Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The objective of the audit was to assess the effectiveness of the Australian Taxation Office's (ATO) management and reporting of selected information relating to the goods and services tax and the fringe benefits tax.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the awarding of funding for the construction of the Adelaide Desalination Plant (ADP) against the requirements of the Commonwealth's grants administration framework, which includes the Government’s policy requirements for the approval of grants, with a particular focus on the assessments undertaken of each proposed grant in terms of the guidelines for the National Urban Water and Desalination Plan (NUWDP); and identify any potential improvements in grants administration practices.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to examine the efficiency of the Australian Commission for Law Enforcement Integrity (ACLEI) in detecting, investigating and preventing corrupt conduct.

Please direct enquiries through our contact page.

The objective of the audit was to continue to examine the progress of the implementation of the annual performance statements requirements under the PGPA Act and the PGPA Rule by the selected entities. The audit was also designed to:

- provide insights to entities more broadly, to encourage improved performance; and

- continue the development of the ANAO’s methodology to support the possible future implementation of annual audits of performance statements.

Please direct enquiries through our contact page.

The objective of the audit was to assess the completeness and reliability of the estimates reported in Tax Expenditures Statement 2006 (TES 2006). That is, the audit examined the development and publication of the detailed statement of actual tax expenditures required by Division 2 of Part 5 of the CBH Act. The development and publication of aggregated information on projected tax expenditures included in the Budget Papers pursuant to Division 1 of Part 5 of the CBH Act was not examined.

The objective of this audit was to assess the administration of internal fraud control arrangements in the ATO and to identify areas with potential for improvement as well as identified better practice. To achieve this objective the ANAO focussed on five key areas. These were:

- the application of the ATO's corporate governance processes to the internal fraud control activities;

- the prevention of internal fraud within the ATO;

- the related use of information technology to minimise fraud risks;

- the detection of internal fraud within the ATO; and

- ATO fraud investigation procedures and practices.

The audit objective was to assess whether the Department of Industry, Innovation and Science has effectively and efficiently administered the collection of North West Shelf royalty revenues.

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess the effectiveness of the Department of Parliamentary Services’ arrangements for managing contracts and retail licences, including the extent to which the department has implemented recommendations from the previous ANAO audit.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to continue to examine the progress of the implementation of the annual performance statements requirements under the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule) by selected entities.

Please direct enquiries through our contact page.

The objective of the audit was to report on the effectiveness of Defence’s approach to the acceptance into service of Navy capability, and to identify where better practice may be used by CDG, DMO and Navy.

This audit is one of a series of fraud control audits undertaken by the ANAO. The audit focussed on Centrelink's arrangements for the prevention, detection and treatment of incorrect payments to its customers. The objective of the audit was to assess whether Centrelink had implemented appropriate fraud control arrangements in line with the Fraud Control Policy of the Commonwealth.

The ANAO Corporate Plan 2024–25 updates the previous corporate plan and outlines how we intend to deliver against our purpose over the next four years (2024–25 to 2027–28). The corporate plan is the ANAO’s primary planning document — it outlines our purpose; the dynamic environment in which we operate; our commitment to building capability; and the priorities, activities and performance measures by which we will be held to account.

Please direct enquiries through our contact page.

The audit objective was to examine whether the selected entities have implemented a selection of agreed parliamentary committee and Auditor-General recommendations.

Please direct enquiries through our contact page.

The objective of this audit was to assess whether the Australian War Memorial is effectively managing the development project.

Please direct enquiries through our contact page.

The objective of this audit was to assess the effectiveness of the Department of Defence's planning and administrative arrangements to support the provision of emergency Defence Assistance to the Civil Community (DACC).

Please direct enquiries through our contact page.

The objective of this audit was to assess the effectiveness of the Department of Health’s administration of the Community Health and Hospitals Program.

Please direct enquiries through our contact page.

The objective of the audit was to examine the effectiveness of the Department of Defence’s arrangements for the management of contractors.

Please direct enquiries through our contact page.

This report complements the Interim Report on Key Financial Controls of Major Entities financial statement audit report published in June 2018. It provides a summary of the final results of the audits of the Consolidated Financial Statements for the Australian Government and the financial statements of Australian Government entities for the period ended 30 June 2018.

Please direct enquiries through our contact page.

The audit objective was to assess the effectiveness of the Department of Communications and the Arts’ contract management of selected telephone universal service obligations.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the administrative effectiveness of Australian Customs Services (Customs) drug detection strategies for air and containerised sea cargo and small craft activity. Within the scope of the audit, the following areas were examined :

- intelligence and law enforcement cooperation;

- air and containerised sea cargo;

- cargo examinations and technology;

- small craft activities;

- Customs funding arrangements (including funding for NIDS initiatives): and

- governance, including performance reporting.

The ANAO may collect personal information in the course of undertaking its audit program and for operational purposes not related to its audit work. This policy outlines our personal information handling practices, how we handle specific types of personal information and the information collected online by the ANAO.

Please direct enquiries about our Privacy Policy through our contact page.

The objective of this audit was to assess whether the Productivity Commission is effectively managing the use of corporate credit cards for official purposes in accordance with legislative and entity requirements.

Please direct enquiries through our contact page.

The objective of this audit was to assess whether the Federal Court of Australia is effectively managing the use of corporate credit cards for official purposes in accordance with legislative and entity requirements.

Please direct enquiries through our contact page.

The objective of this audit was to assess the effectiveness of the Australian Maritime Safety Authority’s (AMSA) management of the Aids to Navigation maintenance procurement.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the Department of Social Services’ 2020 to 2022 procurement of counselling and support services provided through 1800RESPECT.

Please direct enquiries through our contact page.

The objective of the audit was to examine the effectiveness of the integration of the Department of Immigration and Border Protection (DIBP) and the Australian Customs and Border Protection Service.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the governance board in Old Parliament House.

Please direct enquiries through our contact page.

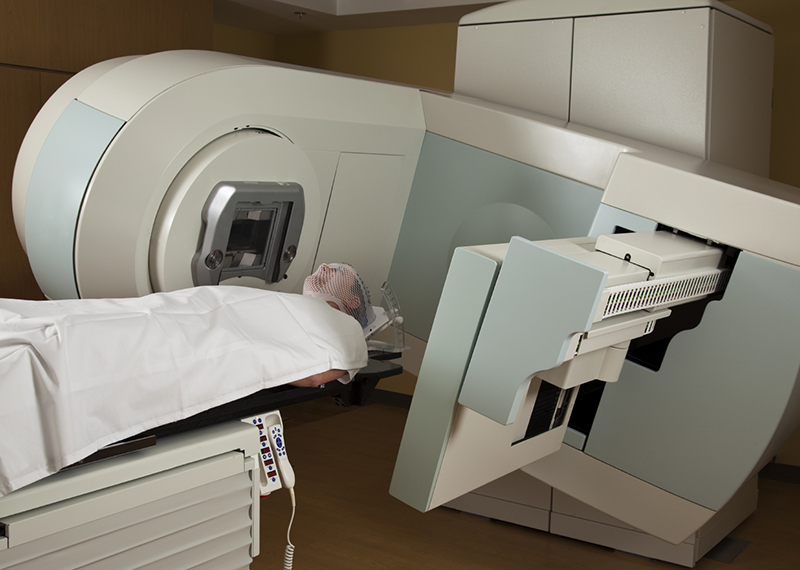

The audit objective was to assess the effectiveness of the Department of Health's and the Department of Human Services' administration of the Radiation Oncology Health Program Grants Scheme.

Please direct enquiries relating to reports through our contact page.

The audit objective was to examine entity compliance with regulatory requirements for the establishment and ongoing management of special appropriations.

Please direct enquiries through our contact page.

The audit objective was to assess the effectiveness of the Department of Health's design, implementation and administration of primary healthcare under the Indigenous Australians' Health Program (IAHP).

Please direct enquiries through our contact page.

The objective of this audit was to assess the effectiveness of the Australian Criminal Intelligence Commission’s administration of the Biometric Identification Service project.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the governance board in the Australian Institute of Marine Science.

Please direct enquiries through our contact page.

The objective of the audit was to assess the Australian Taxation Office's effectiveness in meeting its revenue and resourcing commitments for the Tax Avoidance Taskforce.

Please direct enquiries through our contact page.

The objective was to examine whether the award of funding under the Supporting Reliable Energy Infrastructure Program was informed by an appropriate assessment process and sound advice that complied with the Commonwealth Grant Rules and Guidelines.

Please direct enquiries through our contact page.

The objective of this audit was to assess the effectiveness of the Department of Health’s approach to health provider compliance.

Please direct enquiries through our contact page.

The audit examined whether the Department of Home Affairs implemented all agreed recommendations from parliamentary committee and Auditor-General reports within the scoped timeframe.

Please direct enquiries through our contact page.

The objective of the audit was to examine the effectiveness of Centrelink's approach to investigating and responding to external fraud. The ANAO's assessment was based on four key criteria. In particular, the ANAO assessed whether Centrelink:

- had established a management framework, business systems and guidelines, that support the investigation, prosecution and reporting of fraud;

- had implemented appropriate case selection strategies and controls to ensure resources are targeted to the cases of highest priority;

- complied with relevant external and internal requirements when investigating fraud and referring cases for consideration of prosecution; and

- had implemented an effective training program that supports high quality investigations and prosecution referrals.

The Navy Operational Readiness audit examined the systems that Navy uses to manage readiness and concludes coverage of Navy: readiness organisation and management structures (as well as the interface between these systems and Defence enabling operations); management and maintenance of operational readiness (covering personnel, collective training and other components of operational readiness); and readiness performance information processes. The objective of the audit was to provide assurance to Parliament concerning the progress that Navy has made in the development of operational readiness management and evaluation systems and to identify areas for improvement in these systems.

The audit reviewed the effectiveness and probity of the policy development processes and implementation of improved access to Magnetic Resonance Imaging services. The objective of the audit was to examine and report on the effectiveness and probity of the processes involved in:

(a) the development and announcement of the proposal to improve access to Magnetic Resonance Imaging (MRI) services announced in the 1998 Budget, including negotiation with the diagnostic imaging profession; and

(b) the registration of 'eligible providers' and 'eligible equipment' to enable the payment of claims for MRI services on the Medicare Benefits Schedule

Audit Practice: Auditing Regulatory Activities is intended for senior management and those responsible for managing internal audit within Australian Government entities that have a regulatory function.

Please direct enquiries through our contact page.

The objective of this audit was to assess the effectiveness of the Australian Research Council’s (ARC) management of corporate credit cards.

Please direct enquiries through our contact page.

The objective of this audit was to assess whether the design and implementation of the Australian Apprenticeships Incentive System by the Department of Employment and Workplace Relations is effective.

Please direct enquiries through our contact page.

The audit objective was to assess the effectiveness of the Department of Employment and the Department of Education and Training's administration of the Shared Services Centre to achieve efficiencies and deliver value to its customers.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess whether the award of funding under the Regional Jobs and Investment Packages program was informed by appropriate departmental advice and that processes complied with the grants administration framework.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the award of funding under the first round of the Safer Streets programme.

Please direct enquiries relating to reports through our contact page.

The objective of this information report is to provide transparency and insights on the governing boards of Commonwealth entities and companies and the membership of these boards.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the implementation and award of funding for Round 1 of the Growing Regions Program.

Please direct enquiries through our contact page.

The objective of this audit was to examine whether the Tourist Refund Scheme (TRS) is being effectively administered, with the appropriate management of risks.

Please direct enquiries through our contact page.

The objective of the audit was to examine whether selected entities implemented agreed ANAO performance audit, the Joint Committee of Public Accounts and Audit, and other parliamentary committee recommendations.

Please direct enquiries through our contact page.

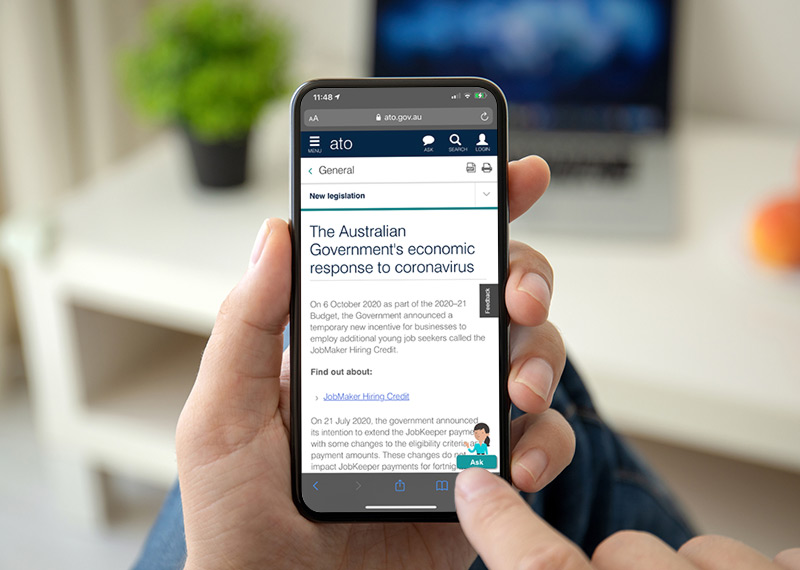

The objective of the audit was to assess whether the Australian Taxation Office (ATO) has effectively managed risks related to the rapid implementation of COVID-19 economic response measures.

Please direct enquiries through our contact page.

The audit objective was to assess the effectiveness of the administration of the National Housing Finance and Investment Corporation (NHFIC).

Please direct enquiries through our contact page.

The objective of the audit is to assess the effectiveness of the Department of the Prime Minister and Cabinet’s implementation of food security initiatives for remote Indigenous communities.

Please direct enquiries relating to reports through our contact page.

The objective of this report is to provide comprehensive information on the status of projects as reflected in the Project Data Summary Sheets (PDSSs) prepared by DMO, and a review by the ANAO.

The objective of this report is to provide the Auditor-General’s independent assurance over the status of selected Major Projects, as reflected in the Project Data Summary Sheets (PDSSs) prepared by the DMO, and the Statement by the Chief Executive Officer (CEO) DMO. Assurance from the ANAO’s review of the preparation of the PDSSs by the Defence Materiel Organisation (DMO) is conveyed in the Auditor-General’s Independent Review Report, prepared pursuant to the endorsed Guidelines, contained in Part 3.

Michael White, Executive Director, Phone: (02) 6203 7393

The objective of this report is to provide comprehensive information on the status of selected Major Projects, as reflected in the Project Data Summary Sheets prepared by the DMO, and the Statement by the Chief Executive Officer (CEO) of the DMO, and including the ANAO’s review of the preparation of the PDSSs by the DMO.

The objective of the audit was to assess the effectiveness of the transitional arrangements from the Cashless Debit Card (CDC) program to the Enhanced Income Management program.

Please direct enquiries through our contact page.

The objective of this audit was to examine whether the Department of Finance (Finance) has implemented a selection of agreed parliamentary committee and Auditor-General recommendations.

Please direct enquiries through our contact page.

The objective of the audit was to assess whether the contractual arrangements that have been put in place for the delivery of the Moorebank Intermodal Terminal (MIT) will provide value for money and achieve the Australian Government’s policy objectives for the project.

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess how effectively the selected public sector entities manage risk.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to examine whether the Department of Infrastructure, Transport, Regional Development and Communications exercised appropriate due diligence in its acquisition of the ‘Leppington Triangle’ land for the future development of the Western Sydney Airport.

Please direct enquiries through our contact page.

This first Assurance Report on the status of selected Defence equipment acquisition projects, which has the support of the Parliament and the Government, represents a substantial step towards improving transparency and public accountability in major Defence procurement projects. It is the pilot of an annual Defence Materiel Organisation (DMO) Major Projects Report, and was developed in conjunction with the DMO. It covers the cost, schedule and capability progress achieved by nine DMO projects, which had an approved budget totalling $13.535 billion as at 30 June 2008.

This report is organised into three parts. Part 1 comprises an ANAO overview and Auditor–General's Foreword. Part 2 comprises the Major Projects Report prepared by DMO, including an overview reflecting DMO's perspective on their business and on the nine projects included in the. Part 3 incorporates the Auditor-General's Review Report, the statement by the CEO DMO, and the information prepared by DMO in the form of standardised Project Data Summary Sheets covering each of the nine pilot projects.

In the next 12 months, the ANAO will review 15 DMO projects planned for inclusion in the 2008-09 DMO Major Projects Report, with the number of projects rising to 30 projects in subsequent years. The ANAO will also work with DMO to refine the approach adopted for providing assurance on each project's progress toward achieving Final Operational Capability. The ANAO will also consider the inclusion of an analysis of each project's emerging trends, as appropriate, to complement DMO's intention to provide improved analysis of project management performance regarding all projects included in the Major Projects Report.

The objective of this audit was to examine whether the Australian Postal Corporation (Australia Post) is meetings its Community Service and International obligations efficiently and the effectiveness of Commonwealth shareholders in monitoring value for money.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Department of Immigration and Border Protection’s identity verification arrangements for applicants in the Citizenship Program.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to assess whether the Department of Veterans’ Affairs is efficiently delivering services to veterans and their dependents.

Please direct enquiries through our contact page.

The objective of the audit was to assess the adequacy of selected Australian Government entities’ practices and procedures to manage business continuity. To conclude against this objective, the ANAO adopted high-level criteria relating to the entities’ establishment, implementation and review of business continuity arrangements.

Please direct enquiries relating to reports through our contact page.

The Public Interest Disclosure Act 2013 (PID Act) came into effect on 15 January 2014. The purpose of the Public Interest Disclosure Scheme is to provide an avenue for public officials to report suspected wrong doing in the Australian public sector.

The scheme provides for employees (including former employees) of the ANAO and contracted service providers to the ANAO, to make a public interest disclosure of suspected wrongdoing relating to any public official, and provides for any public officials and former public officials to make a public interest disclosure of suspected wrongdoing relating to ANAO activities or ANAO officials, either anonymously or openly, in writing or verbally, to an authorised officer in the ANAO. The ANAO has an obligation to assess the disclosure and decide whether to investigate the matter or not.

If you are considering making a disclosure that relates to a current ANAO audit, seek assistance from an authorised officer in the first instance by sending an email to pid@anao.gov.au with the subject 'Advice regarding [audit name]'. An authorised officer can assist you to assess whether your matter may be an audit contribution (for example, you believe that an audit team has been provided with misleading information) and can explain the confidentiality provisions for information gathered as part of an ANAO audit.

The ANAO has appointed two authorised officers to manage public interest disclosures. They are listed under Who can the disclosable conduct be reported to?

The objective of this audit was to assess the effectiveness of the Department of Agriculture, Water and the Environment’s administration of referrals, assessments and approvals of controlled actions under the Environment Protection and Biodiversity Conservation Act 1999.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the Department of Infrastructure, Transport, Regional Development and Communications’ design and implementation of measures to support the aviation sector in response to the COVID-19 pandemic.

Please direct enquiries through our contact page.

The ANAO prepares two reports annually that provide insights at a point in time to the financial statements risks, governance arrangements and internal control frameworks of Commonwealth entities, drawing on information collected during our audits.

This report is the first of the two reports and focuses on the results of the interim financial statements audits, including an assessment of entities’ key internal controls, supporting the 2024–25 financial statements audits. This report examines 27 of the largest Australian Government entities, including all: departments of state; the Department of Parliamentary Services; and other Commonwealth entities that significantly contribute to the revenues, expenses, assets and liabilities within the 2023–24 Australian Government Consolidated Financial Statements (CFS). The National Indigenous Australians Agency is also included in this report given the role it plays working across government with indigenous communities and stakeholders.

Please direct enquiries through our contact page.

This edition of Audit Insights is targeted at Australian Government officials who have responsibility for overseeing or preparing performance information under the Commonwealth Performance Framework. The aim of Audit Insights is to communicate lessons from our audit work and to make it easier for people working within the Australian public sector to apply those lessons. This edition is drawn from audit reports tabled from 2015–16 to 2022–23 into the implementation of the corporate planning and annual performance statements requirements.

Please direct enquiries through our contact page.

The audit objective was to examine whether Airservices Australia has effective procurement arrangements in place, with a particular emphasis on whether consultancy contracts entered into with International Centre for Complex Project Management (ICCPM) in association with the OneSKY Australia project were effectively administered.

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess whether the Department of Homes Affairs has appropriately managed the procurement of garrison support and welfare services for offshore processing centres in Nauru and PNG (Manus Island).

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the Australian Taxation Office’s administration of annual compliance arrangements with large corporate taxpayers.

Please direct enquiries relating to reports through our contact page.

This report complements the Interim Report on Key Financial Controls of Major Entities financial statement audit report published in June 2021. It provides a summary of the final results of the audits of the Consolidated Financial Statements for the Australian Government and the financial statements of Australian Government entities for the period ended 30 June 2021.

Please direct enquiries through our contact page.

The objective of this audit was to assess whether the award of funding under the Disaster Ready Fund was effective and consistent with the published guidelines.

Please direct enquiries through our contact page.

The objective of the audit was to assess whether the Bureau of Meteorology is effectively managing assets in its observing network.

Please direct enquiries through our contact page.

The audit objective was to examine whether the design and conduct of the procurement process for delivery partners for the Entrepreneurs’ Programme complied with the Commonwealth Procurement Rules, and whether the signed contracts are being appropriately managed.

Please direct enquiries through our contact page.

The audit objective was to assess the effectiveness of the management of underperformance in the Australian Public Service (APS) and identify opportunities for improvement.

Please direct enquiries relating to reports through our contact page.

The audit objective was to examine the efficiency of the Office of the Commonwealth Director of Public Prosecutions' (CDPP's) case management.

Please direct enquiries through our contact page.

The audit objective was to examine whether the Department of Defence implemented a selection of agreed parliamentary committee recommendations and ANAO performance audit recommendations.

Please direct enquiries through our contact page.

The objective of this report is to provide a formal conclusion on the review of the Project Data Summary Sheets by the Auditor-General, including comprehensive information on the status of projects as reflected in the PDSSs prepared by the DMO.

The objective of the audit was to assess the effectiveness of the Australian Taxation Office’s procurement of IT managed services.

Please direct enquiries through our contact page.

The objective of this audit was to examine the efficiency and economy of the Department of Defence’s management of its general stores inventory.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the Department of Parliamentary Services’ management of assets and contracts to support the operations of Parliament House.

Please direct enquiries relating to reports through our contact page.

The audit objective was to examine Defence’s administration of Materiel Sustainment Agreements (MSAs) and the contribution made by MSAs to the effective sustainment of specialist military equipment.

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess whether the Department of Immigration and Border Protection adopted sound contract management practices for the delivery of garrison support and welfare services for offshore processing centres in Nauru and Manus Island.

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess the effectiveness to date of the Department of Defence’s procurement and contract management of the Offshore Patrol Vessel program.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness to date of the Department of Defence’s implementation of its Pathway to Change — Evolving Defence Culture 2017–2022 cultural reform strategy.

Please direct enquiries through our contact page.

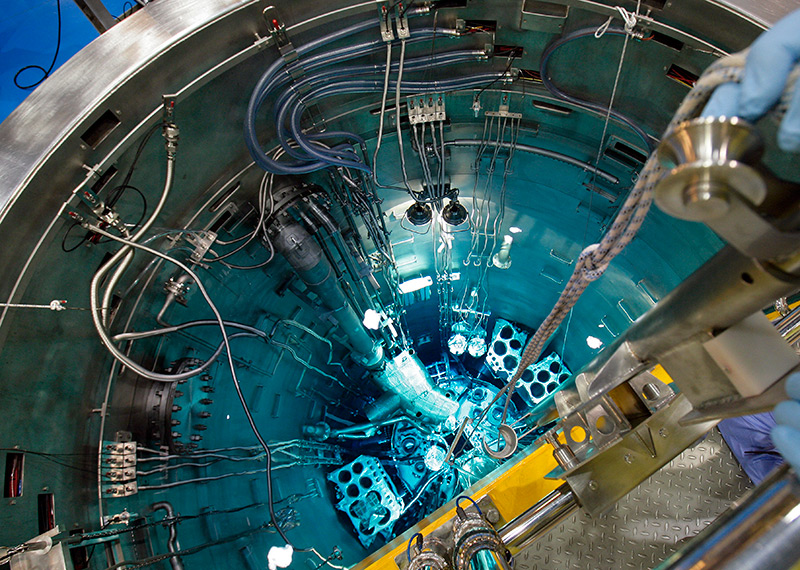

The audit examined the effectiveness of the Australian Nuclear Science and Technology Organisation’s management of assets involved in the manufacture, production and distribution of nuclear medicines.

Please direct enquiries through our contact page.

This report complements the Interim Report on Key Financial Controls of Major Entities financial statement audit report published in June 2022. It provides a summary of the final results of the audits of the Consolidated Financial Statements for the Australian Government and the financial statements of Australian Government entities for the period ended 30 June 2022.

Please direct enquiries through our contact page.

The objective of this report is to provide information, prepared by both the ANAO and DMO, on the performance of major projects as well as providing the Auditor-General’s formal conclusion on the review of the Project Data Summary Sheets (PDSSs) prepared by DMO and contained in this report.

Taxation rulings are a key mechanism used by the Australian Taxation Office (ATO) to disseminate the Commissioner of Taxation's interpretative advice on Australian taxation law. The objective of the audit was to:

report to Parliament on the operation of the ATO's administration of taxation rulings (public, private and oral rulings); and where appropriate, make recommendations for improvements, having regard to considerations of: efficiency and effectiveness of the ATO's administration of the rulings system, particularly in relation to the achievement of the objectives set by Parliament for the rulings system; the ATO's systems' capacity to deliver consistency and fairness for taxpayers; and good corporate governance, including the control framework.

The objective of the audit was to assess the effectiveness of Department of Defence's procurement and implementation of the myClearance system to date.

Please direct enquiries through our contact page.

The objective of the audit was to assess whether Defence has a fit-for-purpose framework for the management of materiel sustainment.

Please direct enquiries relating to reports through our contact page.

The ANAO prepares two reports annually that provide insights at a point in time to the financial statements risks, governance arrangements and internal control frameworks of Commonwealth entities, drawing on information collected during our audits.

This report is the first of the two reports and focuses on the results of the interim financial statements audits, including an assessment of entities’ key internal controls, supporting the 2023–24 financial statements audits. This report examines 27 entities, including all: departments of state; the Department of Parliamentary Services; and other Commonwealth entities that significantly contribute to the revenues, expenses, assets and liabilities within the 2022–23 Australian Government Consolidated Financial Statements (CFS). The National Indigenous Australians Agency is also included in this report given the role it plays working across government with indigenous communities and stakeholders.

Please direct enquiries through our contact page.

The aim of Insights: Audit Lessons (formerly Audit Insights) is to communicate lessons from our audit work and to make it easier for people working within the Australian public sector to apply those lessons.

This edition of Insights: Audit Lessons is targeted at Australian Government officials who are working in governance roles or who have responsibility for ensuring effective oversight and management of probity. Although it is based on audits of financial regulators, the lessons for managing probity risks can be applied across the public sector.

Please direct enquiries through our contact page.

The audit objective was to assess the effectiveness of Health's implementation of the Diagnostic Imaging Review Reform Package, some three years into the five year reform period.

Please direct enquiries relating to reports through our contact page.

This report complements the Interim Report on Key Financial Controls of Major Entities financial statement audit report published in May 2020. It provides a summary of the final results of the audits of the Consolidated Financial Statements for the Australian Government and the financial statements of Australian Government entities for the period ended 30 June 2020.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the Department of Social Services’ (DSS’s) and Services Australia’s management of the accuracy and timeliness of welfare payments.

Please direct enquiries through our contact page.

The Australian National Audit Office (ANAO) publishes two reports annually addressing the outcomes of the financial statement audits of Australian government entities and the Consolidated Financial Statements (CFS) of the Australian Government, to provide the Parliament of Australia with an independent examination of the financial accounting and reporting of public sector entities. This report focused on the results of the interim audit phase, including an assessment of entities’ key internal controls, of the 2017–18 financial statements audits of a range of entities including all departments of state and a number of major Australian government entities.

Please direct enquiries through our contact page.

This report complements the Interim Report on Key Financial Controls of Major Entities financial statement audit report published in June 2024. It provides a summary of the final results of the audits of the Consolidated Financial Statements for the Australian Government and the financial statements of Australian Government entities for the period ended 30 June 2024.

Please direct enquiries through our contact page.

The corporate plan is the ANAO’s primary planning document — it outlines our purpose; the dynamic environment in which we operate; our commitment to building capability; and the priorities, activities and performance measures by which we will be held to account.

The plan highlights our desire to engage positively and transparently in delivering audit and support services to the Parliament. In addition, the plan details our approach to risk management, which is critical to successfully meeting our responsibilities in providing professional and independent audits to the Parliament.

The corporate plan is complemented by the annual audit work program, which reflects the ANAO’s audit strategy for the coming year.

Please direct enquiries through our contact page.

This report complements the interim phase report published in June 2015, and provides a summary of the final audit results of the audits of the Consolidated Financial Statements for the Australian Government and the financial statements of 253 Australian Government entities.

This report complements the Interim Report on Key Financial Controls of Major Entities financial statement audit report published in May 2023. It provides a summary of the final results of the audits of the Consolidated Financial Statements for the Australian Government and the financial statements of 243 Australian Government entities for the period ended 30 June 2023.

Please direct enquiries through our contact page.

This report complements the interim phase report published in June 2014 (Audit Report No.44 2013–14), and provides a summary of the final audit results of the audits of the financial statements of 251 Australian Government entities, including the Consolidated Financial Statements for the Australian Government.

Please direct enquiries relating to reports through our contact page.

This report complements the interim phase report published in August 2016, and provides a summary of the final results of the audits of the Consolidated Financial Statements for the Australian Government and the financial statements of Australian Government entities.

This report complements the Interim Report on Key Financial Controls of Major Entities financial statement audit report published in June 2019. It provides a summary of the final results of the audits of the Consolidated Financial Statements for the Australian Government and the financial statements of Australian Government entities for the period ended 30 June 2019.

Please direct enquiries through our contact page.

Pagination

- First page

- Previous page

- …

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11