorised access, disclosure, loss or misuse. It is also critical that adequate protections are in place for data integration projects where the risk of identification of veterans is increased through the amalgamation of deidentified data sets.

Weaknesses in the implementation and operation of governance and monitoring processes relating to cyber security increase the risk of unauthorised access to systems and data held by entities.

Deficiencies in records management limit an entity’s ability to plan, record and measure outcomes, and demonstrate continuous improvement.

Service delivery

Audit work undertaken has highlighted instances of long periods to process claims from veterans and their dependants, as well a lack of focus on efficiency in service delivery including measuring of performance in this regard. DVA reports that the average time taken to process a claim over the last 12 months was 102 days. This may indicate inefficient work practices and inadequate management oversight and action when service standards are not being met. In the 2023–24 Federal Budget, DVA received $64.1 million to maintain its workforce for a further year to meet its claims processing requirements. In the 2024–25 Federal Budget, DVA received $194.4 million over four years to meet the department’s increased service delivery pressures. In the 2025–26 Federal Budget DVA received an additional $47.6 million for one year, to enable additional resourcing to support service delivery.

DVA’s reliance on the Department of Defence to provide data to support claims requires active management to address the risk that decisions are delayed when required data is not obtained in a timely manner. Robust governance arrangements will be required as DVA and the Department of Defence develop and embed the improved information sharing arrangements recommended by the Royal Commission and rebuild the trust of the community following the testimony to the Royal Commission into Veteran Suicide.

Poor workforce planning and organisational change management impacts an entity’s ability to deliver effective and efficient services, and risks staff psychological safety and retention. The 2024 DVA Capability Review found that the department’s strategic workforce planning capability did not meet the agency’s current needs.

Outsourcing service delivery, and use of information technology (IT) systems in another agency such as Services Australia, does not reduce accountability. DVA needs to ensure that service and quality control expectations are agreed and maintained, and that its business is appropriately prioritised to provide assurance that policy objectives are being met.

Asset management and sustainment

Any automated payment system creates specific risks in IT asset management and embedded compliance controls, as well as governance risks to ensure quality standards are met. The 2024 DVA Capability Review found that technology capability did not meet the agency’s current needs. In the 2023–24 Federal Budget, DVA received $253.7 million over four years to modernise and maintain its ICT systems, including the replacement of the system that facilitates payments to veterans, families and service providers.

Maintaining effective monitoring and reporting arrangements are essential to continue to ensure achievement of value for money and project outcomes as the Australian War Memorial progresses its $550 million development project, due for completion in June 2028.

Financial management

The reliable measurement and monitoring of assumptions and calculations underpinning the assessment of military compensation provision, including assumptions relating to future trends in medical costs, permanent incapacity, and inflation rates, are critical to Defence and DVA, considering the impact of rehabilitation on the overall performance of the compensation scheme and the financial sustainability of the provision.

Previous performance audit coverage

The ANAO’s performance audit activities involve the independent and objective assessment of all or part of an entity’s operations and administrative support systems. Performance audits may involve multiple entities and examine common aspects of administration or the joint administration of a program or service.

During the performance audit process, the ANAO gathers and analyses the evidence necessary to draw a conclusion on the audit objective. Audit conclusions can be grouped into four categories:

- unqualified;

- qualified (largely positive);

- qualified (partly positive); and

- adverse.

In the period between 2020–21 and 2024–25 entities within the Veterans’ Affairs portfolio were included in tabled ANAO performance audits four times. The conclusions directed toward entities within this portfolio were as follows:

- none were unqualified;

- four were qualified (largely positive);

- none were qualified (partly positive); and

- none were adverse.

Figure 2 shows the number of audit conclusions for entities within the Veterans’ Affairs portfolio that were included in ANAO performance audits between 2020–21 and 2024–25 compared with all audits tabled in this period.

Figure 2: Audit conclusions 2020–21 and 2024–25: entities within the Veterans’ Affairs portfolio compared with all audits tabled

Source: ANAO data

The ANAO’s annual audit work program is intended to deliver a mix of performance audits across seven audit activities: governance; service delivery; grants administration; procurement; policy development; regulation and asset management and sustainment. These activities are intended to cover the scope of activities undertaken by the public sector. Each performance audit considers a primary audit activity. Figure 3 shows audit conclusions by primary audit activity for audits involving entities in the Veterans’ Affairs portfolio.

Figure 3: Audit conclusions by activity for audits involving entities within the Veterans’ Affairs portfolio, 2020–21 to 2024–25

Source: ANAO data.

Performance statements audit

The audit of the 2024-25 Department of Veterans’ Affairs (DVA) annual performance statements is being conducted following a request from the Minister for Finance on 2 July 2024, under section 40 of the Public Governance, Performance and Accountability Act 2013. The audit is conducted under section 15 of the Auditor-General Act 1997.

DVA has been included in the annual performance statements audit program since the commencement of the pilot in 2019–20.

The ANAO considers the risk associated with DVA’s performance statements audit as moderate. This is due to changes within DVA and its operating environment that have implications for the performance statements, including heightened public scrutiny and interest following the Royal Commission into Defence and Veteran Suicide. The maturing performance statements processes, and fragmented and legacy IT systems, also contribute to this risk. There are one significant, one moderate and two low-risk unresolved findings from last year’s audit.

Key risks for DVA’s performance statements that the ANAO has highlighted include:

- the completeness and balance of performance information in providing a basis for assessing DVA’s performance in achieving its purpose

- the appropriateness of individual performance measures with a particular focus on quality assurance over data flows to produce complete and accurate information

- performance statements preparation processes to provide timely, complete and accurate audit evidence.

Financial statements audits

Overview

Entities within the Veterans’ Affairs portfolio, and the risk profile of each entity, are shown in Table 1.

Table 1: Veterans’ Affairs portfolio entities and risk profile

|

|

Type of entity |

Engagement risk |

Number of higher risks |

Number of moderate risks |

|

Material entities |

||||

|

Department of Veterans’ Affairs |

Non-corporate |

Moderate |

2 |

0 |

|

Australian War Memorial |

Corporate |

Low |

1 |

2 |

|

Other audit engagements (including Auditor-General Act 1997 sections 15 and 20 engagements) |

||||

|

Defence Services Home Insurance Scheme |

||||

Material entities

Department of Veterans’ Affairs

The Department of Veterans’ Affairs (DVA) is responsible for developing and implementing programs to assist the veteran and ex-service communities. This includes granting pensions, allowances and other benefits, and providing treatment under the Veterans’ Entitlements Act 1986; the administration of benefits and arrangements under the Military Rehabilitation and Compensation Act 2004; determining and managing claims relating to defence service under the Safety, Rehabilitation and Compensation (Defence-related Claims) Act 1998 (DRCT); administering the Defence Service Homes Act 1918 and the War Graves Act 1980; and conducting commemorative programs to acknowledge the service and sacrifice of Australian servicemen and women.

From July 1, 2026, the Veterans’ Entitlements Act 1986 (VEA) and the Safety, Rehabilitation and Compensation (Defence-related Claims) Act 1988 (DRCA) will close to new claims, with all compensation and rehabilitation claims being determined under the amended Military Rehabilitation and Compensation Act 2004 (MRCA).

DVA’s total budgeted liabilities for 2025–26 are $90.6 billion, with personal benefits provisions and health and other provisions representing 51 per cent and 49 per cent, respectively, as shown in Figure 4. Personal benefits expenses account for 46 per cent of total budgeted expenses, and health care payments account for 34 per cent.

Figure 4: Department of Veterans’ Affairs’ total budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are two key risks for the Department of Veterans’ Affairs 2024–25 financial statements that the ANAO has highlighted for specific audit coverage, including one risk that the ANAO considers a potential key audit matter (KAM).

- The judgements involved in the selection of data, assumptions and calculations underpinning the actuarial assessment of the personal benefits and health care (military compensation) provision balances including assumptions relating to future trends in medical costs, permanent incapacity, and inflation rates. (KAM – Valuation of personal benefit and healthcare provisions)

- The accuracy of personal benefit and health care expenses based on a complex legislative environment and information provided by veterans and their dependants.

Australian War Memorial

The Australian War Memorial (AWM) has responsibility for commemorating, interpreting and understanding the Australian experience of war and its enduring impact through maintaining and developing the national memorial and its collection, and exhibiting historical material, and undertaking commemorative ceremonies and research.

The AWM’s total budgeted assets for 2025–26 are $1.9 billion, with property, plant and equipment and land and buildings representing 60 per cent and 38 per cent, respectively, as shown in Figure 5.

Figure 5: The Australian War Memorial’s budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are three key risks for the AWM’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage.

- The valuation of the national collection, due to the complexity in valuing a large collection of unique heritage and cultural items of significant value.

- The valuation of AWM’s land and building assets, due to the complexity in valuing assets of a specialised nature.

- The capitalisation of redevelopment costs in view of the significant expansion of gallery spaces, improvement and modernisation of memorial buildings, and enhancement of visitor experience.