Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The Auditor-General responded on 5 July 2022 to correspondence from the Hon Richard Marles MP dated 31 May 2022, requesting that the Auditor-General conduct an investigation to review the Workforce Australia procurement processes.

Please direct enquiries relating to requests for audit through our contact page.

The audit objective was to assess the effectiveness and efficiency of the Department of Human Services’ management of Smart Centres’ Centrelink telephone services.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Department of Infrastructure and Regional Development’s design and implementation of the first funding round of the Bridges Renewal Programme.

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess the effectiveness of the administration of the Commonwealth Scientific and Industrial Research Organisation's (CSIRO's) Gift to the Science and Industry Endowment Fund.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to assess the extent to which entities’ establishment and use of ICT related procurement panels and arrangements supported the achievement of value for money outcomes.

Please direct enquiries through our contact page.

The objective of this audit was to assess the effectiveness of the Tertiary Education Quality and Standards Agency’s (TEQSA’s) regulation of higher education.

Please direct enquiries through our contact page.

The Auditor-General responded on 9 September 2022 to correspondence from Senator the Hon Jonathon Duniam dated 17 August 2022, requesting that the Auditor-General provide feedback on the University of Tasmania's proposal to relocate the Sandy Bay campus to Hobart CBD.

Please direct enquiries relating to requests for audit through our contact page.

The objective of the audit was to assess the effectiveness of the Australian Taxation Office’s administration of capital gains tax for individual and small business taxpayers.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Department of the Prime Minister and Cabinet’s management of the Australian Government’s Register of Lobbyists.

Please direct enquiries through our contact page.

The Auditor-General responded on 18 March 2019 to correspondence from the Hon. Shayne Neumann MP dated 19 February 2019 and 14 March 2019. The Auditor-General further responded on 1 April 2019. The correspondence from Mr Neumann requested that the Auditor-General conduct an audit into the circumstances surrounding the Department of Home Affairs' procurement of garrison support and welfare services in Papua New Guinea.

Please direct enquiries relating to requests for audit through our contact page.

The objective of the audit was to assess whether the Australian Taxation Office and the Department of Agriculture have effectively administered the Farm Management Deposits (FMD) Scheme.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the design and conduct of the third and fourth funding rounds of the Regional Development Australia Fund.

Please direct enquiries relating to reports through our contact page.

The Auditor-General responded on 29 July 2021 to correspondence from Ms Michelle Rowland MP and Senator Kimberley Kitching dated 9 July 2021, requesting that the Auditor-General conduct an investigation to examine NBN Co Limited executive bonuses for the 2019–2020 financial year and the legitimacy of the underlying targets to which the bonuses were linked.

Please direct enquiries relating to requests for audit through our contact page.

The Auditor-General responded on 22 October 2021 to correspondence from Senator Mehreen Faruqi dated 27 September 2021, requesting that the Auditor-General conduct an investigation to examine the administration of the Australian Research Council's funding application processes.

Please direct enquiries relating to requests for audit through our contact page.

The objective of the audit was to assess whether the controls employed by the Department of Family and Community Services (FACS) and Centrelink to ensure the correctness of payments made under the Age Pension program were effective and efficient. The ANAO focused on:

- business arrangements between FACS and Centrelink and the Business Assurance Framework;

- whether the source of error was correctly attributed in customer records assessed by FACS and Centrelink as containing an error in the 2000-01 Age Pension Random Sample Survey:

- the correctness of Centrelink's processing of reassessments, including Pensioner Entitlements Reviews, Customer Initiated Reassessments and automated reassessments: and

- progress in implementing the recommendations of previous ANAO audits concerning the preventive quality controls that underpin correct payments.

The audit objective was to assess the effectiveness of Health's implementation of the Diagnostic Imaging Review Reform Package, some three years into the five year reform period.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess whether the Department of Immigration and Border Protection (DIBP) had appropriately managed the procurement of garrison support and welfare services at offshore processing centres in Nauru and Papua New Guinea (Manus Island); and whether the processes adopted met the requirements of the Commonwealth Procurement Rules (CPRs) including consideration and achievement of value for money.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Department of the Prime Minister and Cabinet’s management of initiatives to supply low aromatic fuel to Indigenous communities.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the design and implementation of the Department of Human Services' Quality Framework.

Please direct enquiries through our contact page.

The objective of this audit was to examine the effectiveness of the Department of Defence’s development and implementation of Australia’s approach to providing military assistance to the Government of Ukraine.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the Australian Taxation Office’s administration of annual compliance arrangements with large corporate taxpayers.

Please direct enquiries relating to reports through our contact page.

This audit focuses on the NBA’s role in managing the nations blood supply, bearing in mind the NBA’s legislative responsibilities, national policy objectives and ongoing blood sector reforms.

The audit objective was to assess the effectiveness of the Department of Communications and the Arts’ contract management of selected telephone universal service obligations.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Australian Taxation Office's activities to promote employer compliance with Superannuation Guarantee obligations.

Please direct enquiries relating to reports through our contact page.

The Auditor-General responded on 14 December 2016, and followed-up on 19 July 2017, to correspondence from Senator Kakoschke-Moore on 14 November 2016 requesting that the Auditor-General conduct an audit of the National Affordable Housing Agreement (NAHA).

Please direct enquiries relating to requests for audit through our contact page.

The Auditor-General responded on 18 November 2019 to correspondence from Mr Andrew Giles MP, requesting that the Auditor-General conduct an investigation to examine the effectiveness of the procurement to deliver a new global visa processing system.

Please direct enquiries relating to requests for audit through our contact page.

The audit objective was to assess the effectiveness of the management of international travel restrictions during the COVID-19 pandemic.

Please direct enquiries through our contact page.

The audit objective was to assess the effectiveness of the Department of Infrastructure and Regional Development's regulation of passenger security screening at Australian domestic airports.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to assess the effectiveness of Finance’s administration of travel entitlements provided to Parliamentarians.

Please direct enquiries relating to reports through our contact page.

The Auditor-General responded on 23 November 2017 to correspondence from Senators Abetz, Paterson and Reynolds dated 27 October 2017, requesting that the Auditor-General undertake an examination of the administration and governance arrangements relating to the Student Services and Amenities Fee (SSAF). Following a request from Senator Abetz on 17 January 2018 for a more detailed response, the Auditor-General followed-up on 5 April 2018.

Please direct enquiries relating to requests for audit through our contact page.

The objective of the audit was to examine the effectiveness of the Department of Defence’s planning, budgeting and implementation of an electronic health records solution for Defence personnel.

Please direct enquiries relating to reports through our contact page.

The Auditor-General responded on 31 August 2020 to correspondence from Mr Stephen Jones MP dated 5 August 2020, requesting that the Auditor-General review the integrity and performance of the Government’s early release scheme for superannuation, as established through the Coronavirus Economic Response Omnibus Package Act 2020.

Please direct enquiries relating to requests for audits through our contact page.

The Auditor-General responded on 5 January 2021 to correspondence from Ms Kristy McBain MP dated 14 December 2020, requesting that the Auditor-General review the governance and outcomes of a 2019 tender process seeking leased office accommodation for the Department of Defence.

Please direct enquiries relating to requests for audit through our contact page.

The audit objective was to assess whether the Department of Home Affairs is effectively managing the Civil Maritime Surveillance Services contract.

Please direct enquiries through our contact page.

The Auditor-General responded on 21 March 2025 to correspondence from Ms Kylea Tink MP dated 28 February 2025, requesting that the Auditor-General conduct an investigation to examine the defence export permit approvals process.

Please direct enquiries through our contact page.

The objective of the audit was to assess whether select Australian Government entities are effectively managing and controlling the use of Commonwealth credit and other transaction cards for official purposes in accordance with legislative and policy requirements.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the administration of the Defence Home Ownership Assistance Scheme by the Department of Defence and the Department of Veterans’ Affairs.

Please direct enquiries relating to reports through our contact page.

The Auditor-General responded on 7 June 2021 to correspondence from Senator Sarah Hanson-Young dated 10 May 2021, requesting that the Auditor-General conduct an investigation to examine the federal government’s spending on offsets for the Western Sydney Airport.

Please direct enquiries relating to requests for audit through our contact page.

The objective of this audit was to examine the effectiveness of the Department of Social Services’ administration of NRAS allocations; processing of market rent valuations, statements of compliance and incentive payments; and the supporting business systems and processes.

Please direct enquiries relating to reports through our contact page.

The acting Auditor-General responded on 24 September 2024 to correspondence from Senator the Hon Richard Colbeck dated 27 August 2024, requesting that the Auditor-General conduct an investigation to examine the COVID-19 Vaccine Claims Scheme.

Please direct enquiries through our contact page.

The Auditor-General responded on 18 June 2025 to correspondence from Senator David Shoebridge dated 23 May 2025, requesting that the Auditor-General conduct a review of the expenditure and disclosures of the Federal Court.

Please direct enquiries through our contact page.

The Auditor-General responded on 29 March 2019 to the follow-up correspondence from the Hon. Mark Dreyfus QC MP dated 26 March 2019. Mr Dreyfus requested that the Auditor-General extend his investigation to look at the conduct of a range of parties in relation to the announcement of grants. This is in addition to the request to investigate the conduct of a range of parties in relation to the announcement of the grant to the Yankalilla Bowling Club, which was the subject of the original correspondence dated 24 February 2019.

Please direct enquiries relating to requests through our contact page.

The Auditor-General responded on 29 March 2019 to correspondence from Ms Cathy McGowan AO MP dated 5 March 2019, requesting that the Auditor-General investigate the conduct of a range of parties in relation to the announcement of grants under Round 3, Building Better Regions Fund.

Please direct enquiries relating to requests through our contact page.

The objective of the audit was to assess the effectiveness of the design process for the Rural Research and Development for Profit Programme, including performance measurement and reporting arrangements.

Please direct enquiries relating to reports through our contact page.

The Auditor-General responded on 4 February 2021 to correspondence from Senator Sarah Hanson-Young dated 14 January 2021, requesting that the Auditor-General conduct an audit of the approval of the Yeelirrie uranium mine by the Federal Government in 2019.

Please direct enquiries relating to requests through our contact page.

The objective of this audit was to assess the effectiveness of the Department of Immigration and Border Protection’s administration of health services in onshore immigration detention.

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess the departments of Health and Human Services’ administration, including oversight and monitoring arrangements, for the Indemnity Insurance Fund.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Department of the Environment and Energy’s arrangements for the preparation and reporting of Australia’s greenhouse gas emissions estimates and projections.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to examine the effectiveness of selected non-corporate Commonwealth entities' arrangements for managing cyber security risks within their procurements and specific contracted providers under the Protective Security Policy Framework (PSPF).

Please direct enquiries through our contact page.

The audit objective was to review the effectiveness of the Department of Defence’s (Defence) arrangements for delivering selected non-platform sustainment.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Australian Securities and Investments Commission’s administration of enforceable undertakings.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to examine the effectiveness of spectrum reallocation to support the deployment of 5G services.

Please direct enquiries through our contact page.

The objective of the audit was to assess the Australian Customs and Border Protection Service's administration of the Tariff Concession System.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to assess the effectiveness of procurement complaints handling by the Australian Communications and Media Authority, the Department of Finance, the Department of Industry, Science and Resources and the Reserve Bank of Australia.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the management of community intelligence by the Tax Office.

The objective of the audit was to assess the effectiveness of the Department of Human Services’ implementation of myGov as at November 2016.

Please direct enquiries relating to reports through our contact page.

The Auditor-General responded on 22 June 2021 to correspondence from Mr Jason Falinski MP dated 27 May 2021, requesting that the Auditor-General conduct an investigation to examine concerns raised by Mr Falinski's constituent regarding the louvre windows selected by the appointed company for the Department of Defence building project — Cook and Tiroas Barracks, Vanuatu.

Please direct enquiries relating to requests for audit through our contact page.

The audit objective was to assess the effectiveness of the Department of Veterans’ Affairs administration of the Repatriation Transport Scheme.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess whether selected entities had appropriately justified the use of limited tender procurement and whether processes adopted met the requirements of the Commonwealth Procurement Rules.

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess the effectiveness of Defence’s management of the acquisition of medium and heavy vehicles, associated modules and trailers for the Australian Defence Force.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Australian Taxation Office in achieving revenue commitments established under specific Budget-funded compliance measures.

Please direct enquiries relating to reports through our contact page.

The Auditor-General undertook a limited assurance review of the Department of Agriculture and Water Resources’ assessment of the performance of New South Wales under the National Partnership Agreement on Implementing Water Reform in the Murray-Darling Basin relevant to the protection and use of environmental water for the 2014–15 and 2015–16 financial years.

Please direct enquiries through our contact page.

The audit objective was to assess the effectiveness of the Department of Health’s records management arrangements, including Health’s progress in transitioning to digital records management.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Department of Veterans’ Affairs’ and the Department of Defence’s administration of the Australian Government’s $55 million support package announced in the May 2010 Budget for former F-111 fuel tank maintenance workers and their families. The audit examined the implementation of the 14 agreed recommendations in the Government Response to the 2009 Parliamentary Inquiry into the F-111 deseal/reseal issues, which formed the basis of the May 2010, F-111 support package.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to examine Defence’s progress since 2007 in introducing into service a fully capable Tiger fleet and cost-effective sustainment arrangements.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the Moorebank Intermodal Company’s achievement of value for money and management of probity in its operations and procurement activities.

Please direct enquiries through our contact page.

The objective of this audit was to examine whether the selected entities within the Attorney-General’s portfolio have implemented all agreed recommendations from parliamentary committee and Auditor-General reports within the scoped timeframe.

Please direct enquiries through our contact page.

The Auditor-General responded on 22 November 2019 to correspondence from Senator Katy Gallagher dated 25 October 2019, requesting that the Auditor-General conduct an investigation to examine government spending on external contractors and consultants.

Please direct enquiries relating to requests for audit through our contact page.

The objective of the audit was to assess the effectiveness of the Australian Communications and Media Authority’s regulation of unsolicited communications.

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess the effectiveness of the Department of the Environment and Energy's award of funding under the 20 Million Trees Programme.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to assess the efficiency and effectiveness of Australian Human Rights Commission’s handling of complaints.

Please direct enquiries through our contact page.

The objective of the audit was to examine whether the National Capital Authority’s procurement activities are complying with the Commonwealth Procurement Rules and demonstrating the achievement of value for money.

Please direct enquiries through our contact page.

The Auditor-General undertook a limited assurance review of the Department of Finance’s reporting and administration of the Advances to the Finance Minister (AFM) for the Period 26 September 2020 to 30 October 2020.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the award of funding under the first round of the Safer Streets programme.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess whether the contractual arrangements that have been put in place for the delivery of the Moorebank Intermodal Terminal (MIT) will provide value for money and achieve the Australian Government’s policy objectives for the project.

Please direct enquiries relating to reports through our contact page.

Audit Report No.5 1993-94, Explosive Ordnance, Department of Defence, was tabled in the Parliament in September 1993. The report was structured in three parts. The first part covered explosive ordnance (EO) issues common to all three Services; the second part focused on the management of explosive ordnance by the Navy; and the third part was a follow-up of the 1987 audit report on Air Force explosive ordnance. The report made 39 recommendations. Defence agreed to implement most of them.

It was considered timely to undertake a follow-up audit into key issues of the recommendations contained in the audit report, given the elapsed time since the report was tabled and the issues associated with public safety.

The objective of this audit was to assess whether the Department of Veterans’ Affairs is efficiently delivering services to veterans and their dependents.

Please direct enquiries through our contact page.

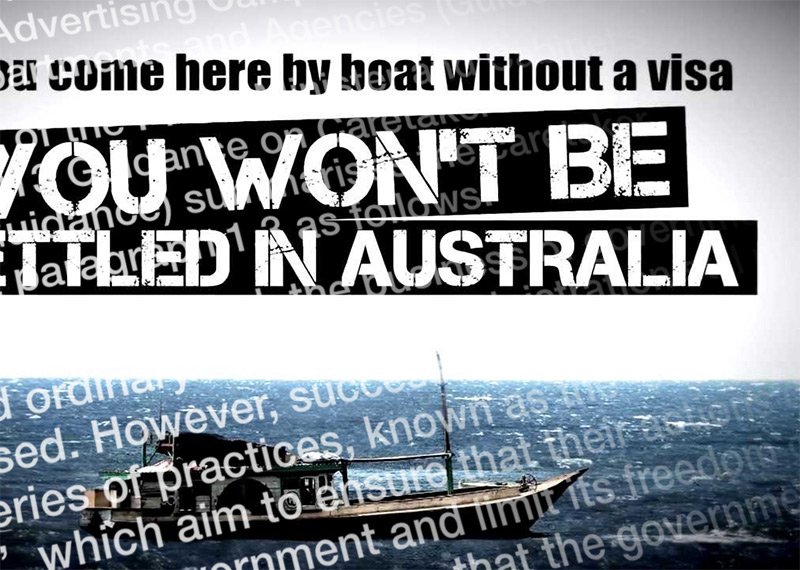

The Auditor-General responded on 1 August 2013 to correspondence from Senator Nick Xenophon of 22 July 2013 on the By boat, no visa advertising campaign.

Please direct enquiries relating to requests for audit through our contact page.

The Auditor-General responded on 17 April 2025 to correspondence from Senator the Hon Michaelia Cash dated 21 March 2025, requesting that the Auditor-General conduct an investigation to examine the Incolink grant.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the administration of procurement initiatives to support opportunities for Indigenous Australians.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the Australian Competition and Consumer Commission in managing compliance with fair trading obligations.

Please direct enquiries relating to reports through our contact page.

The Auditor-General responded on 2 May 2022 to correspondence from Senator Rex Patrick dated 5 April 2022, requesting that the Auditor-General conduct an investigation to examine the process in making statutory and other senior appointments across the whole government over the six months preceding the application of caretaker conventions prior to the 2022 Federal election.

Please direct enquiries relating to requests for audit through our contact page.

The objective of this audit was to provide an independent assurance on the effectiveness of Defence's management of the acqusition of armoured infantry mobility vehicles (IMV) for the Australian Defence Force (ADF). The audit sought to identify the initial capability requirements; analyse the tendering and evaluation process; and examine the management of the project by Defence. As such, this was not an audit of contractor performance, but of the formation and contract management of the aquisition project by Defence.

The objective of the audit was to assess the Australian Agency for International Development's (AusAid) planning for, and management of, the delivery of aid to East Timor. The audit examined Australia's emergency and humanitarian response following the crisis in East Timor in 1999; AusAID's post-crisis strategy for assisting East Timor; coordination with overseas donors; and financial contributions to multilateral reconstruction assistance. Australia's bilateral assistance, comprising shorter-term transitional assistance and medium-term development assistance, was also examined.

The objective of the audit was to assess the effectiveness of the Clean Energy Regulator’s crediting and selection of carbon abatement to purchase under the Emissions Reduction Fund.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to assess the effectiveness of DEEWR's administration of Job Network service fees. The ANAO examined DEEWR's arrangements to:

- specify the nature and level of services to be supplied by JNMs and to communicate this to the JNMS;

- calculate and pay service fees in accordance with the Employment Services Contract (ESC) 2006–2009 it has with JNMs; and

- obtain assurance that JNMs have delivered services in accordance with the contract.

The audit objective was to examine the adequacy of Defence's and DMO's management of the nearly completed elements of Project Air 5276. The ANAO identified a number of causes for time delays and cost escalation in those elements. Those causes are outlined in the overall audit conclusions, to assist in the achievement of improvements in future planning and management of capital equipment acquisitions.

The objective of this audit was to examine the effectiveness of Medicare Australia's administration of the PBS. In assessing the objective, the audit considered three key areas:

- Medicare Australia's relationship with the PBS policy agency (DoHA) and service delivery policy agency (Department of Human Services (DHS));

- the management arrangements and processes underpinning Medicare Australia's delivery of the PBS (including the means by which Medicare Australia gains assurance over the integrity of the PBS); and

- how Medicare Australia undertakes its three main responsibilities relating to the delivery of the PBS, namely: approving pharmacies; approving authority prescriptions; and processing PBS claims.

The Auditor-General responded on 20 August 2021 to correspondence from Mr Julian Hill MP dated 26 July 2021, requesting that the Auditor-General conduct an investigation to examine the efficiency, effectiveness, quality and integrity of partner visa processing by the Department of Home Affairs.

The Auditor-General has received follow-up correspondence from Mr Julian Hill MP dated 27 August 2021.

Please direct enquiries relating to requests through our contact page.

The objective of this audit was to examine whether the Tourist Refund Scheme (TRS) is being effectively administered, with the appropriate management of risks.

Please direct enquiries through our contact page.

The objective of the audit was to assess the Australian Federal Police's (AFP’s) management of policing services at Australian international airports. In order to form a conclusion against this audit objective, the Australian National Audit Office (ANAO) examined if:

- the transition to the 'All In' model of policing at airports (Project Macer) had been delivered effectively;

- appropriate processes are in place for managing risk and operational planning;

- effective stakeholder engagement, relationship management and information sharing arrangements are in place;

- facilities at the airports are adequate and appropriate; and

- appropriate mechanisms for measuring the effectiveness of policing at airports have been developed and implemented.

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess Health's administration of primary care funding, with a focus on the administrative practices of the Primary Care Division and Health's State and Territory Offices. In forming an opinion on the audit objective, the ANAO reviewed 41 agreements, with a combined value of $252 million. The ANAO also reviewed relevant documentation and files, interviewed programme officers and met with a number of stakeholders. The audit comments on a range of issues, including the utility of funding agreements, monitoring, payments, and support for administrators.

The audit objective was to assess the effectiveness of the Department of Veterans’ Affairs management of complaints and other feedback to support service delivery. The audit criteria were that DVA has:

- a well-designed framework for managing complaints and other feedback;

- effective processes and practices to manage complaints; and

- appropriately analysed complaints to inform service delivery.

The audit assessed whether Centrelink effectively manages customer debt, excluding debt relating to Family Tax Benefit, consistently across its network, ensuring integrity of payments made on behalf of the Department of Family and Community Services (FaCS). The audit assessed five components of Centrelink's debt management processes, including administration, prevention, identification, raising and recovery.

The Auditor-General (A/g) responded on 24 September 2015 to correspondence from Senator Glenn Lazarus on 10 September 2015 regarding National Stronger Regions Fund.

Please direct enquiries relating to requests for audit through our contact page.

The objective of the audit is to assess the effectiveness of the ADF’s mechanisms for learning from its military operations and exercises. In particular, the audit focused on the systems and processes the ADF uses for identifying and acting on lessons, and for evaluating performance. The ANAO also examined the manner in which information on lessons is shared within the ADF, with other relevant government agencies, and with international organisations. Reporting to Parliament was also considered.

The objective of the audit was to assess the effectiveness of the selection, implementation, operation and monitoring of FRCs by AGD and FaHCSIA. The three main criteria for this audit assessed whether AGD and FaHCSIA had effectively:

- planned and implemented the FRC initiative, including the FRC selection and funding processes;

- undertaken administration activities to guide the operation and progress of the FRC initiative towards meeting its objectives; and

- monitored, evaluated and reported on the performance of FRCs.

The objective of the audit was to assess the effectiveness of DHS' management of the tender process for a replacement BasicsCard to support the delivery of the income management scheme.

In conducting the audit, the Australian National Audit Office (ANAO) assessed the following five key areas of the replacement BasicsCard procurement process, which are described in the Department of Finance and Deregulation's (Finance) Guidance on the Mandatory Procurement Procedures :

• planning for the procurement;

• preparing to approach the market;

• approaching the market;

• evaluating tender submissions; and

• concluding the procurement, including contract negotiation.

The objective of this performance audit was to assess whether DIMIA's information systems and business processes are effective in supporting APP to meet its border security and streamlined clearance objectives. In particular, the audit focused on the following: Mandatory APP - Stage 1 (MAPP1) project management; MAPP1 IT development and system performance; APP performance reporting; contract management; and financial management.

The objective of this audit was to examine whether the Department of Infrastructure, Transport, Regional Development and Communications exercised appropriate due diligence in its acquisition of the ‘Leppington Triangle’ land for the future development of the Western Sydney Airport.

Please direct enquiries through our contact page.

The objective of this audit was to assess the Private Health Insurance Administration Council's (PHIAC's) administrative effectiveness as a regulator of private health insurance. In making this assessment, the Australian National Audit Office (ANAO) addressed the following criteria: whether PHIAC monitored compliance with its legislative requirements and analysed related data; whether PHIAC addressed and managed non-compliance with its legislative requirements; and whether PHIAC's governance and organisation supported the performance of its legislative functions. Although the Department of Health and Ageing (Health) also has a role in the regulation of the private health insurance industry under the National Health Act 1953 (Health Act), Health's regulatory activities were outside the scope of this audit.

The objective of the audit was to provide assurance to Parliament concerning the adequacy of Defence preparedness management systems and to identify possible areas for improvement. The audit focused on the systems and processes that Defence uses to manage preparedness. We did not review the preparedness levels of specific capabilities, nor did we cover capital acquisition processes. The audit included coverage of: - preparedness systems architecture; - control and direction of preparedness; - coordination among contributors to preparedness; and - performance management and preparedness.

The objective of the audit was to assess the Personnel Management Key Solution Project's planning and approval processes and its contract and project management. The audit addresses the scope of the delivered system, the expectations of end-users, and the system's ability to meet their capability requirements.

The audit objectives were to assess the effectiveness of:

- selected agencies’ administration in developing advertising campaigns and implementing key processes against the requirements of the Australian Government’s campaign advertising framework, and other key legal and administrative requirements; and

- the ongoing administration of the campaign advertising framework.

Please direct enquiries relating to reports through our contact page.

The Auditor-General responded on 13 September 2021 to correspondence from Senator the Hon Eric Abetz dated 17 August 2021, requesting that the Auditor-General conduct an investigation to examine the Australian Broadcasting Corporation's (ABC's) payment of the damages and legal costs of one of its employees in a private defamation proceeding.

The Auditor-General provided a follow-up response to Senator the Hon Eric Abetz on 15 October 2021.

Please direct enquiries relating to requests for audit through our contact page.

The objective of the audit was to assess whether Defence is effectively managing the EO Services Contract.

The audit focused mainly on Defence's contract management framework, including the arrangements to monitor the contractor’s performance in delivering services under the contract. The audit also examined the processes used by Defence to develop the current version of the contract and the extent to which the revised contract, as negotiated in 2006, provides an assurance of better value for money when compared to the original contract signed in 2001.

The Auditor-General responded on 28 April 2025 to correspondence from Senator the Hon Anne Ruston dated 31 March 2025, requesting that the Auditor-General conduct an investigation to examine a grant awarded to the Gallipoli Turkish Cultural Foundation.

Please direct enquiries through our contact page.

The objective of the audit was to assess whether, in relation to appeals to the SSAT and the AAT, Centrelink undertakes its role effectively, so as to support the timely implementation of the Tribunals' decisions about customers' entitlements. In assessing Centrelink's performance, the ANAO examined whether:

- the information provided by Centrelink, in relation to appeals to the SSAT and the AAT, effectively supported customers' and Tribunals' decision-making;

- the relationships and administrative arrangements between Centrelink, DEEWR and FaHCSIA supported the effective management of the appeal process and the capture of issues that may have broader implications for legislation, policy and service delivery; and

- Centrelink implemented SSAT and AAT decisions in an effective and timely manner.

The audit focused on the external review and appeal mechanisms and completes the cycle of audits on Centrelink's review and appeal system. The audit examined those appeals where an implementation action was required and did not consider SSAT and AAT appeals that were dismissed, withdrawn or were not within the Tribunals' jurisdiction.

The purpose of the audit was to determine:

- whether the planning and implementation of the DSS Teleservice project has been adequate to ensure successful operations;

- the efficiency and administrative effectiveness of Teleservice Centre management practices;

- whether Teleservice Centres have been successful in delivering the anticipated improvements to client service; and

- what opportunities might be available for improvement in the operation of the Centres.

An important aim of the audit was to ascertain with DSS what value could be added by identifying more administratively effective and efficient means of managing and operating their Teleservice Centre network. In addition, the ANAO considered that the experience gained and lessons learned from the introduction of Teleservice operations by DSS could improve the planning and implementation of major technology-based operational and client service initiatives in the future, both in DSS and the Australian Public Service (APS) generally.

In carrying out the audit, the ANAO undertook an extensive examination of the Teleservice environment including:

- examining the experience and practices of private sector call centre operations;

- reviewing the DSS Teleservice network, involving detailed discussions with departmental officers, examining files and data and observing Teleservice Centre operations; as well as

- consulting a range of community groups and government agencies familiar with DSS's Teleservice Centre services.

The objective of this audit was to assess whether the Australian Maritime Safety Authority is effectively managing the Search and Rescue Aircraft contract.

Please direct enquiries through our contact page.

The Auditor-General undertook a limited assurance engagement of the Department of Finance’s management of the lease between the Commonwealth of Australia and the New South Wales Rifle Association over the Malabar Headland. The limited assurance engagement examined whether the management was, in all material respects, in accordance with the Commonwealth Property Management Framework.

Please direct enquiries through our contact page.

The objective of the audit was to assess whether FaCSIA administers grants effectively, according to better practice guidelines, and consistently across geographic areas and the range of programmes included in the scope of the audit. The scope of the audit included grants administered by FaCSIA between 1 July 2002 and 30 June 2005, relating to programmes falling within four of the five groups of programmes providing funding for families and communities namely: Community Support; Family Assistance; Childcare Support; and Youth and Student Support. In total, these groups involved total expenditure of some $533 million in 2004–05.

Medicare is Australia's universal health insurance scheme. Underpinning Medicare is one of Australia's largest and more complex computer databases the Medicare enrolment database. At the end of 2004 the Medicare enrolment database contained information on over 24 million individuals. This audit examines the quality of data stored on that database and how the Health Insurance Commission (HIC) manages the data.

The objective of the audit was to assess the effectiveness of the management and administration of the Communications Fund, including an assessment of:

- the development and implementation of appropriate investment strategies; and

- the robustness of the governance structures and controls relating to investment activities.

The audit assessed whether FaCS effectively undertakes its coordination, monitoring and other roles according to the CSTDA. The audit examined all disability services provided for under the CSTDA, except for disability employment services. The ANAO met relevant officers from FaCS' national office and State and Territory offices, and with 22 stakeholder organisations including: advocacy groups; peak national and State bodies representing the interests of disability service providers and people with disabilities; members of national and State Disability Advisory Bodies funded by FaCS; State and Territory governments; relevant Australian Government agencies; In particular, the Department of Health and Ageing and the Australian Institute of Health and Welfare. and local government bodies. Fieldwork for the audit was primarily undertaken during the period September 2004 to February 2005.

The current audit has focussed on Stage 2 of the Scheme. Its objective was to assess whether ACIS is being administered effectively by DIISR and, as relevant, by Customs. In particular, the audit examined the department's arrangements for:

- assessing the eligibility of participants to receive duty credits;

- calculating duty credits accurately and adhering to the funding limits for the Scheme;

- checking the integrity of participants' claims, which are self-assessed;

- accounting for the duty credits transferred to and used at Customs; and

- measuring and reporting on the performance of ACIS.

The audit also followed up on whether the ANAO's previous recommendations have been addressed.

The Auditor-General responded on 19 November 2021 to correspondence from Senator Malcolm Roberts dated 28 October 2021, requesting that the Auditor-General clarify issues relating to the Disaster Recovery Funding Arrangements.

The Auditor-General received further correspondence about this matter from the Chief Executive Officer of the Queensland Reconstruction Authority, Mr Brendan Moon on 6 June 2022.

Please direct enquiries through our contact page.

The audit examined the financial management of all Special Appropriations in the period 1998-99 to 2002-03, with the exception of those related to Special Accounts and those administered by Government Business Enterprises. The audit objectives were to: identity all Special Appropriations and ascertain which entities are responsible for their financial management and reporting; and assess entities' financial management and reporting of Special Appropriations against the Commonwealth's financial management and reporting frameworks.

The objective of the audit was to assess the effectiveness of DFAT's management of the overseas leased estate. In particular, the audit examined whether DFAT:

- has effective governance, reporting and funding arrangements in place to support the sound management and oversight of the overseas leased estate;

- effectively manages overseas leased chancery and residential property on a day-to-day basis; and

- manages relationships with landlords and attached agencies effectively and adequately consults with stakeholders.

The audit examined agency approaches to the management of intellectual property under its control, and identified themes common to the management of all types of intellectual property. The audit objective was to:

(i) form an opinion on whether Commonwealth agencies have systems in place to efficiently, effectively and ethically manage their intellectual property assets; and

(ii) identify areas for better practice in intellectual property management by those agencies.