Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

ANAO Annual Report 2021–22

Please direct enquiries through our contact page.

Part 1 — Foreword by the Auditor-General

As Auditor-General for Australia I am pleased to present this annual report to the Parliament. This year has seen the Australian National Audit Office (ANAO) continue to deliver against its mandate under the Auditor-General Act 1997, through the delivery of high-quality reporting.

A year in review

In March 2022, the JCPAA concluded the 2020 review of the Auditor-General Act 1997 (the Act) and presented Report 491: Review of the Auditor-General Act 1997. The issue of the Auditor-General’s independence is a clear and significant theme throughout the report. The JCPAA noted it is vital that the Act remains fit for purpose — specifically, that the Act must continue to ensure the Auditor-General’s independence and remit, establish clear processes, and interact consistently with other legislation. The report made 27 recommendations, including amendments to the Act and related legislation. I believe the report by the JCPAA provides a positive foundation to strengthen the independence of the Auditor-General. There would be value in timely government consideration of the report’s recommendations.

Further, throughout the inquiry, the JCPAA showed an interest in the collection of evidence in the ANAO’s work with the emergence of new technology within the public sector. In February 2022, the ANAO provided an additional submission to the JCPAA outlining the complexities related to the Auditor-General’s information-gathering powers (sections 32 and 33 of the Act), and the potential for legislative amendments to modernise and clarify how information is requested and gathered under those powers. More broadly, I have observed increasing complexities associated with auditing in a contestable environment — specifically the shift towards government and service provider information being held not only as commercial-in-confidence, but at increasingly higher levels of security classification. There have also been more issues being raised regarding the protection of personal information. Impediments, or perceived barriers, to this access represent a challenge to the audit process.

The role of the auditor will always be focused on transparency, and providing the information necessary to assist the Parliament in holding the executive arm of government to account. The efficient collection of sufficient and appropriate information — to form substantive, accurate, evidence-based conclusions — is critical to our work. Preserving and refreshing the Auditor-General’s information-gathering powers in the shifting environment of the public service remains a key issue for the ANAO.

As part of the Budget 2021–22, the government announced additional funding for the ANAO. Across the year, we utilised this funding to support the delivery of the ANAO’s mandatory financial statements audits for inclusion within entities’ annual reports, for the scrutiny of Parliament. The ANAO also began rebuilding performance audit capacity which had been reduced in prior years. The restoration of capability within this area will enable the ANAO to meet a target of 48 performance audits by 2024–25.

In addition, we continued the staged implementation of our performance statements auditing program, with the auditing of six government entities currently underway. We have also continued to look for efficiencies in how we meet ongoing quality, data analysis, evidence extraction and data storage requirements.

On 23 June 2022, the Australian Government issued changes to the Administrative Arrangements Orders, which resulted in the creation of two new departments — effective 1 July 2022. Mandatory auditing (both financial statements and the emerging performance statements program) of new departments may have an impact on the delivery of performance audits as planned in our forward years.

While the additional funding has alleviated some budgetary pressures in the delivery of our products, the increasing demand for audit-related expertise has led to a competitive recruitment environment, tight labour market and increased costs associated with contracted staff. We have identified that maintaining resourcing requirements is a strategic risk for the organisation, across all audit disciplines.

In April 2022, we published Audits of the Annual Performance Statements of Australian Government Entities — Pilot Program 2020–21. The report reflected on the outcome of the ANAO’s annual performance statements audit pilot program, and the ANAO’s preparation for the staged implementation of an annual performance statements assurance audit program.

Performance statements auditing represents an important change for the sector — as its implementation will improve the performance reporting to Parliament and provide assurance of its reliability. The roll-out of the program has identified areas of improvement for both the sector and the ANAO. In the entities audited so far, we have observed challenges in developing a sound evidence base for measuring performance targets, and difficulties in building the internal capability required to compile reliable information to support performance statements reporting. For the ANAO, adapting to a new methodology and working with entity functions unfamiliar with audit processes has been challenging. We recognise that we need to build familiarity with this new methodology and audit function within the sector, in addition to establishing the right posture within the delivery of these audits. The program will remain a significant focus of the ANAO over the coming years.

While the ANAO’s performance and financial audits point to many areas of high quality and effectiveness within the public sector, there continues to be evidence that the sector’s approach to some core activities regularly falls short of expectations. This is especially prevalent in the areas of cybersecurity, procurement, and grants administration.

Cybersecurity has been an audit focus for the ANAO for many years. These audits continue to reveal deficiencies and risks across entities’ cybersecurity environments. We have also observed optimism bias in reporting by entities, and little analysis or escalation of the success or otherwise of the policy framework to government. Given the extent of audit work undertaken and the evolving risk environment, it is fair to say these observations are disappointing.

Similarly, audits of procurements continue to identify issues in government administration. As a core public sector activity, procurement is regulated by mandatory rules set by the Minister for Finance, the Commonwealth Procurement Rules (CPRs). Despite this, our audits continue to find evidence of procurement activities which fall short of meeting the intent of these rules, thereby compromising the sector’s ability to demonstrate value for money. This often includes the absence of open competition. Poor entity practices related to planning, record keeping, contract management, negotiation, risk management, and probity raise questions about whether the professionalisation of procurement should be a priority within the public sector. There is merit in focusing on both skill development and ethical mindset — that is, delivery against the intent of the framework being of equal importance as compliance with it.

Likewise, performance audits of grants administration indicate that there has not been consistent compliance with the intent of the Commonwealth Grants Rules and Guidelines (CGRGs). The ANAO’s audit work has shown that advice to government has not always been robust — including insufficient attention to the authority of decision-makers and poor record-keeping in decision-making without assessment, or rationale for decisions being documented.

Report on performance

The ANAO’s performance during 2021–22 is reported on in detail within Part 3: Report on Performance.

The ANAO’s performance audit program continues to undertake audits to promote accountability, transparency and improvement in public administration. In 2021–22, the ANAO successfully carried out its Annual Audit Work Program (AAWP), presenting 40 performance audits to Parliament. In the delivery of these performance audits, we achieved the intended coverage outlined in the program. The primary focus of ANAO performance audits was effectiveness and economy — specifically, the extent to which entities delivered on intended objectives and the value for money achieved in doing so.

In 2021–22, we also continued to deliver our multi-year, COVID-19 audit strategy. The ANAO tabled five COVID-19-related performance audits in 2021–22, and commenced a further two COVID-19-related performance audits for tabling in 2022–23. Audits of COVID-19 response activities concluded that public sector entities were largely effective in managing response activities. The key areas for improvement identified by the ANAO were in planning and preparedness for crisis.

Additionally, the ANAO published two Audit Insights reports, which serve to support the focus of the AAWP. Topics addressed were the effectiveness of entities’ management of contractors, and service delivery through other entities.

In 2021–22, a total of 164 findings were reported to entities as a result of the 2020–21 financial statements audits. These comprised two significant, 21 moderate and 127 minor findings, as well as 14 legislative breaches. This is an increase in the number of findings compared to the 2019–20 financial statements audits.

The highest number of findings continue to be in the categories of IT security management and user access — in particular the management of privileged users, and accounting and control of non-financial assets. Similar to 2020–21, the continuation of findings in relation to IT controls further reinforces the poor delivery of fit-for-purpose cybersecurity within the sector. Additionally, there has also been an increase in legislative breaches in executive remuneration. Findings in governance at the top of some organisations is suggestive of cultures where entity staff may not feel permitted to raise concerns. The appropriate governance of remuneration and management of risk in the senior echelons of the public sector will continue to be a focus in financial statements work.

During 2021–22, the ANAO continued its performance statements audit pilot program, auditing the 2020–21 performance statements of the same three entities as in 2019–20: the Attorney-General’s Department (AGD), the Department of Social Services (DSS) and the Department of Veterans’ Affairs (DVA). These audits found that entities were largely compliant with the requirements of the performance framework, and fairly presented the performance of the organisation. However, there were some exceptions where specific measures did not meet those requirements. The ANAO made significant findings and reported exceptions as qualifications to our audit conclusion for 14.9 per cent of the three entities’ performance measures. Qualifications and significant findings are not unexpected early in the delivery of a new audit program.

During 2021–22, the JCPAA conducted six inquiries based on its review of a total of 22 Auditor-General reports throughout the year, resulting in the tabling of four reports. The ANAO provided a total of three briefings, attended 10 public hearings, and made three submissions to assist the Committee in undertaking its functions. In addition to the support provided to the JCPAA, the ANAO further supported the work of the Parliament by providing submissions, information, assistance and briefings to parliamentarians and parliamentary committees. In 2021–22, the ANAO provided 10 briefings to parliamentarians and, in support of other parliamentary committee inquiries, attended nine public hearings, provided one briefing and eight submissions.

The year ahead

Auditing is an important profession. It is through our evidence-based, methodological disciplines that we are able provide assurance to the Parliament. Recognising the fast-paced, rapid-implementation, information-driven environment of the public service, the ANAO will continue to identify opportunities that will allow us to enhance delivery on our purpose, including through the sharing of insights on our work.

Over the next year, I look forward to continuing the staged implementation of performance statements auditing across an increasing number of entities. Engaging with the sector and adopting the right audit posture will be important for the ANAO, as we continue to drive improvement in the quality of performance information provided to the Parliament. Refining the performance statements audit methodology and continuing to pilot various approaches to completing these audits will also remain a focus for us — especially as we look to expand the program and share insights.

The importance of ethics in the use of resources continues to be highlighted within our audits, particularly relating to procurement and grants administration. The Public Governance, Performance and Accountability Act 2013 (PGPA Act) requires accountable authorities of Commonwealth entities to govern in a way that promotes the proper use and management of public resources. The Act defines proper use as ‘efficient, effective, economical and ethical’. The ANAO is finalising the design of an appropriate audit framework against which to test entity compliance with ethical requirements.

In July 2022, to support our workforce requirements, we published a new workforce plan and announced our new integrated learning program — the ANAO Academy. The plan recognises the emerging trends within the recruitment environment, the need for us to cast our net wider for talent, and the potential to ‘grow our own’. The challenge of recruiting and training the staff to deliver our audit products will continue to be a significant issue for the ANAO — where quality audits depend on highly trained, technical and specialist expertise.

The ANAO will also look towards refreshing our organisational strategy, Towards 2025. The strategy will capture the shifts we intend to make within the ANAO, over the next several years, to continue to effectively deliver quality audit services to the Parliament in a changing public service environment.

In December 2022, following the Federal Budget, the ANAO will review the Annual Audit Work Program to ensure our audit strategy remains appropriate to the emerging policy and risk environment. I look forward to maintaining effective and active engagement with parliamentarians and committees in the year to come.

Finally, I would like to recognise the important, ongoing engagement with our national and international audit peers — including the Australasian Council of Auditors-General, international supreme audit institutions and our bilateral partners, Indonesia and Papua New Guinea. In 2021–22, we continued to adapt our engagement strategy to ensure connection in an environment still impacted by the COVID-19 pandemic. I am hopeful that 2022–23 will bring further opportunities for the ANAO to share learnings within this professional auditing community.

Grant Hehir

Auditor-General

Part 2 — Overview of the ANAO

This part provides an overview of the ANAO’s purpose, role and values, our organisational structure, and our relationships with the Parliament and other national and international bodies.

About the ANAO

The Australian National Audit Office (ANAO) is a specialist public sector agency providing a full range of audit and assurance services to the Parliament and entities within the Australian Government sector.

Purpose

The purpose of the ANAO is to support accountability and transparency in the Australian Government sector through independent reporting to the Parliament, and thereby contribute to improved public sector performance.

The ANAO delivers its purpose under the Auditor-General’s mandate as set out in the Auditor-General Act 1997, and in accordance with the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and the Public Service Act 1999.

The executive arm of government is accountable to the Parliament for its use of public resources and the administration of legislation passed by the Parliament. The Auditor-General provides independent assurance as to whether the executive is operating and accounting for its performance in accordance with the Parliament’s intent.

Role

The Governor-General, on the recommendation of the Joint Committee of Public Accounts and Audit (JCPAA) and the Prime Minister, appoints the Auditor-General for a term of 10 years. As an independent officer of the Parliament, the Auditor-General has complete discretion in performing or exercising the functions or powers under the Auditor-General Act 1997 (the Act). In particular, the Auditor-General is not subject to direction in relation to:

- whether a particular audit is to be conducted;

- the way a particular audit is to be conducted; or

- the priority given to any particular matter.

In exercising the functions or powers under the Act, the Auditor-General must have regard to the audit priorities of the Parliament, as determined by the JCPAA, and any reports made by the committee under the Public Accounts and Audit Committee Act 1951.

Under the Act, the Auditor-General’s functions include:

- auditing the annual financial statements of Commonwealth entities, and Commonwealth companies and their subsidiaries (section 11 of the Act);

- auditing the annual consolidated financial statements in accordance with the PGPA Act (section 12 of the Act);

- auditing annual performance statements of Commonwealth entities in accordance with the PGPA Act (section 15 of the Act);

- conducting performance audits and assurance reviews of Commonwealth entities and Commonwealth companies and their subsidiaries (sections 17 and 18 of the Act);

- conducting a performance audit of a Commonwealth partner (section 18B of the Act);

- providing other audit services as required by other legislation or allowed under section 20 of the Act; and

- reporting directly to the Parliament on any matter or to a minister on any important matter.

The ANAO supports the Auditor-General in this role.

Values

The ANAO upholds the Australian Public Service (APS) Values as set out in the Public Service Act 1999. The ANAO places particular focus on respect, integrity and excellence — values that align with the APS Values and address the unique aspects of the ANAO’s business and operating environment. The ANAO’s values guide the office in performing its role objectively, with impartiality and in a manner that supports the Parliament.

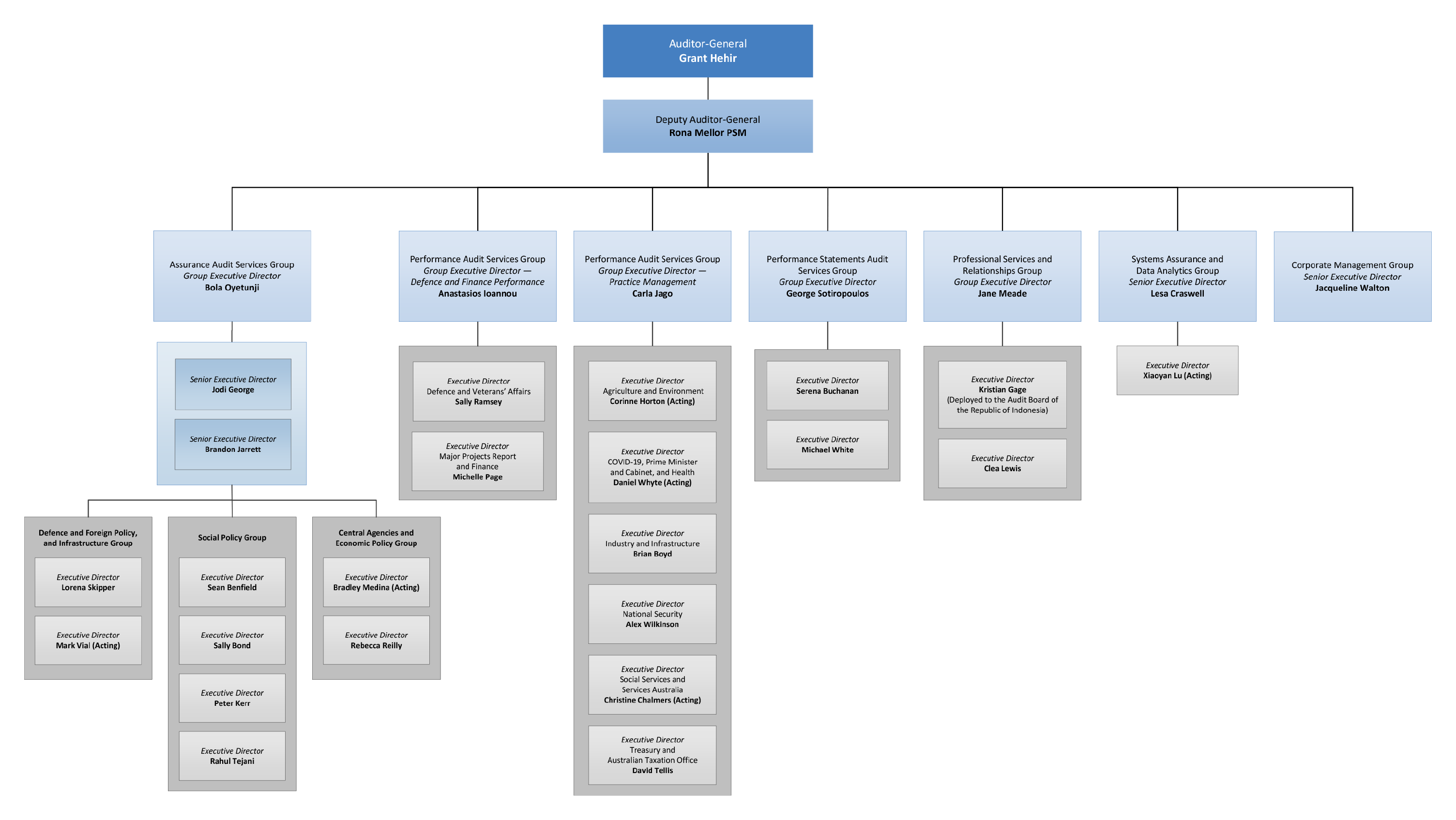

Organisational structure

To deliver on its purpose, the ANAO is organised into six functional areas:

- Assurance Audit Services Group1 provides independent assurance on the financial statements and financial administration of all Australian Government entities. It also conducts assurance reviews.

- Corporate Management Group leads corporate strategy and change for the ANAO. It provides services based on specialised knowledge, best practices and technology that enable the delivery of the ANAO’s purpose and audit outcomes.

- Performance Audit Services Group conducts performance audits and assurance reviews of Australian Government entities and their activities, and produces related publications and other information reports.

- Performance Statements Audit Services Group conducts audits of Australian Government entities’ performance statements and measures.

- Professional Services and Relationships Group provides technical accounting, audit and legal advice and support to the Auditor-General; establishes, manages and monitors the implementation of the quality assurance framework; and manages the ANAO’s external relations.

- Systems Assurance and Data Analytics Group provides IT audit and data analytics support to the ANAO’s assurance and performance audit work and other information reports.

The ANAO’s organisational structure at 30 June 2022 is shown in Figure 2.1.

Figure 2.1: Organisational structure at 30 June 2022

Relationships

In pursuing its purpose, the ANAO maintains key relationships with the Parliament, various national bodies and counterparts, as well as international counterparts, as described below.

The ANAO invests in a number of professional relationships through the two-way exchange and sharing of information and practices, and supports other nations through peer-to-peer institutional capacity development. The ANAO’s engagement strategy details the ANAO’s approach to key relationships with the public sector auditing community.

The impact of the COVID-19 pandemic on the public sector auditing community continued to influence the ANAO’s implementation of its engagement strategy and programs. This impacted the nature of engagement with international and national peers, with the continued use of virtual meetings and forums to exchange ideas and information, and to learn from and support audit offices in other nations.

The ANAO website contains further information about the ANAO’s relationships.

Parliament

The ANAO’s primary relationship is with the Australian Parliament and the ANAO’s key interaction with the Parliament is through the Joint Committee of Public Accounts and Audit (JCPAA). The Auditor-General’s reports assist the Parliament to hold government entities to account and to drive improvements in public administration. The Auditor-General and ANAO support the work of the Parliament by providing independent reporting, assurance and assistance. This assistance includes the provision of submissions and information, appearances before parliamentary committees, and briefings to parliamentarians. The Parliament and its committees also scrutinise the work and administration of the ANAO.

Joint Committee of Public Accounts and Audit

Among its responsibilities, the JCPAA considers the operations and resources of the ANAO, including the ANAO draft budget estimates, about which it makes recommendations to both houses of parliament. The JCPAA is required to review all ANAO reports that are tabled in the Parliament and to report the results of its deliberations to both houses of parliament. The committee’s functions in relation to the ANAO are specified in the Public Accounts and Audit Committee Act 1951. The JCPAA of the 46th Parliament commenced on 2 July 2019 and ceased on 11 April 2022 following the dissolution of the House of Representatives following the announcement of the federal election, which was held in May 2022.

The JCPAA conducted six inquiries on its review of Auditor-General reports throughout 2021–22, resulting in the tabling of four reports. Two inquiries lapsed due to the dissolution of the House of Representatives on 11 April 2022.

On 2 September 2020, the JCPAA resolved to undertake a review of the Auditor-General Act 1997. In 2021–22, the ANAO supported the review by attending three public hearings, making one primary submission and attending one private briefing. The JCPAA tabled Report 491 Review of the Auditor-General Act 1997 on 31 March 2022. In its report, the JCPAA recognised the important role the ANAO plays in examining the expenditure and administration of government programs, and the ANAO’s critical support for the work of the JCPAA and the Parliament. The report included 27 recommendations (six directed to the ANAO) going to matters related to independence and interaction of the Auditor-General Act 1997 with other legislation.

In 2021–22, officers of the ANAO provided a total of three private briefings, attended 10 public hearings and made three submissions to assist the committee in undertaking its functions. An outline of inquiries and reports is provided in Table 2.1.

Table 2.1: JCPAA inquiries and reports

National relationships

In addition to its relationship with the Parliament, the ANAO has important relationships with the accountable authorities of Australian Government entities, the Australasian Council of Auditors-General (which includes the state and territory auditors-general), and professional accounting bodies and standard-setting boards.

Accountable authorities

Accountable authorities of Australian Government entities have primary responsibility for and control over public sector entities’ operations. As such, the ANAO’s work focuses on the duties and responsibilities of accountable authorities (including the proper use and/or management of public resources) and the governance frameworks that accountable authorities put in place in their entities. The ANAO engages with entities at a number of levels to strengthen relationships and promote improved financial reporting and public sector administration, including through attendance at entity audit committees.

The ANAO’s ongoing relationship with chief financial officers (CFOs), officials responsible for preparing performance statements, and audit committees helps the ANAO achieve its purpose to both improve public sector performance and support accountability and transparency in the Australian Government sector. As part of this work, the ANAO conducts forums for CFOs and officials responsible for preparing performance statements, and — jointly with the Department of Finance — audit committee chairs, to share insights on emerging and topical audit issues and requirements affecting Australian Government entities.

The ANAO hosted a CFO forum in November 2021 that was attended by approximately 85 CFOs and entity representatives. The forum was presented by webinar in response to COVID-19 restrictions. In the forum, the ANAO shared information about issues arising in audits and key focus areas of the audit program, and outlined insights and themes on the effectiveness of public administration. The ANAO published a recording of the webinar on its website after the live delivery.

Audit committees, as a requirement of the PGPA Act, play an important role in entities’ governance frameworks. Audit committee chair forums were held in July 2021 and December 2021. In response to COVID-19 restrictions, the July forum was a hybrid event (online and in-person) with limited in-person attendees and the December forum was delivered entirely online. Invitations to the forums were extended to approximately 144 audit committee chairs and representatives. The forums provided an opportunity to share insights from the audit program, and relevant updates and information, to assist committees to meet the requirements of the PGPA Act and associated rules. The ANAO published a communique on its website after each forum.

Australasian Council of Auditors-General

The Auditor-General is a member of the Australasian Council of Auditors-General (ACAG), which comprises the auditors-general of Australia, New Zealand, Papua New Guinea and Fiji, along with the auditors-general of each Australian state and territory. ACAG’s objective is to promote and strengthen public sector audit in Australasia through leadership, collaboration, engagement, advocacy and peer support. The ANAO contributes to ACAG’s work by attending business meetings and subcommittee meetings, preparing discussion papers, participating in information exchanges, contributing to submissions to standard-setting bodies, undertaking annual benchmarking and client surveys, and conducting peer reviews.

Mentoring program

Following on from the ANAO’s four-month, ACAG-supported pilot mentoring program with the Tonga Office of the Auditor General in 2020, the ANAO delivered a mentoring program in Papua New Guinea (PNG) using our twinning partner arrangement with the PNG Auditor-General’s Office. The program is in two phases, with the initial four-month period (February to May 2022) having focused on one-on-one meetings to allow for the transfer of knowledge and skills. The second phase will be a four-month, group-based program aimed at allowing mentors and mentees to discuss and share their experiences.

Professional accounting bodies and standard-setting boards

The ANAO is actively involved in the work of two professional accounting bodies in Australia, CPA Australia and Chartered Accountants Australia and New Zealand (CA ANZ). Ms Carla Jago, Group Executive Director, Performance Audit Services Group, is a member of CA ANZ’s ACT Regional Council as well as a member of the CA ANZ National Council. The ANAO has recognised employer status under CPA Australia’s Recognised Employer Program, which includes organisations that are committed to providing their employees with the highest standard in professional development and support.

The ANAO contributes to the development of accounting and auditing standards through contributing to ACAG responses to exposure drafts for new or amended standards proposed by the Australian Accounting Standards Board, the Auditing and Assurance Standards Board, the Accounting Professional and Ethical Standards Board, and the International Public Sector Accounting Standards Board.

International relationships

The ANAO’s key international activities are engagement with other supreme audit institutions and bilateral capacity-building partnerships with Indonesia and Papua New Guinea under Australia’s international development program.

Supreme audit institutions

The supreme audit institution (SAI) is the lead public sector audit organisation in a country. Engagement with other SAIs allows the ANAO to participate in international dialogue on best practice public administration and developments in public sector auditing. The ANAO responds to requests from SAIs directly, including by hosting and presenting to visiting delegations, providing information and participating in surveys. Although virtual engagements continued throughout 2021–22, the easing of international travel restrictions allowed the ANAO to attend some engagements face to face.

The ANAO is a member of the International Organization of Supreme Audit Institutions (INTOSAI). INTOSAI is dedicated to promoting the exchange of information about audit and financial management among its member institutions and provides a network for the international public sector audit community.

The ANAO contributes to the activities of two INTOSAI regional organisations:

- the Asian Organization of Supreme Audit Institutions (ASOSAI); and

- the Pacific Association of Supreme Audit Institutions (PASAI).

Ms Jane Meade, Group Executive Director, Professional Services and Relationships Group, continues to be a member of the Forum for INTOSAI Professional Pronouncements (FIPP). The FIPP aims to support professional development by ensuring that INTOSAI provides a clear and consistent set of professional standards. The FIPP achieves this through reviewing and monitoring INTOSAI’s framework of professional pronouncements. During 2021–22, the ANAO participated in the forum via teleconference in September and October 2021 and February, April and June 2022.

The ANAO’s key international engagements in 2021–22 included participating in the following events:

- 12th PASAI Annual General Meeting and the 27th, 28th, 29th and 30th Governing Board meetings, attended by the Auditor-General as a member of the PASAI Governing Board;

- PASAI Governing Board subcommittee meetings in March and June 2022 for the Accountability and Transparency Study, attended by the Auditor-General as a member of the subcommittee;

- SAI20 Senior Officials Meeting hosted by SAI Indonesia in June 2022. SAI20 is an engagement group established in 2021 by the Republic of Indonesia under its presidency of the G20 under the G20 framework and focuses on good and accountable governance through the role of SAIs;

- INTOSAI Performance Audit Sub Committee meeting in London in June 2022 — the meeting afforded the Sub Committee the opportunity to discuss its new work plan;

- initial planning meeting for the ASOSAI 13th Research Project on ‘Remote Audit for SAIs: Future and Challenges’, with the project leader SAI Indonesia;

- INTOSAI Working Group on Information Technology Audit seminar on opportunities and challenges in IT audit;

- INTOSAI Capacity Building Committee Peer-to-Peer Meeting series, including five webinars from September 2021 to June 2022;

- bilateral meeting with the National Audit Department of Malaysia on ‘Big Data Analytics’;

- webinar on ‘The Role of SAIs in National Health Crisis — Focusing on Prevention and Preparedness’ — the ANAO delivered a presentation on its policy measures developed in response to COVID-19;

- INTOSAI Working Group on Crisis Management Audit meeting — afforded the working group the opportunity to discuss its work plan;

- INTOSAI Working Group on the Impact of Science and Technology on Auditing meeting;

- ASOSAI 15th Assembly and 8th Seminar on Environmental Auditing — the ANAO delivered a presentation on ‘Audit promoting government accountability for the environment’;

- INTOSAI Development Initiative webinar on ‘Healthcare Audit Analytics’;

- Canadian Audit and Accountability Foundation annual conference — the Deputy Auditor-General delivered a pre-recorded presentation on auditing the impact of the Australian Government’s COVID-19 measures;

- bilateral meeting with Fiji Office of the Auditor-General on building capacity to work remotely during the COVID-19 pandemic; and

- 30th INTOSAI Working Group on Information Technology Audit meeting — focused on the development of guidance on cybersecurity and data protection challenges and audit of IT management functions.

Australia’s international development program

The ANAO, through a partnership agreement with the Department of Foreign Affairs and Trade (DFAT), is participating in Australia’s international development program to assist and support the audit offices of Indonesia and Papua New Guinea to build institutional capacity and facilitate the sharing of auditing knowledge across all three organisations. The partnership supports the Australian Government’s sectoral development initiative to build effective governance institutions.

Australia–Indonesia Partnership for Economic Development (Prospera)

The ANAO’s activities under the Australia–Indonesia Partnership for Economic Development (Prospera) with the Audit Board of the Republic of Indonesia (Badan Pemeriksa Keuangan — BPK) continue to support BPK’s efforts to strengthen its audit functions. The program is aligned with the BPK strategic plan objectives of delivering beneficial and high-quality audits. The key 2021–22 program focus areas were on performance and financial audit management, quality assurance systems, and organisational development to support audit management and capability. Recognising the maturity of the partnership, in addition to supporting the development of audit and organisational capability, the ANAO engaged with BPK on topics of mutual interest and benefit to both offices.

Due to travel restrictions in response to the COVID-19 pandemic, remote delivery remained the principal modality for technical training, workshops, mentoring sessions and executive dialogues, facilitated by the ANAO deployee in Indonesia. The virtual delivery of activities has provided an opportunity for greater outreach across BPK’s network of offices and participation from across the ANAO.

As both countries emerge from the pandemic and both organisations return to the office environment, the program will continue to use hybrid delivery, where appropriate, to maintain the broader outreach. Going forward, the program will transition to include in-person delivery with representatives from both organisations.

The ANAO, in partnership with BPK, delivered 15 of 16 planned activities for 2021–22. In response to COVID-19-related travel restrictions, one planned activity was deferred to 2023. With the lifting of travel restrictions, the ANAO was able to complete two work program activities that involved BPK officers travelling to Australia for immersive work experience.

Australia – Papua New Guinea Institutional Partnerships Program

The Institutional Partnerships Program (IPP) supports the development of long-term institutional relationships between Australian and Papua New Guinea (PNG) government entities. The ANAO’s activities under the program support the efforts of the PNG Auditor-General’s Office to strengthen the management of its audit functions, in line with its Corporate Plan 2017–2021 strategic objectives. The 2021–22 program focus areas were management of institutional linkages, information technology audit support, governance frameworks, and organisational capacity development. The PNG Auditor-General’s Office 2022–2027 Strategic Plan, developed in consultation with the ANAO deployee, launched on 30 May 2022. The forward activities under the IPP will align with the outcomes identified in the five-year strategic plan.

Due to the lockdown restrictions resulting from the COVID-19 pandemic, remote delivery remained the principal modality for IPP technical training, workshops, mentoring sessions and executive dialogues. Activities were facilitated by the ANAO deployee while in both Australia and PNG. Face-to-face delivery resumed in March 2022 as restrictions lifted in PNG.

The ANAO, in partnership with the PNG Auditor-General’s Office, delivered nine of 16 planned activities for 2021–22. Due to travel restrictions, three planned activities for 2021–22 were postponed, and the remaining four activities were unable to be delivered remotely due to PNG emergency response efforts and the closure of the PNG Auditor-General’s Office for extended periods.

Part 3 — Report on performance

The Auditor-General requests that the Independent Auditor, appointed under the Auditor-General Act 1997 conducts an audit of the ANAO’s performance statements to provide assurance to the Parliament of the reliability of the statements as presented.

Annual performance statements

As the accountable authority of the Australian National Audit Office (ANAO), I present the ANAO’s 2021–22 annual performance statements, as required under paragraphs 39(1)(a) and (b) of the Public Governance, Performance and Accountability Act 2013 (PGPA Act), and section 16F of the Public Governance, Performance and Accountability Rule 2014. In my opinion, these annual performance statements are based on properly maintained records, accurately reflect the ANAO’s performance for the reporting period and comply with subsection 39(2) of the PGPA Act.

Grant Hehir

Auditor-General

11 August 2022

Performance framework

The ANAO’s performance framework allows us to monitor and measure:

- what we did (output);

- how well we did it (quality and/or efficiency); and

- what the benefits were (impact).

Taken together, the performance measures tell a story of the ANAO’s achievement of its purpose.

The output measures relay progress in the delivery of the ANAO’s audit work. This audit work generates findings and recommendations for improving public administration and performance that are directed at entities and tabled in the Parliament. The impact measures provide information on entities’ responses to audit findings and implementation of recommendations, and the extent to which the Parliament’s engagement with our work leads to improvements in public sector administration.

The ANAO’s performance framework also includes measures relating to quality and efficiency. These measures are intended to demonstrate efficient use of taxpayer resources and a commitment to quality in our work. We use information from public audit offices in other jurisdictions to benchmark much of our performance.

Corporate plan and portfolio budget statements

The ANAO measures its performance against its purpose using a range of performance measures, which are outlined in the Portfolio Budget Statements 2021–22 and the ANAO’s Corporate Plan 2021–22.

The purpose of the ANAO is to support accountability and transparency in the Australian Government sector through independent reporting to the Parliament, and thereby contribute to improved public sector performance.

In its Portfolio Budget Statements 2021–22, the ANAO’s sole outcome (Outcome 1) is ‘to improve public sector performance and accountability through independent reporting on Australian Government administration to the Parliament, the Executive and the public’.

The ANAO seeks to achieve its purpose and outcome through its audit services, which include:

- financial statements audits of Australian Government entities (Program 1.1); and

- performance audits of Australian Government programs and entities (Program 1.2).

The ANAO’s outcome and programs framework for 2021–22 is shown in Table 3.1.

Table 3.1: ANAO’s outcome and programs framework for 2021–22

|

Outcome 1 |

|

|

To improve public sector performance and accountability through independent reporting on Australian Government administration to the Parliament, the executive and the public. |

|

|

Program 1.1: Assurance audit services |

Program 1.2: Performance audit services |

|

This program contributes to the outcome through:

|

This program contributes to the outcome through:

|

Assurance audits

The ANAO audits the annual financial statements of Australian Government entities and the consolidated financial statements of the Australian Government. The consolidated financial statements present the consolidated whole-of-government financial results, inclusive of all Australian Government-controlled entities, including entities outside the general government sector. These audits are designed to give assurance to the Parliament that an entity’s financial statements fairly represent its financial operations and financial position at year end. The ANAO also undertakes a range of assurance reviews by arrangement with entities, and in accordance with section 20 of the Auditor-General Act 1997.

Performance audits

The ANAO conducts performance audits in accordance with the ANAO Auditing Standards. These performance audits examine common aspects of public administration, reviewing and examining the operations of public sector entities. They identify areas where improvements can be made and often make specific recommendations to assist entities to improve performance. Performance audits may involve multiple entities, including where a program or service is jointly administered. An assurance review of the Department of Defence’s major defence equipment acquisitions is also undertaken annually. On completion, the ANAO’s performance audits are presented to the Parliament.

Performance statements audits

To maintain the momentum and capability building from the 2019–20 performance statements audit pilot program, the ANAO conducted audits of the 2020–21 performance statements of the Department of Social Services (DSS), Attorney-General’s Department (AGD) and the Department of Veterans’ Affairs (DVA). These audits were conducted as a continuation of the Finance Minister’s request to conduct the pilot under section 40 of the PGPA Act, pursuant to section 15 of the Auditor-General Act 1997. For these audits, the ANAO refined the audit methodology to reflect the specific requirements for entities’ performance measures following amendments to the PGPA Rule that came into effect in 2020. In April 2022, the Minister for Finance tabled the three 2020–21 audit opinions, which are available at finance.gov.au/publications/reports.

The ANAO was provided funding in the Budget 2021–22 to progressively implement the auditing of annual performance statements for material Australian Government entities. The ANAO’s portfolio budget statements (PBS) set out a schedule for the tabling of audit opinions on material entities’ performance statements, rising from three in 2021–22, to six in 2022–23, 10 in 2023–24 and 14 in 2024–25.2 By 2025–26, the ANAO will be auditing the performance statements of 19 material entities. From 2025–26, an additional five entities per year will be selected to test maturity of non-financial performance reporting more widely in the sector.

Following a request from the Minister for Finance in October 2021, the ANAO commenced audits of six entities’ 2021–22 performance statements. The ANAO continued the program of work with DVA, AGD and DSS and added three new entities: the former Department of Agriculture, Water and the Environment, the former Department of Education, Skills and Employment, and the Treasury.

The budget decision will enable the Parliament to have independent assurance of the non-financial performance information presented to it through the tabling of entity annual reports by ministers. To this end, it will also strengthen the accountability framework set out in the PGPA Act. The ANAO will progressively build its capacity to conduct performance statements audits according to the PBS schedule.

Analysis of performance against our purpose

Overall, in 2021–22, the ANAO achieved 13 performance measures out of 19, an increase in the number of performance outcomes achieved in 2020–21:

- For Program 1.1: Assurance audit services, five out of seven measures were met.

- For Program 1.2: Performance audit services, five out of six measures were met.

- For relationships and corporate and professional services, three out of six measures were met.

The ANAO successfully carried out its annual audit work program for 2021–22, having regard to the priorities and interests of the Parliament and providing a balanced program of activity that was informed by risk. Through the audit program, the ANAO promoted accountability, transparency and improvements to public administration; followed up on past recommendations; identified trends for improvement or declines in performance across the public sector; and applied all of the Auditor-General’s mandate. The ANAO tabled five COVID-19-related performance audits in 2021–22 and commenced a further two COVID-19-related performance audits for tabling in 2022–23.

The ANAO continued to assist the Parliament by considering requests for audit from members of parliament, by briefing members of parliament and committees, and making submissions to and appearing before parliamentary committees. ANAO engagement with the Parliament included requests for submissions and appearances from committees.

The ANAO made 34 appearances and submissions to the Parliament in 2021–22, less than the performance target of 40. While the ANAO did meet the performance target for providing private briefings to parliamentarians, the number of private briefings requested in 2021–22 (10) was significantly lower than in 2020–21 (25). These engagement activities were impacted by the dissolution of the House of Representatives on 11 April 2022 and the impact of COVID-19 travel restrictions on the operations of the Parliament.

The JCPAA tabled a report on its review of the Auditor-General Act 1997 (the Act) in March 2022. In its report, the JCPAA recognised the important role the ANAO plays in examining the expenditure and administration of government programs and its criticality to supporting the work of the JCPAA and the Parliament. To support the JCPAA since the commencement of its inquiry into the Act in September 2020, the ANAO made one submission and 10 supplementary submissions, and attended seven public hearings.

In 2021–22, the ANAO presented 40 performance audits for tabling in the Parliament. The primary focus of ANAO performance audits was effectiveness and economy — the extent to which entities delivered on intended objectives and the value for money achieved in doing so. The year also saw continued emphasis on risk management and governance within entities, with a focus on service delivery, procurement management, grants, regulation and cybersecurity. Performance audit work covered non-corporate and corporate government entities and one Commonwealth company, reflecting the Auditor-General’s mandate.

In 2021–22, the ANAO published two Audit Insights reports to support its purpose and the focus of the annual audit work program. Topics addressed were the effectiveness of entities’ management of contractors, and service delivery through other entities.

The following sections provide more detailed analysis of the ANAO’s performance results for Program 1.1: Assurance audit services, Program 1.2: Performance audit services, and ANAO-wide activities relating to relationships and corporate and professional services.

Performance results for Program 1.1: Assurance audit services

The primary purpose of financial statements is to provide relevant and reliable information to users about a reporting entity’s financial performance and position. In the public sector, the users of financial statements include ministers, the Parliament and the community. The preparation of timely and accurate audited financial statements is also an important indicator of the effectiveness of an entity’s financial management, which fosters confidence in an entity on the part of users.

The ANAO’s financial statements audits, undertaken in accordance with the ANAO Auditing Standards, provide an independent examination of the financial accounting and reporting of public sector entities. They provide independent assurance that financial statements have been prepared in accordance with the Australian Government’s financial reporting framework and Australian accounting standards and present fairly the financial performance of the entity. The ANAO’s assurance audits contribute to improvements in the financial administration of Australian Government entities.

The Auditor-General presents reports on audits of financial statements to the Parliament twice a year. The first of these reports, Interim Report on Key Financial Controls of Major Entities, reports on ANAO coverage of key financial systems and controls in major Commonwealth entities. The second report, Audits of the Financial Statements of Australian Government Entities, reports on the results of the financial statements audits of all Commonwealth entities. The independent reporting to the Parliament on this activity supports accountability and transparency in the Australian Government sector.

Key to the ANAO’s audit process is an assessment of entities’ internal control frameworks as they apply to financial reporting. An effective internal control framework provides the ANAO with a level of assurance that entities are able to prepare financial statements that are free from material misstatement. In 2021–22, a total of 62 findings were reported to the entities included in the interim audit report to the Parliament, comprising one significant, 14 moderate and 45 minor findings, and two legislative findings. This is an increase on the interim audit results of 2020–21, with a total of 60 reported findings comprising no significant, nine moderate and 51 minor findings. Fifty-eight per cent of findings are in the areas of management of IT controls, particularly the management of privileged users.

The consolidated financial statements present the consolidated whole-of-government financial results, inclusive of all Australian Government-controlled entities, as well as the general government sector financial report. The 2020–21 consolidated financial statements were signed by the Minister for Finance on 12 November 2021 and an unmodified auditor’s report was issued on 15 November 2021.

A total of 164 findings (2019–20: 145) were reported to entities as a result of the 2020–21 financial statements audits. These comprised two significant (2019–20: 2), 21 moderate (2019–20: 22), 127 minor findings (2019–20: 118) and 14 legislative findings (2019–20: 3). The highest number of findings are in the categories of:

- IT security management and user access, in particular the management of privileged users; and

- accounting and control of non-financial assets.

The total findings included three significant legislative breaches, one of which has remained open since 2012–13. There were 11 non-significant legislative breaches, eight of which related to remuneration of key management personnel. A significant breach is reported where a significant potential or actual breach of the Constitution occurs, or where noncompliance with an entity’s enabling legislation, legislation the entity is responsible for administering, or the PGPA Act is identified. A non-significant legislative breach is reported where instances of noncompliance with other legislation, or subordinate legislation, are identified.

Performance measures

Assurance audit services contribute to achieving the ANAO’s purpose through:

- providing assurance on the fair presentation of financial statements of the Australian Government and its controlled entities by providing independent audit opinions for the Parliament, the executive and the public;

- presenting two reports annually addressing the outcomes of the financial statements audits of Australian Government entities and the consolidated financial statements of the Australian Government, to provide the Parliament with an independent examination of the financial accounting and reporting of public sector entities; and

- contributing to improvements in the financial administration of Australian Government entities.

To assess performance against our purpose in relation to assurance audit activities, the ANAO measures the:

- number of financial statements audit opinions issued;

- number of other assurance reports produced;

- number of financial statements-related reports produced;

- timeliness of issuing the auditor’s opinions;

- average cost of financial statements audits; and

- percentage of recommendations agreed and implemented by audited entities.

|

Measure 1 |

Percentage of the mandatory financial statements auditor’s reports completed |

|

|

Source |

ANAO Corporate Plan 2021–22 Portfolio Budget Statements 2021–22, Program 1.1, p. 103 |

|

|

Result |

Achieved a result of 100% against a target of 100% |

MET |

The number of financial statements auditor’s reports issued is a key measure of the ANAO’s core business in achieving its purpose. Financial statements auditor’s reports provide assurance to the Parliament that the financial statements of an entity comply with Australian accounting standards and other reporting requirements (such as the Public Governance, Performance and Accountability (Financial Reporting) Rule 2015), and present fairly the entity’s financial position and its financial performance and cash flows for the period.

During 2021–22, the ANAO completed 245 of 245 mandated financial statements audits for the year ended 30 June 2021.3 This included the consolidated financial statements of the Australian Government.

Details of issues identified during the financial statements audits are included in Auditor-General Report No.14 of 2021–22 Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2021.

|

Measure 2 |

Number of financial statements-related audit reports presented to Parliament |

|

|

Source |

ANAO Corporate Plan 2021–22 Portfolio Budget Statements 2021–22, Program 1.1, p. 103 |

|

|

Result |

Achieved a result of 2 against a target of 2 |

MET |

The Auditor-General presents insights and findings from the outcomes of the financial statements audits of Australian Government entities and the consolidated financial statements of the Australian Government through independent reports to the Parliament. The reports support accountability and transparency in the Australian Government sector and provide the Parliament with an independent examination of the financial accounting and reporting of public sector entities.

Auditor-General Report No.14 of 2021–22 Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2021 was tabled in December 2021. This report complemented the interim-phase report published in June 2021 and provided a summary of the final results of the audits of the consolidated financial statements for the Australian Government and the financial statements of Australian Government entities.

Auditor-General Report No.32 of 2021–22 Interim Report on Key Financial Controls of Major Entities was tabled in June 2022. This report focused on the results of the interim audit phase — including an assessment of entities’ key internal controls — of the 2021–22 financial statements audits of 25 entities, including all departments of state and a number of major Australian Government entities. The work performed for the interim report pre-dated adjustments entities have made to their financial and risk management controls. These risks will be considered in the final audits of financial statements.

|

Measure 3 |

Number of assurance audit reports by arrangement |

|

|

Source |

ANAO Corporate Plan 2021–22 Portfolio Budget Statements 2021–22, Program 1.1, p. 103 |

|

|

Result |

Achieved a result of 40 against a target of 45 |

NOT MET |

The target was based on an estimate of the number of audits and reviews by arrangement that the ANAO may be requested to undertake.

In addition to conducting mandated financial statements audits, the ANAO undertakes other assurance activities by arrangement with audited entities to support accountability and transparency in the Australian Government sector. Measuring audits by arrangement contributes to the delivery of Program 1.1 by independently identifying improvements in the financial administration of Australian Government entities.

In 2021–22, the ANAO agreed to undertake 39 audits or reviews conducted under section 20 of the Auditor-General Act 1997 and completed 38 of those audits or reviews. They include financial statements audits and audits or reviews of compliance with legislative requirements. Also reported against this performance measure are two non-financial statements audits completed by the ANAO in 2021–22. The two non-financial statements audits are required by section 28D of the Australian Postal Corporation Act 1989 and subsection 313(3) of the Bankruptcy Act 1966.

Once inquiries by the ANAO have been concluded, the outcomes and any findings from these individual assurance activities are communicated through the issue of a formal report or by other correspondence. The ANAO charges a fee for these audits and reviews.

|

Measure 4 |

Percentage of auditor’s reports issued within three months of the financial-year-end reporting date |

|

|

Source |

ANAO Corporate Plan 2021–22 Portfolio Budget Statements 2021–22, Program 1.1, p. 103 |

|

|

Result |

Achieved a result of 89% against a target of 85% |

MET |

In order to support timely reporting of entities’ financial performance to the Parliament through annual reports, the ANAO aims to issue 85 per cent of auditor’s reports within three months of the financial-year-end reporting date.

Providing timely auditor’s reports also supports entities in meeting requirements to provide audit-cleared financial information to the Department of Finance in accordance with deadlines that are set to assist the Australian Government to prepare the Final Budget Outcome by 30 September for the financial statements with 30 June year end, and the consolidated financial statements by 30 November each year. The consolidated financial statements present whole-of-government financial results, inclusive of all Australian Government-controlled entities.

Achievement of this measure relies on entities providing the ANAO with auditable financial statements within the required timeframe. The ANAO noted a decrease in financial statements preparation findings compared to the prior year. The minor findings relate to quality review processes and preparation of key position papers. The ANAO works closely with entities to facilitate the timely finalisation of the financial statements, with the objective of issuing auditor’s reports within two business days of the financial statements being signed. The ANAO issued 98 per cent (2020–21: 96 per cent) of auditors’ reports within two business days of the signing of the financial statements by the accountable authority.

The result of 89 per cent of entities being issued a signed auditor’s report within three months of the financial year end is an increase from 77 per cent in the prior year. The average for the three reporting periods from 2019–20 to 2021–22 is 83.3 per cent.

|

Measure 5 |

Percentage increase to average cost per financial statements audit |

|

|

Source |

ANAO Corporate Plan 2021–22 Portfolio Budget Statements 2021–22, Program 1.1, p. 103 |

|

|

Result |

Achieved a result of 1.79% decrease against a target of a greater than 0% reduction |

MET |

The ANAO is committed to delivering cost-effective audits through increased efficiency and effectiveness. One way of demonstrating this is to measure the cost of delivering audits over time. This measure is designed to track the ANAO’s organisational performance against the delivery of audit outcomes.

In 2021–22, the ANAO is reporting on audits of financial statements from the 2020–21 audit cycle, as the financial year ended on 30 June and the audit occurred after the end of the financial year. Therefore, the average cost per audit for the Assurance Audit Services Group is calculated by comparing the average cost of the 2020–21 audit cycle to the average cost of the 2019–20 audit cycle.4 The average cost for the 2020–21 audit cycle was $161,331 and the 2019–20 average cost was $164,268, representing a 1.79 per cent decrease (Table 3.2). The decrease was mainly driven by savings achieved from a change of auditor’s expert engaged to carry out investment valuation work. Also, the Assurance Audit Services Group completed 100 per cent of the audit work within six months of the financial year end (the previous year was within 12 months).

Table 3.2: Cost of assurance audit reports, 2018–19 to 2020–21

|

Audit cycle |

Percentage increase Target (%) |

Average cost per mandated audit ($)(a) |

Range of audit fees charged ($) |

Actual result (%) |

|

2020–21 |

0 |

161,331 |

5,500–3,890,000 |

−1.79 |

|

2019–20 |

0 |

164,268 |

5,500–3,700,000 |

6.06 |

|

2018–19 |

0 |

154,889 |

5,500–3,800,000 |

0.63 |

(a) Cost is calculated on a nominal cost recovery basis using an accrual-based costing model.

|

Measure 6 |

Percentage of moderate or significant findings from assurance audit reports agreed to by audited entities |

|

|

Source |

ANAO Corporate Plan 2021–22 Portfolio Budget Statements 2021–22, Program 1.1, p. 103 |

|

|

Result |

Achieved a result of 100% against a target of 90% |

MET |

The ANAO provides entities with audit findings and recommendations to improve internal controls and business processes, based on observations noted during the conduct of financial statements audits. These matters are reported to the accountable authority and copied to the chair of the audit committee and the chief financial officer via an interim management letter, a closing report or a final management letter. The ANAO seeks to confirm all factual observations concerning the audit findings with entities before finalising these reports. Included in the measure of agreed recommendations are situations where the audited entity agrees with the ANAO’s factual observations, but the entity may suggest an alternative method to resolve the issue.

The audit findings and recommendations are reported using a rating scale whereby significant and moderate risk issues are reported individually to the audited entities, the relevant minister and the Parliament. Lower risk issues are also reported individually to each entity, and in aggregate in the ANAO’s reports to the Parliament.5

All audit findings and recommendations are followed up as part of the audit of the following year’s financial statements.

|

Measure 7 |

Percentage of moderate and significant findings that are addressed by material entities within one year of reporting |

|

|

Source |

ANAO Corporate Plan 2021–22 Portfolio Budget Statements 2021–22, Program 1.1, p. 103 |

|

|

Result |

Achieved a result of 61% against a target of 90% |

NOT MET |

The ANAO measures the percentage of moderate and significant findings that are addressed by entities in order to measure the impact that the ANAO’s audit work has on public administration. This measure relates to the percentage of moderate or significant findings from material entity audits that are addressed within 12 months of being reported to the entity. ‘Addressed’ means that the entity has responded to and actioned the ANAO finding.

Audit findings are reported to entities at the conclusion of each year’s financial statements audit. In order to determine whether these findings have been addressed by entities within one year of reporting, a full 12-month period is required from the end of the previous audit cycle. The audit cycle generally runs from October to September. Therefore, this performance measure for 2021–22 considers whether the audit findings reported at the conclusion of the 2019–20 audit cycle had been addressed by entities at the conclusion of the 2020–21 audit cycle. At the conclusion of the 2019–20 audit cycle, 18 significant and moderate findings were reported to material entities. A number of these findings relate to complex areas and/or system changes that entities have needed additional time to address. Eleven of these findings (61 per cent) were resolved within one year of being reported.

Performance results for Program 1.2: Performance audit services

The ANAO reports to the Parliament on aspects of public administration and makes specific recommendations to assist the Parliament in holding government entities to account for meeting expectations of, and making improvements to, proper use of resources as required by the PGPA Act. Performance audits may report on one entity or involve multiple entities on a common aspect of administration or policy implementation, or where there is joint administration of a program or service.

The ANAO’s performance audit services include audit activities that involve performance audits of all or part of an entity’s operations and result in independent performance audit reports to the Parliament. Other information and limited assurance reviews are also prepared, including the Defence Major Projects Report. These reports, along with performance audits, contribute to accountability and transparency of public sector administration.

In 2021–22, the primary focus of ANAO performance audits was effectiveness (the extent to which entities delivered on intended objectives and their performance measurement against these objectives) and economy (the extent to which value for money is being achieved). In 2021–22, the focus on effectiveness included an examination of the government’s response to the COVID-19 pandemic.

The year also saw the continuation of a series of audits on procurements by the Australian Government, including major Defence procurements, advertising by the Australian Government, Indigenous service delivery, cyber resilience, management of contractors by selected entities, and entity governance. The ANAO also tabled a cross-entity performance audit of the management of staff leave in the Australian Public Service.

In response to ongoing parliamentary interest, the ANAO continued its audit series on the implementation of ANAO and parliamentary recommendations. In 2021–22, the Auditor-General tabled three performance audits that either followed up on an entity’s progress in implementing recommendations or followed on from other related audits.

Performance measures

Performance audit services contribute to achieving the ANAO’s purpose through:

- audits of the performance of Australian Government programs and entities, including identifying recommendations for improvement and key messages for all Australian Government entities; and

- other assurance reviews and information reports to the Parliament.

To assess performance against our purpose in relation to performance audit activities, the ANAO measures the:

- number of performance audits presented to the Parliament;

- time and cost of these audits (our efficiency); and

- percentage of recommendations agreed to and the status of their implementation by entities (our impact and effectiveness).

|

Measure 8 |

Number of performance reports prepared for Parliament |

|

|

Source |

ANAO Corporate Plan 2021–22 Portfolio Budget Statements 2021–22, Program 1.2, p. 105 |

|

|

Result |

Achieved a result of 40 against a target of 40 |

MET |

In 2021–22, the Auditor-General presented 40 performance audits for the information of the Parliament (Table 3.3).

In addition to the 40 performance audits presented to the Parliament, the ANAO presented Auditor-General Report No.13 of 2021–22 2020–21 Major Projects Report in December 2021. This is an annual publication that provides assurance regarding the progress of major Defence projects.

Table 3.3: Number of performance audit reports, 2015–16 to 2021–22

|

|

Number of performance audit reports |

|

|

|

Target |

Result |

|

2021–22 |

40 |

40 |

|

2020–21 |

42 |

42 |

|

2019–20 |

48 |

42 |

|

2018–19 |

48 |

48 |

|

2017–18 |

48 |

47 |

|

2016–17(a) |

48 |

58 |

|

2015–16(a) |

49 |

35 |

(a) The number of performance audits presented to the Parliament in 2015–16 and 2016–17 was affected by the double dissolution of the Parliament on 9 May 2016, during which time Auditor-General reports could not be presented for tabling, which caused a delay in publishing audits into 2016–17.

|

Measure 9 |

Average elapsed time (months) for completion of performance audits |

|

|

Source |

ANAO Corporate Plan 2021–22 Portfolio Budget Statements 2021–22, Program 1.2, p. 105 |

|

|

Result |

Achieved a result of 10.2 months against a target of 10 months |

NOT MET |

The duration of a performance audit (Table 3.4) is impacted by multiple factors, including the complexity of the activities examined, the depth of the audit scope, the number of entities selected for a particular audit, the experience of staff contributing to the audit, and the timely and comprehensive provision of information by entities. Delays in the provision of information, including when an auditee requires the ANAO to request access to information using the formal information gathering powers in the Auditor-General Act 1997, continue to impact on the timeframes for audits.

When selecting audit topics from the annual audit work program, the ANAO seeks to achieve an appropriate balance of different audit types and complexities. This includes consideration of portfolio coverage, basic administration as well as complex program implementation, activity area (for example, policy development, service delivery, procurement, asset management and grant management) and whether a follow-up from a previous audit is timely.

In 2021–22, although there was one audit that took 20.3 months to deliver, 23 of the remaining audits were delivered in under 10 months. In 2020–21, 18 audits were delivered in under 10 months.

Table 3.4: Duration of performance audits, 2015–16 to 2021–22

|

|

Time taken to complete report (months) |

||

|

|

Target |

Average |

Range |

|

2021–22 |

10.0 |

10.2 |

7.4–20.3 |

|

2020–21 |

10.0 |

10.5 |

5.4–17.4 |

|

2019–20 |

10.0 |

10.0 |

6.3–14.0 |

|

2018–19 |

10.5 |

10.1 |

4.6–18.1 |

|

2017–18 |

10.5 |

9.6 |

6.2–15.9 |

|

2016–17 |

N/A |

10.6 |

5.2–22.0 |

|

2015–16 |

N/A |

11.6 |

6.9–18.6 |

|

Measure 10 |

Percentage increase to average cost per performance audit |

|

|

Source |

ANAO Corporate Plan 2021–22 Portfolio Budget Statements 2021–22, Program 1.2, p. 105 |

|

|

Result |

Achieved a result of 6.6% decrease against a target of a greater than 0% reduction |

MET |

The average cost of audits delivered in 2021–22 decreased compared to audits delivered in 2020–21 (Table 3.5).

In 2020–21 the average cost of a performance audit was $520,000 due to the factors outlined in the ANAO’s 2020–21 performance statements. These same factors did not emerge in 2021–22 as staffing levels were built back up throughout 2021–22, thereby alleviating some of the need for a higher proportion of senior involvement in audits that occurred in 2020–21. The decrease in the average cost was also partly due to efficiencies and cost savings found in 2021–22 by conducting some audits in a series. Three audits examined entities’ public sector board governance and three audits examined the management of contractors by entities. The average cost across these six audits was $287,200.

The cost of an audit is calculated by multiplying the hours that each level of staff worked on that audit by a charge-out rate that is set for each staffing level. The charge-out rates are set to recover the direct costs of those staff working on the audit and the overhead cost of supporting those staff.

Table 3.5: Cost of performance audit reports, 2015–16 to 2021–22

|

|

Percentage increase |

Cost per performance audit ($’000)(a) |

Actual result (%) |

|

|

|

Target (%) |

Average |

Range |

|

|

2021–22 |

0 |

486 |

159–1,106 |

−6.6 |

|

2020–21 |

0 |

520 |

234–984 |

18.0 |

|

2019–20 |

0 |

439 |

186–904 |

5.0 |

|

2018–19 |

0 |

419 |

131–670 |

−0.7 |

|

2017–18 |

0 |

422 |

159–786 |

−9.8 |

|

2016–17 |

N/A |

468 |

102–1,500 |

−11.0 |

|

2015–16 |

N/A |

526 |

230–767 |

N/A |

(a) Cost is calculated on a nominal cost recovery basis using an accrual-based costing model.

|

Measure 11 |

Percentage of recommendations from performance audit reports agreed to by audited entities |

|

|

Source |

ANAO Corporate Plan 2021–22 Portfolio Budget Statements 2021–22, Program 1.2, p. 105 |

|

|

Result |

Achieved a result of 96% against a target of 90% |

MET |

The ANAO makes recommendations in performance audit reports to support the Parliament in its role in holding entities to account for their use of public money, and to seek to improve public administration. Throughout a performance audit, the ANAO keeps entities informed of findings and discusses potential recommendations to ensure entities understand the basis and intention of recommendations. Table 3.6 provides a breakdown of audited entities’ responses to the ANAO’s recommendations against the total number of recommendations made. Only recommendations that were agreed without qualification are included as ‘agreed’ recommendations in the result for this measure.

In 2021–22, 154 recommendations were agreed, four recommendations were agreed with qualification and three recommendations were not agreed.

Table 3.6: Agreement to recommendations in performance audit reports, 2015–16 to 2021–22

|

|

Recommendations |

||||

|

|

Total number |

Fully agreed (%) |

Agreed with qualifications (%) |

Not agreed (%) |

Noted or no response by entities (%) |

|

2021–22(a) |

161 |

95.7 |

2.5 |

1.9 |

0.0 |

|

2020–21 |

165 |

92.1 |

6.1 |

1.2 |

0.6 |

|

2019–20 |

141 |

90.8 |

1.4 |

2.8 |

5.0 |

|

2018–19 |

146 |

90.0 |

6.8 |

0.7 |

2.7 |

|

2017–18 |

126 |

84.9 |

9.5 |

2.4 |

3.2 |

|

2016–17 |

102 |

91.0 |

4.0 |

3.0 |

2.0 |

|

2015–16 |

103 |

94.0 |

6.0 |

0.0 |

0.0 |

(a) The percentages for 2021–22 do not total 100 per cent due to rounding.

|

Measure 12 |

Percentage of ANAO recommendations implemented within 24 months of a performance audit report |

|

|

Source |

ANAO Corporate Plan 2021–22 Portfolio Budget Statements 2021–22, Program 1.2, p. 105 |

|

|

Result |

Achieved a result of 86% against a target of 70% |

MET |

The ANAO monitors entities’ implementation of performance audit recommendations by attending entity audit committees and conducting audits that follow up on entity progress in implementing previously made recommendations. The ANAO also seeks advice annually from all relevant entities on progress in implementing audit recommendations over a two-year implementation period.

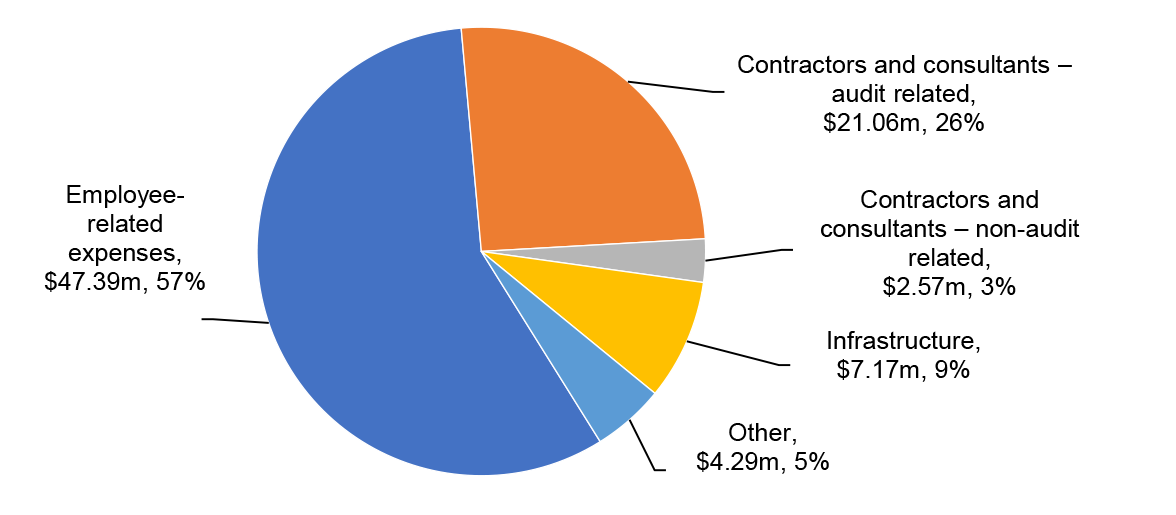

The self-reported data for audit recommendations made in 2019–20 suggests that entities are implementing ANAO recommendations largely within 24 months of the recommendation being agreed (Table 3.7). For those recommendations that have not yet been implemented, the majority of entities have advised that work is underway.