Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The objective of the audit was to examine whether strategic water procurements by the Department of Agriculture, Water and the Environment were conducted consistent with government policy, were supported by appropriate program design, were planned and executed appropriately, and achieved value for money.

Please direct enquiries through our contact page.

This audit focuses on the Australian Defence Force's (ADF) Air Combat fleet's logistics support, regular maintenance and structural refurbishment. These activities are collectively referred to as fleet in-service support. The current Defence White Paper states that Air Combat is the most important single capability for the defence of Australia.

The audit objective was to assess the effectiveness of the Air Combat fleet's in-service support arrangements to provide capability for air combat operations. Capital equipment acquisition projects covered by this report are limited to the Hornet and F-111 structural refurbishment projects, which aim to ensure these aircraft remain serviceable until their withdrawal from service.

The objective of the audit was to assess whether FaCSIA administers grants effectively, according to better practice guidelines, and consistently across geographic areas and the range of programmes included in the scope of the audit. The scope of the audit included grants administered by FaCSIA between 1 July 2002 and 30 June 2005, relating to programmes falling within four of the five groups of programmes providing funding for families and communities namely: Community Support; Family Assistance; Childcare Support; and Youth and Student Support. In total, these groups involved total expenditure of some $533 million in 2004–05.

Given the importance of customer feedback to Centrelink's business, the ANAO considered it timely to conduct a series of performance audits relating to Centrelink's customer feedback systems, particularly in relation to its delivery of the services then provided on behalf of FaCS. The overarching objective of this series of ANAO performance audits of Centrelink's customer feedback systems was to assess whether Centrelink has effective processes and systems for gathering, measuring, reporting and responding effectively to customer feedback, including in relation to customer satisfaction with Centrelink services and processes.

In view of the significant level of investment by Commonwealth agencies in the implementation and production of Financial Management Information Systems (FMISs), the ANAO, in conjunction with Gartner, undertook a benchmarking study within the Commonwealth budget sector with the objective of determining and reporting on FMIS:

- implementation and production costs; and

- implementation timeframes.

The benchmarking study also provides some data on resource support, size, volume and utilisation of the FMIS information. These data and metrics have significant implications for FMIS product selection. This study follows on from ANAO Audit Report No.12 'Selection, Implementation and Management of Financial Management Information Systems in Commonwealth Agencies', which was tabled in September 2001. That report provided details of the results of FMIS selections and implementations across the same eight Commonwealth budget sector agencies (the Commonwealth peer group) considered in this benchmarking study.

The audit examined some key aspects of HRD in relation to Centrelink's Customer Service Officers (CSOs). The objective of the audit was to determine whether Centrelink had appropriate systems and strategies in place to ensure that its CSOs had access to the skills and knowledge necessary to meet expected levels of performance and customer service.

The audit reviewed the Amphibious Transport Ship Project, involving the acquisition and modification of two second-hand US Navy ships . The objective of the audit was to assess the efficiency and effectiveness of Defence's management of the project, focusing on the capability development process, costs and schedule issues, contract issues, the management of project risks and project review processes.

The audit reviewed the efficiency and effectiveness of Defence's management of Naval Aviation Force (NAF) in achieving its required capability within budgeted resources. The objectives of the audit were to assess whether planning, management and resource allocation mechanisms and practices for NAF were conducive to achieving the latter's objectives in a cost-effective manner.

The sale raised gross proceeds of $95.4 million, which was at the upper end of the Business Advisor's estimate for the mid-1997 sale. In addition, it should be noted that the principal financial effect for the Commonwealth was not in the proceeds of the sale but in the termination of ongoing revenue supplements and financial losses. The Commonwealth's direct costs of selling the businesses are estimated to be $9.3 million, or 9.7% of gross proceeds. In addition, the Australian National's financial liabilities totalling $1393 million have been or are being repaid or assumed by the Commonwealth.

The objectives for the audit were to examine Commonwealth guarantees, indemnities and letters of comfort in relation to:

- the potential size of the Commonwealth's exposure to these instruments;

- the extent to which the overall exposures of the Commonwealth are managed and monitored;

- the adequacy of administrative reporting arrangements;

- areas of better administrative practice relating to their management; and

- to raise agencies' awareness of appropriate risk management and accountability practices in relation to these instruments.

The audit set out to quantify the Commonwealth's exposure to guarantees, indemnities and letters of comfort.

Grant Hehir, Auditor-General for Australia, attended the 18th Meeting of INTOSAI Working Group on Environmental Auditing in Bundung Indonesia in July 2018, and presented a keynote address titled Sharing experience on auditing urban environmental management. The accompanying paper to the speech is available here.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the Australian Fisheries Management Authority’s administration of its Domestic Fishing Compliance Program.

The objective of this review was to determine whether the establishment and early implementation of the Fair Entitlements Guarantee Recovery Program by the Department of Jobs and Small Business has provided a sound basis for achieving value for money.

Please direct enquiries through our contact page.

The objective of this audit was to assess how effectively the Defence Science and Technology Group (DSTG) administers the science and technology work it undertakes for the Australian Defence Organisation.

Please direct enquiries relating to reports through our contact page.

The slides and video from the Chief Financial Officer Forum held on Friday 8 July 2022 are now available. Please also provide any feedback you’d like to see incorporated in future forums.

For any enquiries, please contact External.Relations@anao.gov.au

The slides and video from the Chief Financial Officer Forum held on Friday 26 November 2021 are now available. Please also provide any feedback you’d like to see incorporated in future forums.

Please direct enquiries through our contact page.

The slides and video from the Chief Financial Officer Forum held on Friday, 27 November 2020 are now available. Please also provide any feedback you’d like to see incorporated in future forums.

Please direct enquiries through our contact page.

Response completed as a limited scope assurance review.

The Auditor-General responded on 2 September 2015 to correspondence from Senator Nick Xenophon of 3 June 2015 on the Australian bid for the football World Cup.

Please direct enquiries relating to requests for audit through our contact page.

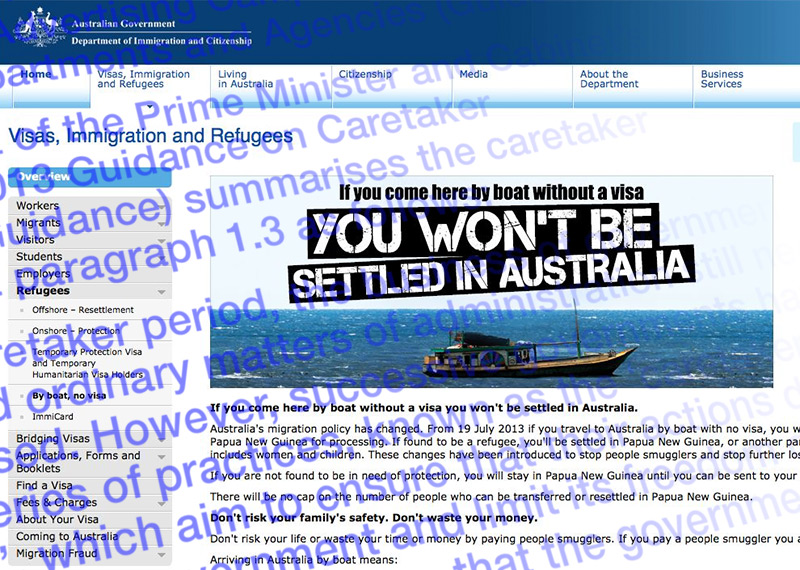

The Auditor-General responded on 14 August 2013 to correspondence from Senator Nick Xenophon of 12 August 2013 on the continuation of the Australian Government’s By boat, no visa advertising campaign during the caretaker period.

Please direct enquiries relating to requests for audit through our contact page.

The slides and video recording from the Chief Financial Officer Forum held on Friday 2 December 2022 are now available.

If you have any feedback you’d like to see incorporated in future forums, please contact External.Relations@anao.gov.au

This annual report documents the performance of the Australian National Audit Office (ANAO) in the financial year ending on 30 June 2018. The report addresses all applicable obligations under the Public Governance, Performance and Accountability Act 2013 (PGPA Act); the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule); the Auditor-General Act 1997; the performance measures set out in the outcome and programs framework in the ANAO’s 2017–18 Portfolio Budget Statements (PBS) and the ANAO 2017–18 Corporate Plan and annual reporting requirements set out in other relevant legislation.

Please direct enquiries relating to annual reports through our contact page.

The objective of this audit is to assess the effectiveness of the Department of Climate Change, Energy, the Environment and Water's (DCCEEW) corporate plan as its primary planning document in accordance with the Public Governance, Performance and Accountability Act 2013.

Please direct enquiries through our contact page.

This annual report documents the performance of the Australian National Audit Office (ANAO) in the financial year ended on 30 June 2019. The report addresses all applicable obligations under the Public Governance, Performance and Accountability Act 2013; the Public Governance, Performance and Accountability Rule 2014; the Auditor-General Act 1997; the performance measures set out in the outcome and programs framework in the ANAO’s Portfolio Budget Statements 2018–19 and the ANAO Corporate Plan 2018–19, and annual reporting requirements set out in other relevant legislation.

Please direct enquiries relating to annual reports through our contact page.

The audit objective was to assess the effectiveness of the development and administration of the Fifth Community Pharmacy Agreement (5CPA), and the extent to which the 5CPA has met its objectives.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to examine the effectiveness of the administration of the Gateway review process by Finance and FMA Act agencies. The audit also examined the extent to which those Gateway reviews that have been conducted have contributed to improvements in the delivery of major projects undertaken by FMA Act agencies.

The objective of the audit was to evaluate the Tax Office's corporate management of data matching, including analytics.

The ANAO examined the Tax Office's strategic goals and governance arrangements for data matching and analytics, its compliance with privacy requirements and whether the Tax Office is achieving intended results, which include revenue collection, optimised compliance and provision of improved services to taxpayers.

Tax Office executives have been increasingly drawing on the interrelationships and conceptual commonalities of Tax Office data matching and analytics activity. Accordingly, the audit included these relationships and conceptual commonalities within the scope of the audit. The audit was guided, therefore, by a broader definition of ‘data matching': meaning ‘finding relationships and patterns in large volumes of data'. This includes the more traditional idea of data matching as ‘bringing together data from different sources and comparing it'.

The Auditor-General responded on 9 May 2016 to correspondence from Ms Catherine King MP on 22 April 2016 regarding comments made by Ms Sophie Mirabella in relation to Commonwealth funding for Wangaratta Hospital.

Please direct enquiries relating to requests for audit through our contact page.

The Auditor-General responded on 6 April 2016 to correspondence from Senator Hanson-Young on 30 March 2016 regarding Refugee resettlement deal established between the Commonwealth Government of Australia and the Kingdom of Cambodia in September of 2014.

Please direct enquiries relating to requests for audit through our contact page.

The Auditor-General (A/g) responded on 15 September 2015 to correspondence from the Hon Dr Sharman Stone MP on 11 September 2015 regarding Murray-Darling Basin Authority's (MDBA) implementation of the Basin Plan.

Please direct enquiries relating to requests for audit through our contact page.

The objective of this audit was to assess whether the National Disability Insurance Agency has appropriate controls to ensure supports in participant plans are ‘reasonable and necessary’.

Please direct enquiries through our contact page.

The Auditor-General responded on 2 December 2016 to correspondence from Senator the Hon Stephen Parry, President of the Senate, on 14 October 2016, regarding a resolution agreed by the Senate requesting that the Auditor-General conduct a performance audit assessing the procurement of services related to the National Cancer Screening Register.

Please direct enquiries relating to requests for audit through our contact page.

The Auditor-General responded on 8 September 2015 to correspondence from Senator Lee Rhiannon on 10 August 2015 regarding the WestConnex road building project in NSW.

Please direct enquiries relating to requests for audit through our contact page.

The objective of this audit was to assess the effectiveness of the Department of Defence’s design process and implementation to date of the Defence Export Strategy.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the Department of Infrastructure, Transport, Regional Development and Communications’ design and implementation of measures to support the aviation sector in response to the COVID-19 pandemic.

Please direct enquiries through our contact page.

The Auditor-General responded on 27 June 2017 to correspondence from Mr Andrew Wilkie MP dated 26 May 2017, requesting that the Auditor-General conduct an audit of Centrelink's automated debt recovery programs.

Please direct enquiries relating to requests for audit through our contact page.

The Auditor-General (A/g) responded on 23 September 2015 to correspondence from Mr Tim Watts MP on 28 August 2015 regarding Liberal Party misappropriation of parliamentary entitlements.

Please direct enquiries relating to requests for audit through our contact page.

The audit objective was to assess the effectiveness of the administration of the Commonwealth Scientific and Industrial Research Organisation's (CSIRO's) Gift to the Science and Industry Endowment Fund.

Please direct enquiries relating to reports through our contact page.

The Auditor-General (A/g) responded on 23 September 2015 to correspondence from Ms Julie Collins MP on 1 September 2015 regarding parliamentary entitlements paid to Liberal MPs and Senators.

Please direct enquiries relating to requests for audit through our contact page.

This audit would assess the effectiveness of selected entities’ administration of sponsorship arrangements.

Commonwealth entities are solicited to enter into sponsorship arrangements, including for events. A two-page guidance document published in July 2015 sets out sponsorship considerations, better practice processes and directs the reader to Resource Management Guide: 302 Australian Government Charging Framework.

Please direct enquiries through our contact page.

This audit would examine whether the Pacific Maritime Security Program has been designed and implemented effectively.

The 2023 Defence Strategic Review and 2024 National Defence Strategy emphasised the increasing economic, military and strategic competition in the Indo-Pacific and re-iterated the strategic importance of Defence’s Pacific Maritime Security Program. The program commenced in 2015 with the award of two contracts to Austal, comprising a construction contract for 24 Guardian Class Patrol Boats to be gifted to 12 Pacific Island countries and a sustainment contract for in-service support work for seven years. As of November 2024, 22 of the boats had been delivered and the reported values of the contracts were $493.8 million and $172.7 million, respectively. Other aspects of the program involve the provision of related infrastructure, disposal of the 22 previously gifted vessels and deployment of 33 technical advisors to assist with capacity building in the Pacific Island countries. This audit would include examining the objectives of the program and the extent to which those objectives have been achieved.

Please direct enquiries through our contact page.

The audit would assess the delivery of outcomes achieved by selected entities as intended by government approved New Policy Proposals.

Please direct enquiries through our contact page.

This audit would examine whether the Department of Defence is managing fatigue-related risks in the Australian Defence Force (ADF) effectively.

The Defence Safety Manual provides Defence’s corporate policy framework to support compliance with its legislative obligations under the Work Health and Safety Act 2011 (WHS Act) and Work Health and Safety Regulations 2011. The manual includes a fatigue management policy which applies to all Defence workers, and is supplemented by specific fatigue management guidance developed individually by Army, Navy and Air Force. An audit would provide independent assurance to the Parliament that Defence is appropriately managing fatigue-related risks in accordance with its legislative obligations.

Please direct enquiries through our contact page.

The audit would assess the effectiveness of the design and implementation of the National Housing Accord and the Housing Australian Future Fund.

The National Housing Accord is an agreement between all levels of government, institutional investors and the construction sectors. It aims to increase the supply of housing with: ‘an initial, aspirational target of delivering a total of one million new, well-located homes over five years from 2024; and immediate and longer-term actions for all parties to support the delivery of more affordable homes’.

The Housing Australia Future Fund was established in November 2023. It is a $10 billion investment fund managed by the Future Fund Board. The income generated by the fund is expected to provide funding to deliver 20,000 new social and 10,000 affordable homes over five years. Housing Australia is responsible for administering the majority of disbursements from the fund through the Housing Australia Future Fund Facility. In the 2025–26 Budget, the Government increased in the cap on the Commonwealth’s guarantee of Housing Australia’s liabilities from $10 billion to $26 billion including support for commitments for projects under the Housing Australia Future Fund and the National Housing Accord Facility.

Please direct enquiries through our contact page.

The audit would assess the effectiveness of Department of Finance’s administration of coordinated procurement arrangements and procurements of goods or services by selected entities.

Coordinated procurement arrangements are established for commonly used goods or services by the Commonwealth, to realise efficiencies in process, price, service and quality for the Commonwealth. Arrangements managed by the Department of Finance include travel, government advertising, management advisory services and property services.

Please direct enquiries through our contact page.

The audit would assess the effectiveness of the administration of statutory functions by selected Inspectors-General. This may include assessing how relevant entities address recommendations made by Inspectors-General.

There are several Commonwealth Inspectors-General including: Inspector-General of Intelligence and Security; Inspector-General of Biosecurity; Inspector-General of the Australian Defence; Inspector-General of Aged Care; Inspector-General of Water Compliance; Inspector-General of Taxation and Taxation Ombudsman; and the Inspector-General of Animal Welfare and Live Animal Exports.

Please direct enquiries through our contact page.

The goal of the $250 million Emerging Markets Impact Investment Fund (EMIIF) is to help address access to finance challenges for small and medium-sized enterprises (SMEs) in South and South East Asia. It invests in funds and other financial intermediaries that in turn invest in early and growth stage SMEs with investments in the range of USD5,000 to USD2 million. The May 2023–24 Federal Budget measure that increased the size of the EMIIF stated that the majority of assistance would be provided via equity and loans (rather than grants), the cost of which will be met from Australia’s existing Official Development Assistance (ODA) funding.

EMIIF is an investment trust with DFAT as the sole beneficiary. Day to day management is undertaken by the investment manager appointed by DFAT and investment decision making is undertaken by the investment committee appointed by DFAT, as well as representatives from the investment manager. The design of EMIIF was intended to enable appropriate DFAT oversight by a DFAT delegate for the EMIIF being responsible for making any contractual and strategic decisions, who would be advised by an SES-level Impact Investing Advisory Group to provide advice, guidance and support regarding the overall direction and implementation of EMIIF and DFAT’s other impact investing programs. In addition, a Secretariat within DFAT is responsible for the day-to-day management of EMIIF, including interaction with counterparties to monitor ongoing performance, disseminate information and prepare relevant reporting to the advisory group or decision-makers. The audit would examine DFAT’s establishment and oversight of the EMIIF.

Please direct enquiries through our contact page.

This audit would examine the effectiveness of Defence’s establishment and use of the Major Service Provider (MSP) Panel.

The MSP Agreement 2018–2026 was established to facilitate the engagement and management of large, long-term, multi-discipline and integrated work packages across the air, land and maritime capability domains. Defence selected four consortia (comprising 13 companies) as MSPs under the panel arrangements, which commenced in February 2018. AusTender data in December 2024 indicated that the four MSPs had been awarded 380 contracts with a reported total of $5.63 billion since the commencement of the panel in February 2018.

Please direct enquiries through our contact page.

The audit would assess the administration of procurement on the construction and development of the National Security Office precinct.

The Department of Finance is leading the development of a National Security Office Precinct (Precinct) at the York Park in Barton, ACT. The Precinct will provide a permanent solution to the critical accommodation and capability requirements of several national security and other Commonwealth agencies. The Precinct is expected to accommodate up to 5,000 workers.

Please direct enquiries through our contact page.

This audit would examine the effectiveness of the allocation of funding for assistive technology supports under the National Disability Insurance Scheme (NDIS), including how the NDIA assesses these supports as reasonable and necessary for each participant and manages associated fraud risks.

Assistive technology is a support category for devices, mobility aides, software, equipment, vehicle modifications or animals that assist people with disability to do things more easily, safely or independently. Funding for assistive technology under the NDIS must meet ‘reasonable and necessary’ decision criteria. In the twelve months to 30 September 2023, assistive technology accounted for 3 per cent ($1.4 billion) of annualised committed supports in current participant plans.

Please direct enquiries through our contact page.

The potential audit would examine the effectiveness of measures to reduce the backlog in processing of visas, modernise the visa system and embed simplification.

The ANAO agreed to consider an audit into this topic in response to Recommendation 17 of the Joint Standing Committee on Migration in its September 2024 report Migration, Pathway to Nation Building.

Please direct enquiries through our contact page.

This audit would examine the effectiveness of the Department of Agriculture, Fisheries and Forestry’s (DAFF) management of Approved Arrangements for the importation of live animals. The Biosecurity Act 2015 allows DAFF to approve public or private industry entities (or biosecurity industry participants) to carry out certain border biosecurity risk management activities, in accordance with specified conditions. Approved arrangement (AA) holders are approved to undertake certain biosecurity actions.

Please direct enquiries through our contact page.

This audit would examine the Department of Social Services’ (the department’s) management of its Data Exchange (DEX) performance reporting portal.

DEX is a web portal that allows providers receiving government funding to report on program outputs (such as the number of clients assisted) and outcomes (such as improvements in clients’ health and wellbeing). It is underpinned by three principles: providers should spend less time collecting and reporting administrative data and more time helping clients; data collection should focus on client outcomes; and client personal information and privacy is protected. The department uses DEX as the data source for three corporate plan performance measures under its Families and Communities and Disability and Carers programs. DEX has also been extended to other Commonwealth and state government programs, including grant programs delivered through DSS’s Community Grants Hub. While the department is responsible for managing DEX, Services Australia has operated the portal since 2021 as part of its delivery of shared ICT services for the department.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of Defence’s management of the disposal of specialist military equipment.

At 30 June 2024, Defence reported that it manages $145.9 billion of total assets, including $88.6 billion of specialist military equipment. When one of these items is no longer suitable for or is surplus to Defence’s requirements, Defence disposes of it by either: transferring it to an Australian Government agency or another government, selling it, gifting it or destroying it. An audit would examine whether the disposal of selected equipment was conducted in accordance with Defence policy and applicable Commonwealth legislative requirements.

Please direct enquiries through our contact page.

The audit will assess the effectiveness of the Department of Health, Disability and Ageing’s (Health) and Services Australia’s approach to health provider compliance, including their response to the 2023 Independent Review of Medicare Integrity and Compliance (the Philip Review). The audit will also examine the Professional Services Review Scheme, which investigates referred cases of possible inappropriate practice in relation to the Medicare Benefits Schedule, Child Dental Benefits Schedule (CDBS) and Pharmaceutical Benefits Scheme (PBS).

Health has policy responsibility for Medicare, the CDBS and the PBS. Through its Health Benefit Compliance Program, Health aims to support the integrity of health benefit claims through prevention, early identification and treatment of incorrect claiming, inappropriate practice and fraud. Auditor-General Report No. 17 2020–21 Managing Health Provider Compliance found that Health’s approach to health provider compliance was partially effective, due in part to a lack of risk-based compliance planning and monitoring of compliance outcomes. The Philip Review made a number of recommendations to Health and Services Australia to strengthen the integrity of the Medicare system and its health provider compliance mechanisms. In the 2023–24 Federal Budget, Health received $29.8 million to establish a taskforce to respond to the Philip Review’s recommendations. In the 2024–25 Budget, Health received $18.1 million over four years to extend and expand the government’s response to the Philip Review.

Please direct enquiries through our contact page.

This audit would examine the stand up and early implementation of Medicare Urgent Care Clinics (UCCs) to provide assurance that the Department of Health, Disability and Ageing (Health) has administered UCC funding appropriately and is monitoring and evaluating the performance of UCCs to ensure the model is meeting its objectives and achieving value for money. Health describes the purpose of UCCs as helping to reduce pressure on hospitals and emergency departments, through providing urgent care in a general practitioner setting that is open seven days a week, early and late.

The October 2022–23 Federal Budget included $235 million over four years to commence the roll-out of 50 Medicare Urgent Care Clinics (UCCs). In the 2023–24 Federal Budget, the Australian Government announced $358.5 million over five years to establish 58 UCCs. In the 2024–25 Federal Budget, the government announced a further $227.0 million to boost the capacity of UCCs including by establishing another 29 UCCs, for a total of 87. In March 2025, the Prime Minister and Minister for Health and Aged Care committed an additional $644 million to open another 50 UCCs, with more clinics planned in every state and territory.

Please direct enquiries through our contact page.

This audit would assess whether the arrangements under the Federation Funding Agreement (FFA) framework are effective in supporting payment and program objectives. On 28 August 2020, the Council on Federal Financial Relations (CFFR) implemented new governance arrangements for Commonwealth-state funding agreements, known as the Federation Funding Agreements (FFA) Framework. The sectoral FFAs covering Health, Education and Skills, Infrastructure, Environment, and Affordable Housing, Community Services and Other, consolidated all existing National Partnership Agreements, Streamlined Agreements and Project Agreements as schedules.

This audit would examine FFA Framework arrangements, through sample arrangements or through specific programs, for example the Housing Support Program.

Please direct enquiries through our contact page.

The audit will assess the effectiveness of selected entities in meeting one or more Australian Government requirements related to climate change and may assess the effectiveness of policy owners with respect to supporting entities to meet requirements.

The Australian Government has developed policies and requirements aimed at supporting the public service to respond to climate change. These include: APS Net Zero Emissions by 2030; the Climate Risk and Opportunity Management Program; and the Commonwealth Climate Disclosure policy.

- APS Net Zero Emissions by 2030 aims to support the achievement of net zero in government operations by 2030. It includes the requirement for non-corporate Commonwealth entities to develop Emissions Reductions Plans.

- The Climate Risk and Opportunity Management Program aims to support entities to consider climate risk and opportunities as part of decision-making processes and enterprise risk management.

- The Commonwealth Climate Disclosure policy is the Government’s policy for Commonwealth entities and Commonwealth companies to publicly report on their exposure to climate risks and opportunities, as well as their actions to manage them, delivering transparent and consistent climate disclosures to the Australian public.

Please direct enquiries through our contact page.

This report will focus on key selected major Defence acquisition projects in accordance with the Joint Committee of Public Accounts and Audit (JCPAA) MPR Guidelines.

Increased transparency and accountability on progress with major Defence equipment acquisitions has been a focus of parliamentary interest for some time. Beginning in 2007–08, an annual program has been established in conjunction with the Department of Defence (Defence) to enable the ANAO to review and report to the Parliament on the status of major Defence acquisition projects, as set out in the major projects report. The review includes information relating to the cost, schedule and progress towards delivery of required capability of individual projects at 30 June each year and is undertaken at the request of JCPAA.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of the Department of Finance’s administration of the governance and accountability framework for Government Business Enterprises (GBE), including its support and advice to the Minister for Finance, who is a GBE shareholder minister. The audit may also review entities’ implementation of framework requirements and expectations set out in the GBE guidelines.

A GBE is a Commonwealth entity or Commonwealth company that is prescribed pursuant to the Public Governance, Performance and Accountability Act 2013 and related Public Governance, Performance and Accountability Rule 2014. Ten GBEs have been prescribed. Two GBEs are corporate Commonwealth entities: Australian Postal Corporation; and Defence Housing Australia. Eight GBEs are Commonwealth companies: ASC Pty Limited; Australian Naval Infrastructure Pty Ltd; Australian Rail Track Corporation Limited; CEA Technologies Pty Limited; National Intermodal Corporation Limited; NBN Co Limited; Snowy Hydro Limited; and WSA Co Limited. The Department of Finance provides advice to the Australian Government relating to its GBEs and other commercial entities.

Please direct enquiries through our contact page.

The Auditor-General (A/g) responded on 24 September 2015 to correspondence from the Hon Warren Truss MP on 18 September 2015 regarding probity and conflict of interest arrangements in place for the OneSKY Australia programme being led by Airservices Australia.

Please direct enquiries relating to requests for audit through our contact page.

This audit examined the effectiveness of the National Archives of Australia’s implementation of the Building Trust policy and selected entities’ management of information assets (records, information and data).

Please direct enquiries through our contact page.

The audit objective was to examine whether the design and conduct of the procurement process for delivery partners for the Entrepreneurs’ Programme complied with the Commonwealth Procurement Rules, and whether the signed contracts are being appropriately managed.

Please direct enquiries through our contact page.

The objective of this audit is to assess whether the management of funding under the Settlement Engagement and Transition Support services program was effective in achieving the program objectives and consistent with the Commonwealth Grant Rules and Guidelines.

Please direct enquiries through our contact page.

The objective of this audit is to assess the effectiveness of Snowy Hydro Limited's (SHL) management of the delivery of Snowy 2.0 in support of achieving value for money.

Please direct enquiries through our contact page.

The objective of this audit is to assess whether the selected entities’ administration of Freedom of Information Act 1982 (FOI) requests is effective in giving the community access to Australian Government information.

Please direct enquiries through our contact page.

The objective of this audit is to examine whether the Office of Parliamentary Counsel’s procurement and contract management of the new Federal Register of Legislation project complied with the Commonwealth Procurement Rules and demonstrated the achievement of value for money.

Please direct enquiries through our contact page.

The objective of this audit is to assess whether procurements conducted by the Department of Foreign Affairs and Trade for the Security Enhancement Program achieved value for money and complied with the Commonwealth Procurement Rules.

Please direct enquiries through our contact page.

The objective of this audit is to assess the effectiveness of the Commonwealth Home Support Programme.

Please direct enquiries through our contact page.

The audit would assess the effectiveness of Aboriginal Investment NT’s administration of grants programs.

Aboriginal Investment NT, which was established in 2022, administers various community and business grant programs. Auditor-General Report No1 7 of 2024-25 Management of conflicts of interest by Aboriginal Hostels Limited, Aboriginal Investment NT and Outback Stores Pty Ltd found that Aboriginal Investment NT was partly effective in the management of conflicts of interest and made two recommendations to the entity.

Please direct enquiries through our contact page.

This audit would examine the effectiveness of the Department of Climate Change, Energy, the Environment and Water’s (DCCEEW) administration and operation of the Recycling Modernisation Fund (RMF).

The RMF was established in 2020 to support industry to transition to the regulation of waste exports, by increasing Australia’s onshore capacity to collect, reuse, recycle ad recover waste materials. The Australian Government has committed to over $200 million towards new and upgraded recycling infrastructure through the RMF, with funding provided to states and territories via the Federation Funding Agreement–Environment and the National Partnership on Recycling Infrastructure.

Please direct enquiries through our contact page.

This audit would assess the effectiveness and efficiency of the Department of Home Affairs’ and Australian Border Force’s customs duty administration.

Border and customs operations generate the Commonwealth’s second largest source of revenue. In 2023–24 there was $15.4 billion in revenue collected from customs duty ($13.8 billion), passenger movement charges ($1.1 billion) and import processing charges ($451 million). This was $3.4 billion less than had been estimated, meaning the department had not met its performance target for revenue collection. In its 2023-24 Annual Report, the department noted that it supports revenue protection through a range of activities, including through sampling refund and duty drawback applications to ensure eligibility and administering the voluntary disclosure program that encourages compliance with revenue payment to the Commonwealth.

Please direct enquiries through our contact page.

The DTA is the Australian Government’s adviser for the development, delivery, and monitoring of whole-of-government strategies, policies, and standards for digital and ICT investments, including ICT procurement. This audit would assess the administration and assurance of selected frameworks administered by the DTA for the use of emerging technologies in the public sector. This would include the delivery of the Data and Digital Government Strategy and Implementation Plan. This is the first combined data and digital strategy for the Australian Government, as a blueprint for the use and management of data and digital technologies through to 2030.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of the administration of the Paid Parental Leave scheme (PPL scheme) by the Department of Social Services (DSS) and Services Australia.

The Australian Government provides a range of payments to support families with children. The PPL scheme provides up to 22 weeks of payment to support parents to take time off paid work after a birth or adoption. This entitlement will be expanding to 24 weeks for births and adoptions on or after 1 July 2025 and to 26 weeks for births and adoptions on or after 1 July 2026. DSS has policy responsibility for the PPL scheme and Services Australia administers payments on behalf of DSS. In the October 2022–23 Budget, $531.6 million was allocated over four years to ‘modernise’ the PPL scheme and promote a more equal distribution of work within households. In 2023–24, the PPL scheme cost $2.83 billion and 246,725 people received payment under the PPL scheme.

Please direct enquiries through our contact page.

The VET Student Loans (VSL) program commenced on 1 January 2017 and provides income contingent loans to eligible students studying approved courses. In 2022, the program provided $222.7 million towards the cost of tuition (out of total of $235 million in total fees charged) for around 30,000 students. The design and implementation of the VSL was audited in 2018–19. This audit would assess the effectiveness of the Department of Employment and Workplace Relation’s management of the VSL program.

Please direct enquiries through our contact page.

The Australian Border Force (ABF) is responsible for management of onshore detention centre contracts through its contracted service providers. According to Home Affairs public reporting, as of 31 December 2023 there were 872 people in immigration detention facilities (inclusive of 859 people in immigration detention centres and 13 in alternative places of detention).

The Department of Home Affairs publicly reports on the number of critical incidents in immigration detention facilities. In 2022–23, Home Affairs reported that there were 73.6 critical incidents per 1,000 detainees, compared to 46.8 per 1,000 detainees during 2021–22. A performance audit would examine the effectiveness of the Australian Border Force’s management of critical incidents in detention.

Please direct enquiries through our contact page.

This information report would cover Australian Government grants reporting following on from Auditor-General Report No. 7 2021–22 Australian Government Grants Reporting. The report would provide transparency of, and insights on government grants expenses and Commonwealth entities’ self-reporting of grants on GrantConnect.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of the Australian National University’s financial management framework, and processes to support the Council, Committees, Vice-Chancellor and other senior executives to make informed decisions.

The Australian National University (ANU), established in 1946, is an accredited higher education provider under the Higher Education Support Act 2003 and a corporate Commonwealth entity under the Public Governance, Performance and Accountability Act 2013.

Please direct enquiries through our contact page.

This audit would examine the effectiveness of the Australian Taxation Office’s (ATO) regulation of Self-Managed Superannuation Funds (SMSFs), and include a follow-up audit on employer compliance with Superannuation Guarantee requirements.

Australians generally rely on superannuation as their main asset (other than the family home) to save for their retirement. The ATO’s role in the superannuation system includes regulating and supporting Self-Managed Superannuation Funds to comply with superannuation and taxation laws to safeguard retirement incomes, and to support employers to meet their superannuation obligations.

The ATO corporate plan 2024–25 identifies the maintenance of high levels of compliance across the superannuation system and avoiding any deterioration in performance as a core priority. The ANAO last examined the ATO’s approach to managing SMSFs in 2007, and addressing Superannuation Guarantee non-compliance in 2022.

Please direct enquiries through our contact page.

This audit would examine the effectiveness of the Future Drought Fund (FDF). The FDF was established in 2019 to provide funding for drought resilience initiatives. The Future Drought Fund (Drought Resilience Funding Plan 2024–2028) Determination 2024 includes funding principles. The Funding Plan provides a high-level principles-based framework to guide all FDF spending. The Productivity Commission carried out a review of the Future Drought Fund (FDF) and released their Inquiry Report on 26 September 2023, which included 14 recommendations.

Please direct enquiries through our contact page.

This audit would assess whether the award of funding under the Urban Rivers and Catchments Program was effective and consistent with the Commonwealth Grants Framework.

The Urban Rivers and Catchments Program is a $200 million grants program that comprises two rounds. The 2022–23 October Federal Budget provided $91 million (from 2022–23) for the first round of the program, and the 2023–24 May Federal Budget provided $109 million (from 2024–25) for the second round of the program. The second round closed on 13 February 2024.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of the processes to design and co-ordinate programs to address rates of family and gendered violence, and out of home care, under the National Agreement on Closing the Gap.

Target 12 of the National Agreement on Closing the Gap is to reduce the rate of over-representation of Aboriginal and Torres Strait Islander children in out-of-home care by 45 per cent by 2031. Target 13 is to reduce the rate of all forms of family violence and abuse against Aboriginal and Torres Strait Islander women and children by at least 50 per cent by 2031. Both targets seek to achieve the goal of stronger families. The Australian government has agreed to commitments under the National Plan to End Violence against Women and Children 2022–2032 and the Aboriginal and Torres Strait Islander Action Plan 2023–25. The Department of Social Services plays a leading role in supporting the achievement of targets 12 and 13. The National Indigenous Australians Agency is responsible for leading and coordinating the development and implementation of Australia’s Closing the Gap targets in partnership with Indigenous Australians.

The ANAO agreed to consider an audit into target 13 in response to recommendation 8 of the Senate Standing Committee on Legal and Constitutional Affairs’ August 2024 report into Missing and Murdered First Nations Women and Children.

Please direct enquiries through our contact page.

The ANAO will conduct a program of audits of entities’ compliance with legislative and Australian Government policy requirements derived from the Public Governance, Performance and Accountability Act 2013, the Public Service Act 1999 and other legislative and policy frameworks. These audits include a focus on public sector ethics, integrity and probity.

Topics that may be considered for audit include compliance with: requirements to establish audit committees; requirements relating to recruitment and remuneration in the Australian Public Service; requirements related to privacy; and information management requirements.

ANAO audits continue to find that in routine areas of public administration (e.g. record keeping, governance, procurement and risk management), performance consistently falls short. Compliance — not just with mandatory requirements, but also their intent — is a hallmark of integrity, and essential to the craft of public administration.

The selection of entities for these audits will be based on relevance, materiality, representativeness and performance history. Audits may include any Commonwealth entities and companies. The audits would examine the effectiveness of entities’ design, implementation and governance arrangements to ensure compliance with relevant requirements.

Please direct enquiries through our contact page.

This audit would assess the effectiveness and efficiency of cost recovery activities conducted by IP Australia. Areas to be examined would be cost recovery models used by IP Australia, including business processes, fee structures, how this links to the delivery of its business and how IP Australia ensures arrangements remain fit for purpose with changes to its operating environment. Following the Productivity Commission inquiry in 2016 and the government’s response, IP Australia has completed two fee reviews. In 2023–24 IP Australia recovered more than 98 per cent of its costs by charging for its services.

Please direct enquiries through our contact page.

This audit would examine the effectiveness of the Australian Taxation Office’s (ATO) governance of data and analytics.

The ATO has established a new enterprise risk relating to misuse of data and analytics: ‘There is a risk that we (or those we share our data or analysis with) do not lawfully or appropriately use our data and/or analysis, caused by a failure in our data and analytics governance, resulting in adverse impacts on individuals, loss of revenue and/or loss of public trust and confidence and reduction in willing participation.’

Please direct enquiries through our contact page.

This audit would examine the effectiveness of Defence’s management of the Integrated Investment Program with a focus on Defence’s costing and approval processes for the projects that comprise the IIP.

The Integrated Investment Program sets out the specific defence capabilities the government will invest in to give effect to the 2024 National Defence Strategy (NDS). The government announced in the 2024–25 Budget process an additional $5.7 billion over the next four years to 2027–28 and $50.3 billion over the next decade to 2033–34, above the previous trajectory over that period. The total funding of $765 billion over the decade includes $330 billion in allocated funding for the capabilities set out in the Integrated Investment Program.

This audit would provide assurance to the Parliament on Defence’s processes for managing its Integrated Investment Program and its reported program and project costs.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of Defence’s administration of Defence export permits.

The Department of Defence is responsible for the implementation of the 2018 Defence Export Strategy. The aim of the strategy is to achieve greater export success by building a stronger, more sustainable and more globally competitive Australian defence industry. Defence administers various programs in support of this, including providing assistance to Australian industry participants with entry into international and global Defence supply chains.

Before military goods can be exported, industry participants must apply for and be issued with a Defence export permit. Defence is also Australia’s military and dual-use goods export regulator. It is responsible for assessing applications to export, supply, publish or broker military goods and technology, as well as conducting permit compliance activities. This audit would include examining whether any tension or competing priorities exist between Defence’s export-related responsibilities.

Please direct enquiries through our contact page.

This audit would examine the effectiveness of Defence’s procurement and implementation of the Defence Enterprise Resource Planning (ERP) Program to date.

The ERP Program is a Defence-wide priority and a key part of the Defence transformation agenda. The most recent release in May 2025 — ERP Tranche 1B Main release — was Defence’s fifth and largest ERP capability release to date, and was to deliver the finance, procurement, supply chain management, transport management, land maintenance and engineering components of the ERP system. Defence intended for this release to significantly expand the number of users accessing ERP in the course of their day-to-day activities within Defence.

This audit would examine whether the ERP system delivered is consistent with the capability and specifications approved by government.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of the Department of Education’s administration of the National Collaborative Research Infrastructure Strategy (NCRIS).

NCRIS provides funding for national research infrastructure including physical assets (such as the National Computational Infrastructure that supports Australia’s weather and climate modelling capability) and intangible assets (such as the Australian Research Data Commons, a portal that supports researchers to access and reuse existing data). It would examine areas relating to the department’s allocation of funding and ongoing engagement with NCRIS projects.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of the Department of Education’s regulation of recurrent school funding under the Australian Education Act 2013 ($30.1 billion in 2024–25).

In 2023–24, via the Strengthening non-government schools funding integrity measure, the Australian Government announced it would ‘strengthen policy and financial assurance and compliance to ensure funding for non-government schools is used appropriately for school education’.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of the design and implementation of the Consumer Data Right (CDR).

The CDR is a secure online system that enables consumers to get value from data that is collected about them through the provision of specific goods and services by consenting to that data being shared with trusted accredited third parties. CDR is an economy-wide reform that will be rolled out sector by sector. The CDR has already been rolled out to banking and energy, with non-bank lending to follow as the third sector. The Treasury, Australian Competition and Consumer Commission (ACCC), and Office of the Australian Information Commissioner (OAIC) are the key agencies leading the CDR initiative. The Treasury leads policy development and determines which sectors should be included in the CDR, while the ACCC focuses on accreditation and compliance of data recipients, and the OAIC handles privacy and data breach notifications. The Data Standards Body develops the technical standards for how data is shared under the CDR, working closely with the Treasury, ACCC, and OAIC.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of the National Disability Insurance Agency (NDIA) in the design and implementation of its new customer relationship management (CRM) system named ‘PACE’, including the broader supporting program known as ‘3P’ (Participant, Platform and Process).

PACE will replace existing business and payments systems and portals with a new embedded CRM system. PACE is intended to improve system controls, including controls to validate payments for services. Following a pilot of PACE that started in November 2022 for Tasmanian participants and providers, PACE implementation began across all remaining NDIA locations on 30 October 2023. Full implementation was expected to take 18 months with NDIA’s existing systems continuing to be used alongside PACE during that period.

Please direct enquiries through our contact page.

This audit would review the progress of selected components of the Australian Government’s Digital Identity program including the effectiveness of the implementation, design and functionality of the Digital Identity System, roles and responsibilities of stakeholders and the allocation and expenditure of funding, including contract management.

The Digital Identity program is delivered by the Department of Finance (policy and program lead), with Services Australia and the Australian Taxation Office (ATO) delivering critical operational functions. Components of the program include the Digital ID Act 2024, the Identity Exchanges (delivered by Services Australia), myID (the Commonwealth’s Identity Provider, delivered by ATO) and connected services to the system.

The Digital ID Act 2024 and the Digital ID (Transitional and Consequential Provisions) Act 2024 commenced on 1 December 2024 and support the expansion of the Australian Government Digital ID System and introduce a voluntary accreditation scheme for digital ID services providers. The Digital ID Regulator is the Australian Competition and Consumer Commission; and the Office of the Information Commissioner as the privacy regulator and Digital ID Data Standards Chair.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of Services Australia’s processes to ensure that payments are made in accordance with the law.

Services Australia delivers a wide range of services and payments on behalf of other Australian Government entities, including social security, child support, student payments, family assistance, aged care, and health programs. Services Australia operates under a legal framework that includes various pieces of legislation and regulatory commitments including the Human Services (Centrelink) Act 1997, Child Support (Registration and Collection) Act 1988, Child Support (Assessment) Act 1989, Public Governance, Performance and Accountability Act 2013, and the Commonwealth Fraud Control Framework. Services Australia operates a compliance program that aims to maintain the integrity of Australia’s welfare system and ensure that all operations are conducted within the legal framework. Components of the approach include payment reviews, data-matching and data mining, investigations, and various compliance activities, including identity checks and educating customers about their rights and obligations to support voluntary compliance.

Please direct enquiries through our contact page.

The audit would assess the effectiveness of the management of Machinery of Government changes by selected Australian Government entities.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of Services Australia’s use of enforcement powers in its child support program.

In 2023–24, Services Australia delivered $153.2.3 billion in social security and welfare payments on behalf of the Australian Government, including facilitating $1.9 billion in child support payments. In ensuring recipients receive only the payments to which they are entitled, Services Australia has a range of enforcement powers it applies through compliance activities. These include powers to require individuals to provide information, produce documents, answer questions, and make payments (including through the use of garnishee orders).

Please direct enquiries through our contact page.

The audit would examine the effectiveness of systems and processes to evaluate Australian Government programs aimed at First Nations peoples.

Auditor General Report 47 2018–19 Evaluating Aboriginal and Torres Strait Islander Programs found that, five years after the establishment of the Indigenous Advancement Strategy (IAS), the development of an evaluation framework was still in the ‘early stages’. The audit made three recommendations. The May 2019 Order to Establish the National Indigenous Australians Agency (NIAA) as an Executive Agency lists ‘to analyse and monitor the effectiveness of programs and services for Aboriginal and Torres Strait Islander people, including programs and services delivered by bodies other than the Agency’ as one of NIAA’s key responsibilities.

The Productivity Commission published the Indigenous Evaluation Strategy in October 2020. Section 24 of the Productivity Commission Act 1998 (PC Act) requires at least one commissioner to have extensive skills and experience in dealing with policies and programs that have an impact on Indigenous persons. A new Indigenous Policy Evaluation Commissioner was appointed to the Productivity Commission on 25 June 2024.

Please direct enquiries through our contact page.

This audit series assesses the effectiveness of governance arrangements in selected entities for monitoring and implementing agreed parliamentary committee and Australian National Audit Office (ANAO) performance audit recommendations.

Parliamentary committee and Auditor-General reports identify areas where administration can be improved and make recommendations to improve the delivery of outcomes. Once entities have agreed to implement performance audit recommendations, or in the case of parliamentary committee reports, the Australian Government has committed to the implementation of recommendations, timely implementation in line with the intended outcome of the recommendation is important in achieving the full benefit of the recommendation.

Please direct enquiries through our contact page.

This audit would examine the effectiveness of the Australian Public Service Commission’s (APSC’s) implementation of reporting against the Australian Public Service (APS) Strategic Commissiong Framework (the framework), including its methodology for determining whether the intended outcomes of the framework are being achieved.

The APSC issued the framework in October 2023, with the first round of reporting by Australian Government entities due for 2024–25. The framework is intended to strengthen APS capability through reduced reliance on contractors and consultants for core work. The APSC issued an update on 4 November 2024, stating that entities had reported targets totalling $527 million of core capability to be brought in-house in 2024–25.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of the Department of Parliamentary Services’ (DPS) management of assets. According to its 2025–26 Portfolio Budget Statements, DPS is responsible for the management of approximately $3.4 billion in combined administered and departmental assets.

Key assets include: land and buildings ($3 billion); heritage and cultural assets, including the Parliament House art collection ($134 million); and property, plant and equipment ($166 million).

Please direct enquiries through our contact page.

This audit would assess the effectiveness of Services Australia’s management of automated decision making. Automation can support timely, efficient and consistent decision making. The Commonwealth Ombudsman’s 2025 Better Practice Guide on Automated Decision-Making and the Australian Government’s Artificial Intelligence (AI) Ethics Principles provide entities with guidance on key principles for the design, implementation and monitoring of automated decision-making processes.

The Royal Commission into the Robodebt Scheme report of 7 July 2023 highlighted risks relating to automation, particularly where the automated processes remove any element of human decision-making and limit a citizen’s ability to challenge the decision. The Australian Government accepted the Royal Commission’s recommendation relating to introducing a consistent legal framework for automated decision-making. In the response to the Privacy Act Review Report released on 28 September 2023, the Australian Government agreed to increase the transparency and integrity of decisions made using automated decision-making that uses personal information.

Please direct enquiries through our contact page.

This audit would examine the management of Commonwealth fisheries including the implementation of recommendations from Auditor-General Report No. 45 of 2020–21, Management of Commonwealth Fisheries. The Australian Government is involved in the management of 16 fisheries located between three and 200 nautical miles from the Australian coast. Nine fisheries are managed solely by the Australian Fisheries Management Authority (AFMA) on behalf of the Australian Government. Seven fisheries are managed jointly by AFMA and regional or international partners.

AFMA’s legislated functions and objectives require the pursuit of efficient and cost-effective fisheries management, balancing the principles of ecologically sustainable development with maximising net economic returns.

In the 2021 audit, the ANAO found that AFMA’s overall management of Commonwealth fisheries was partly effective and provided nine recommendations. AFMA agreed to all recommendations.

Please direct enquiries through our contact page.

This audit would be a follow-up to Auditor-General Report No. 49 2018–19 Management of Commonwealth National Parks. The previous audit found that the Director of National Parks had not established effective arrangements to plan, deliver and measure the impact of its operational activities within the six terrestrial national parks. The previous audit made seven recommendations to the Director of National Parks.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of the Australian Taxation Office’s (ATO) management of confidential information.

The ATO manages commercially and legally sensitive information as part of its administration of the taxation and superannuation systems. Mobility between the public and private sector presents challenges to entities like the ATO to ensure that confidential information is not compromised. The provisions of the APS Code of Conduct, the Public Service Regulations 1999, the Privacy Act 1988, the Crimes Act 1914 and specific secrecy offences in Commonwealth laws outline the responsibilities of employees and agencies to manage confidential information.

Please direct enquiries through our contact page.

This audit would continue the ANAO’s series of audits on cyber security.

The scope would include assessing selected entities’ cyber security frameworks and controls against the controls required under the Protective Security Policy Framework and the Australian Signals Directorate’s Essential Eight Maturity Model.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of measures the Northern Australian Infrastructure Facility has taken to strengthen the integrity and transparency in decision making regarding funding decisions for projects. As at 30 June 2024, there was $4.4 billion in committed loans.

Auditor-General Report No. 33 2018–19 Governance and Integrity of the Northern Australia Infrastructure Facility made six recommendations.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of the Department of Agriculture, Fisheries and Forestry’s administration of post entry quarantine.

Imported plants and animals, including cats, dogs, birds and horses, complete quarantine at the department’s Post Entry Quarantine facility in Mickleham, Victoria.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of the Department of Defence’s management of the Defence estate.

Defence is projected to spend at least $12.2 billion over the forward estimates on sustaining its estate. The Defence estate consists of around 700 owned and leased properties, comprising 25,000 buildings and 6,000 other structural assets, including critical infrastructure and facilities such as military bases, wharves, ports, airbases, training ranges, fuel and explosive ordnance infrastructure. A number of strategic reviews conducted over the last 10 to 15 years have made recommendations relevant to Defence’s estate and infrastructure. This audit would examine Defence’s implementation of those recommendations, including those arising from the 2023 Defence Strategic Review.

Please direct enquiries through our contact page.

The audit would examine the effectiveness of the administration of the PALM scheme. The Pacific Australia Labour Mobility (PALM) scheme is Australia’s primary temporary migration program and supports Australia’s strategic interests in the Pacific. The PALM scheme helps to fill unskilled to semi-skilled jobs in rural and regional Australia, and in agriculture and food processing nationally, by offering eligible employers access to a pool of workers from the Pacific Islands and Timor-Leste. The PALM scheme is managed by the Department of Employment and Workplace Relations and the Department of Foreign Affairs and Trade. In 2023–24, the PALM Scheme’s administered expense budget was $11.0 million. As at 30 June 2024, there were 34,230 workers participating in PALM with 478 participating employers.

Please direct enquiries through our contact page.

The audit is to assess whether the Department of Parliamentary Services’ procurement and contract management activities are complying with the Commonwealth Procurement Rules and demonstrating the achievement of value for money.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of the Department of Veterans' Affairs (DVA) in managing its backlog of compensation claims under the Veterans' Entitlements Act 1986, the Safety, Rehabilitation and Compensation (Defence-related Claims) Act 1988 and the Military Rehabilitation and Compensation Act 2004.

DVA is responsible for processing veteran compensation claims for liability, permanent impairment and incapacity. As at September 2022, DVA had a backlog of 45,226 compensation claims (claims not allocated to a claims officer). The Royal Commission into Defence and Veteran Suicide’s August 2022 Interim Report included a recommendation for DVA to eliminate the claims backlog. The Australian Government agreed to the recommendation. The Australian Government provided $298 million over four years (across October 2022–23 and May 2023–24 Federal Budgets), to employ 500 additional frontline staff to process claims andmaintain a skilled workforce. As at 30 April 2024, DVA had allocated 94.3 per cent of the backlog identified by the Royal Commission (41,799) and there were 73,590 claims with a claims officer for processing.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of Services Australia administration of Medicare Compensation Recovery.

Medicare compensation recovery aims to recover any Medicare benefits, nursing home benefits, residential care, or home care government subsidies paid to a claimant resulting from compensable injury or illness. When a person receives a lump sum compensation payment of more than $5000, they may have to pay the costs of these back to the Australian Government before they receive their compensation payment. In 2023–24 46,634 cases were finalised and $29.2 million in benefits was recovered.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of the National Disability Insurance Scheme (NDIS) Quality and Safeguards Commission’s (the NDIS Commission’s) management of the restrictive practices undertaken by NDIS providers to NDIS clients.

Section 9 of the National Disability Insurance Scheme Act 2013 (NDIS Act) defines a restrictive practice as any practice or intervention that restricts the rights or freedom of movement of a person with disability. Under the National Disability Insurance Scheme (Restrictive Practices and Behaviour Support) Rules 2018 certain restrictive practices are subject to regulation. The NDIS Commission has regulated restrictive practices under the NDIS since the entity was established in 2018. This includes monitoring the use of regulated restrictive practices and promoting their reduction and elimination.

Across the four quarters of 2022–23, an average of 4,480 participants were subject to unauthorised restrictive practices, and an average of 12,253 participants were subject to regulated restrictive practices.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of the Department of Industry, Science and Resources’ (DISR) policies, program and stewardship to support safe and responsible use of new and emerging technologies in Australia, including Artificial Intelligence.

In February 2025 the Joint Committee of Public Accounts and Audit released its report Inquiry into the use and governance of artificial intelligence systems by public sector entities — ‘Proceed with Caution’ that noted the need for continuing work in this area given the rapid nature of change.

Please direct enquiries through our contact page.

This audit would assess whether entities’ procurement activities have been conducted in accordance with the Commonwealth Procurement Rules as applicable.

The National Intelligence Community (NIC) was officially formed in 2017 and comprises agencies from the Home Affairs, Defence, Foreign Affairs and Prime Minister and Cabinet portfolios. This audit would examine whether the procurement activities of selected NIC entities have demonstrated value for money and were appropriately managed. It would include procurements used to develop capabilities of individual NIC agencies, as well as those that are for a shared capability across the sector.

Please direct enquiries through our contact page.

This audit would examine whether the National Anti-Corruption Commission’s (NACC) procurement activities are complying with the Commonwealth Procurement Rules and demonstrating the achievement of value for money.

Please direct enquiries through our contact page.

This audit would assess whether the Department of Veterans’ Affairs (DVA’s) procurement of counselling service providers for the Open Arms program has been conducted in accordance with the Commonwealth Procurement Rules.

Open Arms is a counselling service for Australian veterans and their families, provided through DVA. Open Arms counselling is delivered by a national network of mental health professionals, both in Open Arms centres across the country and by partnerships with private psychologists and social workers, called Outreach Program Counsellors (OPCs). In 2022–23, 323,874 Open Arms services were provided to 43,134 veterans and their families with the program costing $115.6 million. In February 2024, DVA commenced a procurement process to develop a panel of OPCs. The establishment of the panel is expected to be completed by 30 June 2024.

Please direct enquiries through our contact page.

This audit would assess to what extent the Australian Rail Track Corporation (ARTC) and its subsidiary Inland Rail Pty Limited has effectively managed its procurement and contracts for Inland Rail.

Inland Rail is a key government infrastructure project. It involves building and operating a freight train line from Brisbane to Melbourne. Construction started in 2018 with sections between Beveridge VIC and Parkes NSW expected to be finished in 2027. Design and approvals works are underway for the Parkes NSW to Ebenezer Qld line. Since 2018, there has been more than $3.8 billion in contracts awarded.

In October 2022, the Australian Government announced an independent review into Inland Rail. This was completed in April 2023 and made 19 recommendations. The government responded to the review in April 2023. One of the independent review’s recommendations was the establishment of a subsidiary of ARTC to deliver the Inland Rail project. Inland Rail Pty Limited (IRPL) was established as a subsidiary of ARTC in July 2023.

Please direct enquiries through our contact page.

This audit would examine the effectiveness of the Department of Health, Disability and Ageing’s (Health’s) implementation of star ratings for residential aged care.

The star ratings system was introduced in December 2022. An overall star rating and star ratings in four categories (compliance, residents’ experience, staffing and quality measures) are assigned to residential aged care services on a public facing website (My Aged Care) operated by Health. The star rating system aims to help older Australians and their representatives make more informed choices about their care and to help aged care providers to see where they are performing well and how they can improve. In October 2024 the Commonwealth Ombudsman made a public statement expressing a view that star ratings were not sufficiently meaningful to help people make informed decisions about their aged care. From November to December 2024 Health ran a consultation process on planned design changes to star ratings. Health has stated that an evaluation report was expected to be provided to the Australian Government in early 2025.

Please direct enquiries through our contact page.

This audit would examine the effectiveness of the Australian Government’s response to scams in Australia.

Scams are a growing threat to Australian consumers and businesses, with financial losses to scams reported to be at least $3.1 billion in 2022 (a 72 per cent increase on losses recorded in 2021). In 2021–22, 65 per cent of Australians were exposed to a scam attempt, up from 55 per cent in the previous year. Since 1 July 2023, the National Anti Scam Centre in the ACCC has aimed to link government organisations, industry and Australians to work together to prevent scam activity. From 1 July 2026 the Scams Prevention Framework, coordinated by the Department of the Treasury will come into effect. This is expected to formalise the work of the department in coordinating scam prevention efforts with industry.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of the early implementation of the Rewiring the Nation program. The Australian Government allocated $20 billion to establish the Rewiring the Nation program in the October 2022–23 Federal Budget. The Rewiring the Nation Office in the Department of Climate Change, Energy, the Environment and Water is responsible for managing the program, the Australian Energy Market Operator will act as a technical advisor, and the Clean Energy Finance Corporation will act as the financing arm.

The program has supported several transmission projects including VNI West (KerangLink) between Victoria and NSW; Sydney Ring – Hunter Transmission Project; Central-West Orana Renewable Energy Zones; HumeLink; and the Marinus Link between Tasmania and Victoria.

Please direct enquiries through our contact page.