Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Portfolio overview

The Treasury portfolio is responsible for a range of activities aimed at achieving strong, sustainable and inclusive economic and fiscal outcomes for Australians.

The Department of the Treasury (the Treasury) is the lead entity in the portfolio and provides policy advice, analysis and the delivery of economic policies and programs, including legislation, administrative payments and regulatory functions, which support the effective management of the Australian economy. Further information is available from the department’s website.

An Administrative Arrangement Order (AAO) was made on 13 May 2025 which impacts areas of responsibility in the Treasury portfolio.

In addition to the department, there are 17 entities within the portfolio with a broad range of responsibilities, including revenue collection, consumer protection, financial regulation and the provision of official statistics. The portfolio includes the Australian Taxation Office (ATO) – audit considerations for the ATO are discussed in a separate overview.

In the 2025–26 Portfolio Budget Statements (PBS) for the Treasury portfolio — excluding the ATO — the aggregated budgeted expenses for 2025–26 total $249.8 billion. The PBS contain budgets for those entities in the general government sector (GGS) that receive appropriations directly or indirectly through annual appropriation Acts.

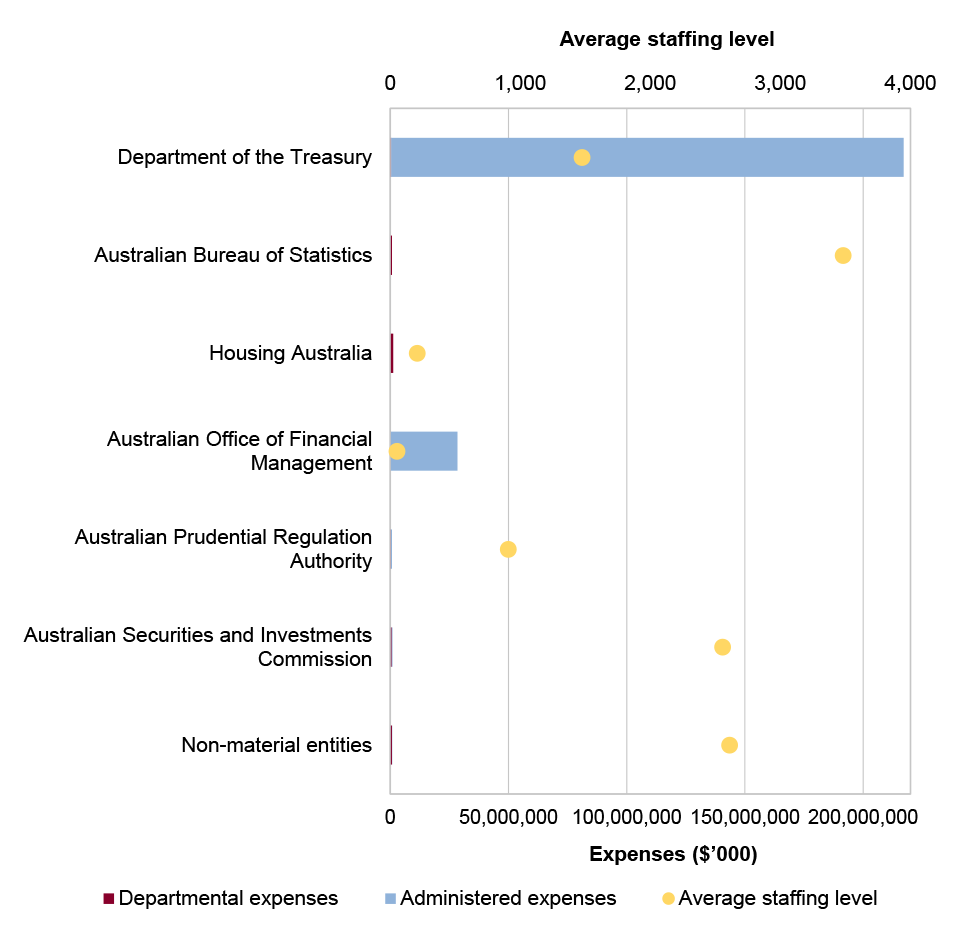

The level of budgeted departmental and administered expenses, and the average staffing level for entities in the GGS within this portfolio are shown in Figure 1. The Department of the Treasury represents the largest proportion of the portfolio’s expenses, and administered expenses of the portfolio are the most material component, representing 98 per cent of the entire portfolio’s expenses.

Figure 1: Treasury portfolio – total expenses and average staffing level by entity

Source: ANAO analysis of 2025–26 Portfolio Budget Statements and the 13 May 2025 AAO.

Audit focus

In determining the 2025–26 audit work program, the ANAO considers prior-year audit and other review findings and what these indicate about portfolio risks and areas for improvement. The ANAO also considers emerging risks from new investments or changes in the operating environment.

The primary risk for the portfolio relates to cross-portfolio stewardship and delivery of reforms, policies and programs.

Specific risks in the Treasury portfolio relate to governance, policy development, regulation, asset management and sustainment, and financial management.

Governance

ANAO audits in the portfolio have highlighted the importance of: reviewing and updating risk frameworks and risk assessments; implementing rigorous performance measurement, monitoring and reporting; record keeping and giving greater assurance over the quality of, and compliance with legislation, policies and procedures.

Governance arrangements need to position Treasury to have a strong cross-portfolio stewardship and engagement focus.

Machinery of Government changes require close management to ensure continuity of business, management of risk and cost and support to the government, employees and stakeholders.

Policy development

Treasury’s operating context, and the Australian economy, are subject to uncertainty and structural changes. In this context, Treasury’s policy development risks relate to its modelling and analytical capabilities, and its advising capabilities with respect to policy and regulatory reform (including economic policy and Treasury’s legislative program).

Housing is a focus area for the portfolio due to a range of policies aimed at increasing Australia’s level of safe and affordable housing. There are risks around stakeholder engagement and governance in relation to the development of measures to support housing finance and construction activity given implementation involves multiple layers of government across Australia as well as a range of non-government partners.

Effective cross-portfolio stewardship arrangements support delivery, including governance, monitoring, reporting and evaluation. Without these, there is a risk that the policy will not achieve its objectives. As part of implementation, the government should be provided with timely and accurate advice, and decisions should be sought, as appropriate.

Regulation

A number of government outcomes in the Treasury portfolio are delivered through portfolio entities, including financial regulators such as the Australian Prudential Regulation Authority, the Reserve Bank of Australia and the Australian Securities and Investments Commission. The risk is whether regulatory activities are data driven, and remain contemporary and effective. In managing this risk, regulators should appropriately use their range of regulatory powers.

Financing government policies

Under successive governments there has been a shift toward delivering more government policies using alternative financing arrangements, such as equity investments, concessional loans and guarantees, rather than direct payments. Transparency on the decision-making process that leads to the use of these alternative financing arrangements and the longer-term costs and risks of these types of arrangements remains an area that requires focus.

The management and impacts of significant new housing programs delivered through Housing Australia and the uncertainty over the increasing size and estimation of Disaster Recovery Funding Arrangements provision are risk areas for the Treasury portfolio.

Previous performance audit coverage

The ANAO’s performance audit activities involve the independent and objective assessment of all or part of an entity’s operations and administrative support systems. Performance audits may involve multiple entities and examine common aspects of administration or the joint administration of a program or service.

During the performance audit process, the ANAO gathers and analyses the evidence necessary to draw a conclusion on the audit objective. Audit conclusions can be grouped into four categories:

- unqualified;

- qualified (largely positive);

- qualified (partly positive); and

- adverse.

In the period between 2020–21 and 2024–25 entities within the Treasury portfolio were included in tabled ANAO performance audits 18 times. The conclusions directed toward entities within this portfolio were as follows:

- two were unqualified;

- eight were qualified (largely positive);

- seven were qualified (partly positive); and

- one was adverse.

Figure 2 shows the number of audit conclusions for entities within the Treasury portfolio that were included in ANAO performance audits between 2020–21 and 2024–25 compared with all audits tabled in this period.

Figure 2: Audit conclusions 2020–21 to 2024–25: entities within the Treasury portfolio compared with all audits tabled

Source: ANAO data

The ANAO’s annual audit work program is intended to deliver a mix of performance audits across seven audit activities: governance; service delivery; grants administration; procurement; policy development; regulation and asset management and sustainment. These activities are intended to cover the scope of activities undertaken by the public sector. Each performance audit considers a primary audit activity. Figure 3 shows audit conclusions by primary audit activity for audits involving entities in the Treasury portfolio.

Figure 3: Audit conclusions by activity for audits involving entities within the Treasury portfolio, 2020–21 to 2024–25

Source: ANAO data.

Performance statements audit

The audit of the 2024–25 Treasury annual performance statements is being conducted following a request from the Minister for Finance on 2 July 2024, under section 40 of the Public Governance, Performance and Accountability Act 2013. The audit is conducted under section 15 of the Auditor-General Act 1997.

Treasury is in its fourth year of inclusion in the annual performance statements audit program. The ANAO considers the risk associated with the performance statements audit as low. This is due to:

- established and documented processes for the development and review of the Treasury’s performance measures;

- centralised responsibility for the management of performance statements preparation; and

- there are no unresolved significant or moderate audit issues from prior performance statements audits.

The key low risks for Treasury’s performance statements that the ANAO has highlighted include:

- appropriateness and completeness of performance measures and targets that meet the requirements of the Public Governance, Performance and Accountability Rule 2014; and

- stakeholder surveys that are designed to report appropriately on performance measures identified in the corporate plan and are underpinned by a quality assurance framework.

Financial statements audits

Overview

Entities within the Treasury portfolio, and the risk profile of each entity, are shown in Table 1.

Table 1: Treasury portfolio entities and risk profile

|

|

Type of entity |

Engagement risk |

Number of higher risks |

Number of moderate risks |

|

Material entities |

||||

|

Department of the Treasury |

Non-corporate |

Moderate |

1 |

2 |

|

Australian Bureau of Statistics |

Non-corporate |

Low |

1 |

3 |

|

Australian Office of Financial Management |

Non-corporate |

Moderate |

0 |

1 |

|

Australian Prudential Regulation Authority |

Non-corporate |

Low |

0 |

1 |

|

Australian Reinsurance Pool Corporation |

Corporate |

Moderate |

1 |

2 |

|

Australian Securities and Investments Commission |

Non-corporate |

Moderate |

0 |

2 |

|

Housing Australia |

Corporate |

Moderate |

0 |

2 |

|

Reserve Bank of Australia |

Corporate |

Moderate |

1 |

1 |

|

Non-material entities |

||||

|

Australian Competition and Consumer Commission |

Non-corporate |

Low |

||

|

Australian Financial Security Authority |

Non-corporate |

Moderate |

||

|

Commonwealth Grants Commission |

Non-corporate |

Low |

||

|

Inspector-General of Taxation |

Non-corporate |

Low |

||

|

National Competition Council |

Non-corporate |

Low |

||

|

Office of the Auditing and Assurance Standards Board |

Non-corporate |

Low |

||

|

Office of the Australian Accounting Standards Board |

Non-corporate |

Low |

||

|

Productivity Commission |

Non-corporate |

Low |

||

|

Royal Australian Mint |

Non-corporate |

Moderate |

||

|

Other audit engagements (including Auditor-General Act 1997 section 20 engagements) |

||||

|

Australian Financial Security Authority – section 313 of the Bankruptcy Act 1966 |

||||

|

Green bonds limited assurance – compliance engagement |

||||

Material entities

Department of the Treasury

The Department of the Treasury (the Treasury) provides policy advice, analysis and the delivery of economic policies and programs, including legislation, administrative payments and regulatory functions, which support the effective management of the Australian economy.

The Treasury’s total budgeted liabilities for 2025–26 are $36.8 billion, with 19 per cent attributable to grants provisions. Total budgeted expenses are $217.1 billion, with 74 per cent of these expenses attributable to grants, as shown in Figure 4.

Figure 4: Department of the Treasury’s total budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are three key risks for the Treasury’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage, two that the ANAO considers potential key audit matters (KAMs).

- The management and valuation of the Disaster Recovery Funding Arrangements provision, due to the judgement involved in estimating costs expected to be incurred for those eligible for assistance under these arrangements. The Treasury is also reliant on state and territory governments to provide information to support these estimates. (KAM – Valuation of the Disaster Recovery Funding Arrangements provision)

- The stewardship over grant payments to states and territories under the Federal Financial Relations Act 2009, due to reliance on other Australian Government entities and state and territory governments to administer the programs and provide information to support payments. (KAM – Accuracy and occurrence of grants expense)

- The accounting complexities associated with the significant new housing programs delivered through Housing Australia that will be accounted for by the Treasury.

Australian Bureau of Statistics

The Australian Bureau of Statistics (ABS) is Australia’s national statistical agency. The ABS’ purpose is to inform Australia’s important decisions by delivering relevant, trusted and objective data, statistics and insights. It provides trusted official statistics on a wide range of economic, social, population and environmental matters of importance to Australia. The ABS’s total budgeted assets for 2025–26 are $274.9 million, with 16 per cent of these assets attributable to intangibles. The sale of goods and services contribute to 7 per cent of total budgeted revenues, as shown in Figure 5.

Figure 5: Australian Bureau of Statistics budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are four key risks for the ABS’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage.

- The valuation and impairment assessments of intangibles (software).

- The recognition of revenue from the rendering of services.

- The valuation of employee benefits – Population Survey Operations.

- The capitalisation of expenditure and classification of spend as capital or operating.

Australian Office of Financial Management

The Australian Office of Financial Management (AOFM) is responsible for managing Australian Government debt and financial assets. It issues Treasury Bonds, Treasury Indexed Bonds and Treasury Notes, manages the government’s cash balances and invests in high quality financial assets under the Australian Business Securitisation Fund and the Structured Finance Support Fund.

AOFM’s total budgeted liabilities for 2025–26 are $968.5 billion. 89 per cent of these liabilities are attributable to Treasury Bonds, as shown in Figure 6.

Figure 6: Australian Office of Financial Management’s budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There is one key risk for AOFM’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage, which the ANAO considers a potential key audit matter (KAM), being the management and financial reporting of Australian Government securities, which are impacted by external market factors. (KAM – Valuation of Australian Government securities)

Australian Prudential Regulation Authority

The Australian Prudential Regulation Authority (APRA) is responsible for the prudential regulation of the Australian financial services industry through the oversight of banks, credit unions, building societies, friendly societies, general insurers, life insurers, private health insurers, reinsurance companies and most of the superannuation industry. APRA is funded largely by the industries that it regulates.

APRA’s total budgeted revenues for 2025–26 include private health insurance risk equalisation receipts and financial institutions supervision levies. Private health insurance risk equalisation receipts of $430.0 million are forecast to be collected and paid as part of APRA’s administration of the scheme. Financial institutions supervision levies are forecast to be $282.6 million, of which $258.3 million is forecast to be retained as departmental operational funding for the agency.

Figure 7: Australian Prudential Regulation Authority’s budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There is one key risk for APRA’s 2024–25 financial statements that the calculation and recognition of administered levy revenue, including the financial institutions supervisory levies, financial assistance levies and the private health insurance risk equalisation levy revenue and associated payments. This involves complex calculations that are prescribed by legislation.

Australian Reinsurance Pool Corporation

The Australian Reinsurance Pool Corporation (ARPC), established by the Terrorism and Cyclone Insurance Act 2003, is responsible for administering the Terrorism Reinsurance Pool, providing primary insurers with reinsurance for commercial property and associated business interruption losses arising from a declared terrorist incident and the Cyclone Reinsurance Pool, providing insurers with reinsurance for household, strata and small business property insurance for losses arising from cyclone and cyclone related flooding for declared cyclone events.

ARPC’s total actual revenues for 2023–24 were $1.0 billion, of which 93 per cent were attributable to premium revenue, as shown in Figure 8. Outwards retrocession premium expenses contributed to 19 per cent of total actual expenses.

Figure 8: Australian Reinsurance Pool Corporation’s actual financial statements by category ($’000)

Source: ANAO analysis of Australian Reinsurance Pool Corporation’s 2023–24 Annual Report.

There are three key risks for ARPC’s 2024–25 financial statements.

- Valuation of the Outstanding Claims Reserve, including the selection of subjective methods and assumptions for the Cyclone Reinsurance Pool. In 2024-25 the impacts of Cyclone Alfred are expected to have a significant impact on the claims reserve and the financial position of ARPC.

- The recognition and reporting of premium revenue and unearned premium liability for the Cyclone Pool, which involves complex calculations and reliance on third-party information.

- The recognition and reporting of premium revenue and unearned premium liability for the Terrorism Pool, which involves complex calculations and reliance on third-party information.

Australian Securities and Investments Commission

The Australian Securities and Investments Commission (ASIC) is Australia’s integrated corporate, financial services, markets and consumer credit regulator, supporting a fair, strong and efficient financial system for all Australians. ASIC’s core responsibility is to maintain and facilitate the performance of Australia’s financial system and promote confident and informed participation by investors and consumers.

ASIC’s total budgeted liabilities for 2025–26 are $1.0 billion, with 67 per cent of these liabilities attributable to unclaimed monies provisions, as shown in Figure 9. Revenues, other than Revenue from Government, contribute to 80 per cent of total budgeted revenues.

Figure 9: Australian Securities and Investments Commission’s budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are two key risks for ASIC’s 2024–25 financial statements.

- The estimation of the Commonwealth’s future liability for repayment of unclaimed monies, which uses a complex valuation model.

- The recognition of ASIC’s diverse administered revenue streams, involving complex calculations that are prescribed in a number of Acts and regulations.

Housing Australia (formerly National Housing Finance and Investment Corporation)

Housing Australia is responsible for: the establishment and operation of an Affordable Housing Bond Aggregator (AHBA), which provides finance to registered community housing providers by aggregating their lending requirements and issuing bonds to institutional investors and; the establishment and operation of the National Housing Infrastructure Facility (NHIF) to provide loans, grants and investments for social and affordable housing as well as to overcome impediments to the provision of housing that is due to the lack of necessary infrastructure. It also administers the Home Guarantee Scheme (HGS) to support first home buyers and single parents to access the housing market sooner. In 2022–23 the Government announced the Housing Australia Future Fund (HAFF) and the National Housing Accord, to be administered by Housing Australia, to improve housing outcomes for Australians and which will collectively support the delivery of 20,000 new social and 20,000 new affordable homes across Australia over five years.

Housing Australia’s total budgeted liabilities for 2025–26 are $8.5 billion, with 89 per cent of these attributable to other provisions (primarily for grants in the form of availability payments), as shown in Figure 10. Loans account for 11 per cent of total budgeted liabilities.

Figure 10: Housing Australia’s actual financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are two key risks for Housing Australia’s 2024–25 financial statements.

- The accounting for, and assessment of, concessional loans, which are complex and involve the application of judgement surrounding the selection and application of indices such as market rates. Housing Australia’s aim is to improve housing outcomes by reducing pressure on housing affordability, which will be undertaken by providing concessional finance to registered community housing providers.

- Issuance and valuation of financial instruments, including their subsequent measurement, due to the significant judgements required in the valuation and accounting of financial instruments. This includes both concessional and other loans held and the bonds issued by Housing Australia under the Affordable Housing Bond Aggregator program and the agreements under the HAFF.

Reserve Bank of Australia

The Reserve Bank of Australia (RBA) is responsible for determining and implementing monetary policy that seeks to contribute to the stability of the currency and maintains full employment, works to maintain a strong financial system and efficient payments system and issue the nation’s banknotes. As well as being a policymaking body, the RBA provides selected banking services to a range of Australian Government entities and to a number of overseas central banks and official institutions. The RBA is also responsible for the management of Australia’s gold and foreign exchange reserves.

RBA’s total actual assets for 2023–24 were $413.7 billion, of which 76 per cent were attributable to Australian dollar investments and 22 per cent were attributable to foreign currency investments, as shown in Figure 11. Australian banknotes on issue represent 23 per cent of total actual liabilities.

Figure 11: Reserve Bank of Australia’s actual financial statements by category ($’000)

Note a: Net interest income is shown as an expense as it is a negative figure in the financial statements.

Source: ANAO analysis of Reserve Bank of Australia 2023–24 Annual Report.

There are two key risks for the RBA’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage, including one risk that the ANAO considers a potential key audit matter (KAM).

- The valuation of Australian dollar securities and foreign currency investments, due to the complexity in determining the fair value of a range of investments. In addition, there is an inherent risk of significant financial impact due to fluctuations in the value of the Australian dollar and the volume of Australian bond holdings. (KAM – Valuation of Australian dollar securities and foreign currency investments)

- The accuracy of the liability for Australian banknotes on issue, due to the dependence on the assumption that all Australian banknotes on issue retain their legal tender status.