Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Portfolio overview

The Social Services portfolio is responsible for achieving the Australian Government’s social policy outcomes and delivering social security priorities through policy advice, program administration and research.

The Department of Social Services (DSS) is the lead entity in the portfolio and has two core areas of responsibility:

- a sustainable social security system that incentivises self-reliance and supports people who cannot fully support themselves by providing targeted payments and assistance; and

- contributing to stronger and more resilient individuals, children, families and communities by providing targeted supports.

Further information is available from the department’s website.

An Administrative Arrangement Order (AAO) was made on 13 May 2025, with subsequent amendments made on 26 June 2025, which impacts areas of responsibility in the Social Services portfolio.

In addition to DSS, the portfolio includes the Australian Institute of Family Studies, the Domestic, Family and Sexual Violence Commission, and the National Commission for Aboriginal and Torres Strait Islander Children and Young People. The entities within the Social Services portfolio administer services and programs with other government entities, non-government organisations, program participants and other stakeholders.

The Portfolio Budget Statements (PBS) contain budgets for those entities in the general government sector (GGS) that receive appropriations directly or indirectly through annual appropriation Acts. In the 2025–26 PBS for the Social Services portfolio — excluding Services Australia — the aggregated budgeted expenses for 2025–26 total $195.8 billion.

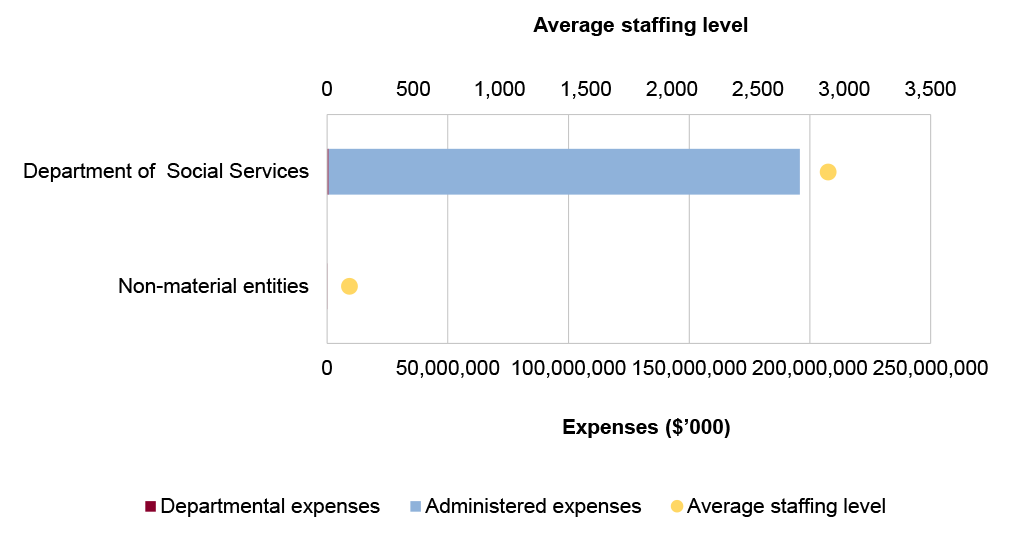

The level of budgeted departmental and administered expenses, and the average staffing level for entities in the GGS within this portfolio are shown in Figure 1. DSS represents the largest proportion of the portfolio’s expenses, and administered expenses are the most material component, representing just under 100 per cent of the portfolio expenses.

Figure 1: Social Services portfolio – total expenses and average staffing level by entity

Source: ANAO analysis of 2025–26 Portfolio Budget Statements and the 13 May 2025 AAO.

Audit focus

In determining the 2025–26 audit work program, the ANAO considers prior-year audit and other review findings and what these indicate about portfolio risks and areas for improvement. The ANAO also considers emerging risks from new investments, or changes in the operating environment and coverage across the sector.

The primary risks identified for the portfolio relate to ensuring allocated resources are effectively and lawfully applied to achieve intended policy outcomes, through program delivery by the department, state and territory governments and third party providers.

As the administrator of the Community Grants Hub, the department must ensure grant program outcomes are delivered in a manner consistent with the Commonwealth Grant Rules and Principles (CGRPs).

Specific risks in the Social Services portfolio relate to governance, grants administration and policy development.

Governance

In delegating to or relying on other government entities or third party providers for service delivery functions, the department has to develop and implement fit-for-purpose governance arrangements to maintain oversight of its policy responsibilities. Audit work and the findings of the Royal Commission into the Robodebt Scheme and the Commonwealth Ombudsman’s own motion review into income apportionment have highlighted the risks posed by ineffective oversight and risk management of joint service delivery arrangements, including legal risks.

Legal governance continues to be an important risk area in the Social Services portfolio in view of the complex social services legislation administered by the Department, with the support of Services Australia, for payment and compliance processes over personal benefits. Systems to facilitate the early identification and reporting of potentially significant legal risks across the portfolio are essential for the effective management of legal governance, accounting and external reporting processes.

It is important for entities to have effective risk management practices for the delivery of cyber security by an ICT service provider including service provided by other government entities. This includes conducting assessments of the effectiveness of security controls, security awareness training, and adopting a risk-based approach to prioritise improvements to cyber security. Weaknesses in the implementation and operation of governance and monitoring processes relating to cyber security increase the risk of unauthorised access to systems and data held by entities.

Previous audits have identified weaknesses in the department’s use of program evaluation to examine whether government initiatives are cost effective and achieving intended outcomes.

Machinery of Government changes require close management to ensure continuity of business, management of risk and cost and support to the government, employees and stakeholders.

Grants administration

The department administers grants programs in the area of families and communities. It also delivers grant administration services on behalf of Commonwealth entities through the Community Grants Hub. Delivering grants programs in a manner consistent with the Commonwealth Grant Rules and Principles is an ongoing risk for the department.

The department needs to consider how the intended benefits from the delivery of grants programs through a hub can be better demonstrated and how Commonwealth grants administration and payments data quality can be assured.

Policy development

In providing robust policy advice, a frank assessment of implementation risk based on best available evidence should be taken into account.

Audits have highlighted deficiencies with performance measures and evaluation planning. The collection and integrity of baseline data is critical to support evaluation planning and inform continuous improvement activities and future policy advice. The delivery of programs and achievement of policy objectives must be demonstrated by robust and verifiable performance information and evaluation findings.

Previous performance audit coverage

The ANAO’s performance audit activities involve the independent and objective assessment of all or part of an entity’s operations and administrative support systems. Performance audits may involve multiple entities and examine common aspects of administration or the joint administration of a program or service.

During the performance audit process, the ANAO gathers and analyses the evidence necessary to draw a conclusion on the audit objective. Audit conclusions can be grouped into four categories:

- unqualified;

- qualified (largely positive);

- qualified (partly positive); and

- adverse.

In the period between 2020–21 and 2024–25 entities within the Social Services portfolio were included in tabled ANAO performance audits eight times. The conclusions directed toward entities within this portfolio were as follows:

- two were unqualified;

- three were qualified (largely positive);

- two were qualified (partly positive); and

- one was adverse.

Figure 2 shows the number of audit conclusions for entities within the Social Services portfolio that were included in ANAO performance audits between 2020–21 and 2024–25 compared with all audits tabled in this period.

Figure 2: Audit conclusions 2020–21 to 2024–25: entities within the Social Services portfolio compared with all audits tabled

Source: ANAO data

The ANAO’s annual audit work program is intended to deliver a mix of performance audits across seven audit activities: governance; service delivery; grants administration; procurement; policy development; regulation and asset management and sustainment. These activities are intended to cover the scope of activities undertaken by the public sector. Each performance audit considers a primary audit activity. Figure 3 shows audit conclusions by primary audit activity for audits involving entities in the Social Services portfolio.

Figure 3: Audit conclusions by activity for audits involving entities within the Social Services portfolio compared with all audits tabled between 2020–21 and 2024–25

Source: ANAO data.

Performance statements audit

The audit of the 2024–25 Department of Social Services (DSS) annual performance statements is being conducted following a request from the Minister for Finance on 2 July 2024, under section 40 of the Public Governance, Performance and Accountability Act 2013. The audit is conducted under section 15 of the Auditor-General Act 1997.

- DSS has been included in the annual performance statements audit program since the commencement of the pilot in 2019–20. The risk rating of the 2024–25 audit engagement is low. The auditor’s report on DSS’ statements was not qualified in 2023–24. The auditor’s report contained two Emphasis of Matter paragraphs relating to disclosures that the department was not able to gain assurance for the Escaping Violence Payment and the Our Watch. In addition to these matters, the 2024–25 performance statements audit has identified the following emerging risks:

- the new measures in DSS’ 2024–25 Corporate Plan relating to Australia’s Disability Strategy, the department’s workforce of people identifying with disability, NDIS market initiatives, the National Housing and Homelessness Agreement and the Community Grants Hub;

- the measurement and assessment of the Disability Support Pension and Carer Payment and Carer Allowance key activities;

- the department’s consideration of a performance measure on its policy capability and advice; and

- DSS’ progress in developing program logic mapping and Performance Measurement Frameworks.

Financial statements audits

Overview

Entities within the Social Services portfolio, and the risk profile of each entity, are shown in Table 1.

Table 1: Social Services portfolio entities and risk profile

|

|

Type of entity |

Engagement risk |

Number of higher risks |

Number of moderate risks |

|

Material entities |

||||

|

Department of Social Services |

Non-corporate |

Moderate |

2 |

2 |

|

Non-material entities |

||||

|

Australian Institute of Family Studies |

Non-corporate |

Low |

||

|

Domestic, Family and Sexual Violence Commission |

Non-corporate |

Low |

||

|

National Commission for Aboriginal and Torres Strait Islander Children and Young People |

Non-corporate |

Low |

||

Material entities

Department of Social Services

The Department of Social Services (DSS) is responsible for social security, families and communities, disability employment services and carers. DSS works in partnership with other government and non-government organisations on a range of policies, programs and services focused on improving the wellbeing of people and families in Australia.

DSS’s total budgeted administered expenses for 2025–26 are $195.1 billion, with 78 per cent attributable to personal benefits and one per cent attributable to grants. Receivables represent 72 per cent of total budgeted administered assets, while provisions represent 50 per cent of total budgeted liabilities, as shown in Figure 4.

Figure 4: Department of Social Services’ total budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are four key risks for DSS’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage, including three risks that the ANAO considers potential key audit matters (KAMs).

- The accuracy and occurrence of personal benefits expenses which represent a significant outlay for the Australian Government. Under the Bilateral Management Agreement between DSS and Services Australia, personal benefits payments are delivered by Services Australia on behalf of DSS. Due to their demand driven nature, these payments are often impacted by changes in the market and/or environmental conditions. (KAM – Accuracy and occurrence of personal benefits expenses)

- The valuation of personal benefits provisions and receivables and contingent liabilities, as they include estimates relating to amounts payable/receivable to/from individuals within the community, in accordance with legislative requirements and government policy decisions. The estimates are based on historical data and DSS’s assessment of the number of eligible recipients, claim rates and recipient’s behaviour. (KAM – Valuation of personal benefits provisions and receivables)

- The validity of grants expenses, as DSS administers a number of significant grant programs and has streamlined these grants based on common social policy functions. The grants are administered and reported through an in-house IT system, Grants Payment System (GPS). The GPS system is utilised by DSS for the administration of the DSS Community Grants Hub, which provides grant services to DSS and other Government agencies, through Partnership Agreements. (KAM – Validity of grants expenses)

- Income apportionment, as DSS is managing a legal matter that was the subject of an own-motion investigation by the Office of the Commonwealth Ombudsman into the practice of income apportionment for personal benefit payments which may impact the personal benefits recognised.