Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Entity overview

On 1 July 2025, the responsibilities for Services Australia moved from the Social Services portfolio to the Finance portfolio. Services Australia is the Australian Government’s primary payment and service delivery provider and delivers a range of payments and services to support individuals, families and communities, as well as providers and businesses. These include income support payments and services, aged care payments, Medicare payments and services, child support services and a range of ICT functionalities for Australian Government departments and agencies. Further information is available from Services Australia’s website.

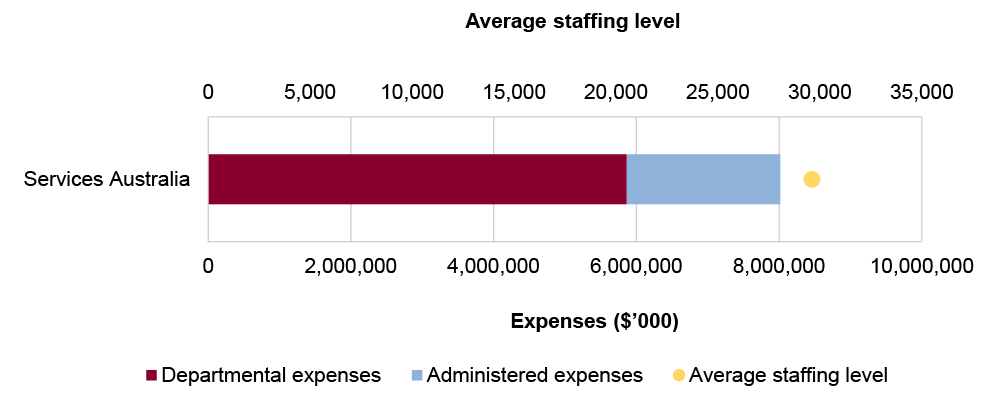

In the 2025–26 Portfolio Budget Statements (PBS) for the Social Services portfolio, the aggregated budgeted expenses for Services Australia for 2025–26 total $8.0 billion. The PBS contain budgets for those entities in the general government sector (GGS) that receive appropriations directly or indirectly through annual appropriation Acts.

The level of budgeted departmental and administered expenses, and the average staffing level are shown in Figure 1. Departmental expenses are the most material component representing 73 per cent of the total budgeted expenses.

Figure 1: Services Australia – total expenses and average staffing level by entity

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

Audit focus

In determining the 2025–26 audit work program, the ANAO considers prior-year audit and other review findings and what these indicate about portfolio risks and areas for improvement. The ANAO also considers emerging risks from new investments or changes in the operating environment.

The ANAO had regard to the final report of the capability review of Services Australia that was endorsed by the Australian Public Service Commissioner in December 2024.

The primary risks identified by the ANAO for Services Australia relate to the integrity and lawfulness of decision making, risk management, cyber security and effective project management for ICT systems. Timely and effective delivery of Services Australia’s modernisation agenda, ICT reforms and compliance programs is required to maintain the integrity of the services and payments which Services Australia manages on behalf of the Australian Government.

Specific risks in Services Australia relate to governance, service delivery, procurement, regulation and asset management and sustainment.

Governance

Audit work and the findings of the Royal Commission into the Robodebt Scheme and the Commonwealth Ombudsman’s own motion review into income apportionment have highlighted issues with program governance, engaging with risk at senior levels, decision making and relationships with policy entities.

Fit for purpose bilateral arrangements, timely performance monitoring and reporting and the proactive management of shared risks are required for Services Australia to maintain effective relationships with policy entities and balance competing priorities across the services and payments it delivers for the Australian Government. Policy entities and entities receiving corporate shared services require timely, reliable and complete access to information from ICT systems to meet legislative and policy requirements.

Services Australia delivers programs through a large number of ICT systems. IT control weaknesses increase the risk of fraudulent, unauthorised or erroneous transactions being processed, and increase the risk of such transactions not being detected in a timely manner. Given the dependencies on the appropriate governance of the ICT environment to ensure accurate payments and business continuity, the ANAO’s work includes a focus on access management, change management and program development.

The volume and sensitivity of the personal and business information held by Services Australia requires the prompt identification and remediation of cyber security vulnerabilities and robust information access and incident management processes.

The scale and breadth of Service’s Australia’s remit poses challenges for its governance and delivery of services. Factors that increase complexity of Services Australia’s governance and delivery include the number of staff and locations that it operates in, entities that it delivers services on behalf of and to, and legislation and policy that it must implement.

Service delivery

Strategic management of resources and improvements to the reliability of information sources and the methodology for its performance reporting are essential to demonstrate achievement of the agency’s purpose and meet service delivery requirements.

Over the forward estimates period to 2027–28, Service’s Australia’s departmental resourcing reduces by $1.4 billion (24 per cent) due to the impact of terminating budget measures. A continued focus on operational capability will be essential to ensure it can support the continued delivery of its wide range of services.

A priority for Services Australia is improving the digital service offer and welfare payment infrastructure through projects and investment in core technology enablers. Services Australia faces challenges around the effective implementation of new ICT systems while also maintaining the entity’s current ICT infrastructure, including implementing legislative and policy changes. In June 2023, Services Australia wrote off $230.5 million of software mostly associated with the Welfare Payment Infrastructure Transformation Program – Entitlement Calculation Engine which was designed to replace the current Centrelink system. Under-delivery or overspending in the IT and telecommunications space will put pressure on Services Australia’s ability to fulfil its purpose and meet service delivery requirements of policy entities.

The delivery of services on behalf of policy entities places a responsibility on Services Australia to provide adequate assurance in relation to its management of fraud and payment integrity risks to support policy entities meeting their responsibilities under the Public Governance, Performance and Accountability Act 2013 (PGPA Act).

Procurement

Audit work and the ‘Independent Review of Services Australia and NDIA Procurement and Contracting’ report published in March 2023 identified weaknesses in compliance with the Commonwealth Procurement Rules, particularly in relation to demonstrating achievement of value for money and transparent decision making.

Regulation

Services Australia is responsible for monitoring, promoting and enforcing legislative compliance for both the payments and services it delivers on behalf of policy entities and its administration of the child support scheme. Effective regulatory approaches are required to maintain the public’s trust and achieve the desired outcomes. Audit work has identified deficiencies in relation to the implementation of risk based and data driven strategies for regulatory activities, governance arrangements, compliance with procedural and legislative requirements, investigations and enforcement activities, and performance measurement and evaluation.

Asset management and sustainment

Services Australia is continuing to undertake a major transformation and modernisation program across each of its service delivery channels – digital, face-to-face and telephony. Appropriate physical asset management includes consideration of asset risks, development of a strategic asset management strategy that is aligned to entity purposes and reporting against asset performance measures. In the 2024–25 Federal Budget, Services Australia was allocated $629.5 million over four years to operate and enhance the myGov platform and $313.8 million over two years to enhance safety and security at service centres. Services Australia is transitioning its contact centre management services from Telstra to Optus. The contract is worth $578 million. Services Australia will need to manage risks related to this transition.

Previous performance audit coverage

The ANAO’s performance audit activities involve the independent and objective assessment of all or part of an entity’s operations and administrative support systems. Performance audits may involve multiple entities and examine common aspects of administration or the joint administration of a program or service.

During the performance audit process, the ANAO gathers and analyses the evidence necessary to draw a conclusion on the audit objective. Audit conclusions can be grouped into four categories:

- unqualified;

- qualified (largely positive);

- qualified (partly positive); and

- adverse.

In the period between 2020–21 and 2024–25 Services Australia was included in 14 performance audits. The conclusions directed toward Services Australia were as follows:

- one was unqualified;

- seven were qualified (largely positive);

- six were qualified (partly positive); and

- none were adverse.

Figure 2 shows the number of audit conclusions for Services Australia that were included in ANAO performance audits between 2020–21 and 2024–25 compared with all audits tabled in this period.

Figure 2: Audit conclusions 2020–21 to 2024–25: Services Australia compared with all audits tabled

Source: ANAO data.

The ANAO’s annual audit work program is intended to deliver a mix of performance audits across seven audit activities: governance; service delivery; grants administration; procurement; policy development; regulation and asset management and sustainment. These activities are intended to cover the scope of activities undertaken by the public sector. Each performance audit considers a primary audit activity. Figure 3 shows audit conclusions by primary audit activity for audits involving Services Australia.

Figure 3: Audit conclusions by activity for audits involving Services Australia, 2020–21 to 2024–25

Source: ANAO data.

Performance statements audit

The audit of the 2024–25 Services Australia annual performance statements is being conducted following a request from the Minister for Finance on 2 July 2024, under section 40 of the Public Governance, Performance and Accountability Act 2013. The audit is conducted under section 15 of the Auditor-General Act 1997.

This is the third audit of the Services Australia’s annual performance statements. The overall risk of the audit is moderate, which reflects Services Australia’s growing maturity in performance planning and reporting. There are two significant, two moderate and one minor audit finding from the prior year.

Services Australia’s performance statements are complex with a maturing performance reporting framework. Key risks for Services Australia’s performance statements that the ANAO has highlighted include:

- the reliability and verifiability of data sources and methodologies for the measures on ‘Customers served within 15 Minutes’ and ‘Timeliness of claims processing’;

- the lack of an efficiency measure to measure the achievement of Services Australia’s purposes;

- the adequacy of Services Australia’s measurement and assessment of its regulatory functions; and

- the data governance and IT controls supporting the Services Australia performance measures.

Financial statement audits

Overview

Services Australia is part of the Finance portfolio. Services Australia’s risk profile is shown in Table 1.

Table 1: Services Australia risk profile

|

|

Type of entity |

Engagement risk |

Number of higher risks |

Number of moderate risks |

|

Material entity |

||||

|

Services Australia |

Non-corporate |

High |

2 |

1 |

Material entities

Services Australia

Services Australia has responsibility for delivering a range of payments and services to support individuals, families and communities, as well as providers and businesses. These include income support payments and services; aged care payments; Medicare payments and services; and child support services. Social and health-related payments and services delivered by Services Australia on behalf of other entities are recognised within each of the individual policy agencies’ financial statements.

Services Australia’s total budgeted assets for 2025–26 are $6.3 billion, with 19 per cent of these assets attributable to child support receivables and 32 per cent attributable to land and buildings, encompassing right-of-use assets, as shown in Figure 4.

Figure 4: Services Australia’s total budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

Services Australia has been classified by the ANAO as a high risk engagement. This engagement risk rating reflects the number and quantum of key areas of financial statements risk that will be a focus of the audit, as well as, the: heightened public scrutiny and interest as a result of the Robodebt Royal Commission and other public reviews; significant IT and legal governance findings reported at the conclusion of the 2023–24 audit; and the role of Services Australia in delivery of the Australian Government’s health and social welfare benefits.

There are three key risks for Services Australia’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage. ANAO considers all three risks potential key audit matters (KAMs).

- The valuation of receivables related to the Child Support Scheme due to the value of child support payments yet to be paid by non-paying parents at the end of each financial year, which involves an actuarial estimation process, and requires significant judgement and assumptions. (KAM - Valuation of receivables related to the Child Support Scheme)

- Recognition of Medicare compensation recovery claims due to weaknesses in governance that resulted in non-compliance with legislative requirements and non-pursuit of monies potentially owed to the Commonwealth, leading to the need to estimate the value of revenue foregone. (KAM – Recognition of Medicare compensation recovery revenue)

- The recognition and impairment of intangible assets due to the complexities in capturing the actual costs of various internally developed software applications and consideration of the indicators of impairment to estimate the value of intangible assets in accordance with relevant accounting standards. (KAM – Valuation of intangible assets)